AI-Powered Financial Planning: Is It More Accurate?

Introduction: The Future of Financial Planning Is Automated—But Is It Actually Better?

If you’ve ever tried to build a financial plan manually, you know the drill:

- Dozens of spreadsheet tabs

- Endless “what-if” calculations

- Hours tweaking assumptions, only to get outdated results the next week

And when the numbers don’t match investor expectations—or your growth stalls—you’re back at square one, again.

Now, AI-powered financial planning tools are promising to fix all that.

They say you can:

- Model faster

- Forecast more accurately

- Test more scenarios in less time

- Stay aligned with real-time performance metrics

But the big question for founders is:

Is AI-powered financial planning actually more accurate—or just more convenient?

Because while automation sounds great, your business decisions depend on those numbers being right.

Not just pretty. Not just fast. But accurate.

And if your forecast is based on flawed logic, even the best tech won’t save you.

Why This Question Matters Now

Startups today move faster than ever.

Markets shift. CACs spike. Customers behave unpredictably.

And investors expect founders to:

- Justify their numbers

- Model different growth paths

- Make strategic decisions backed by real financial logic

If your plan can’t keep up—or your numbers are guesses—you’ll lose confidence (and capital).

That’s why more founders are turning to AI-powered platforms like PlanVista to make planning:

- Smarter

- Faster

- Easier to update

- And ideally… more accurate

But does the tech really deliver? Or are we just swapping manual mistakes for automated ones?

In this blog, we’ll dig into:

- What AI-powered financial planning actually is (in plain English)

- Whether it improves accuracy—and how

- What common planning problems it helps eliminate

- A real founder story that shows how AI helped (and what it didn’t fix)

- What to look for in a smart planning too

- Why PlanVista is leading the charge for startup-friendly, intelligent forecasting

If you’re tired of bloated Excel models, confused by inconsistent metrics, or just want a model you can trust without rebuilding it every month—this one’s for you.

Let’s separate the hype from the help.

What Is AI-Powered Financial Planning—And How Does It Work?

Let’s start by stripping away the buzzwords.

AI-powered financial planning isn’t about replacing you with a robot CFO.

It’s about using machine learning, real-time data, and intelligent automation to make building, adjusting, and managing your financial plan way easier—and yes, more accurate.

Here’s what that actually looks like in practice.

Traditional Planning vs. AI-Powered Planning

Old-School Financial Planning:

- Manual spreadsheet inputs

- Static templates

- You guess numbers, then try to validate them

- Takes hours to update one assumption

- Easy to break, hard to scale

AI-Powered Planning:

- Guided, dynamic inputs based on business model type

- Predictive suggestions (like CAC based on industry benchmarks)

- Auto-adjustments as you update revenue, pricing, or growth rate

- Real-time recalculations across burn, runway, margins, and more

- Easier collaboration with co-founders or advisors

Instead of building a plan from scratch, you start with a smart foundation—and AI helps fill in the blanks, adjust logic, and surface insights.

How AI Actually Works in These Tools

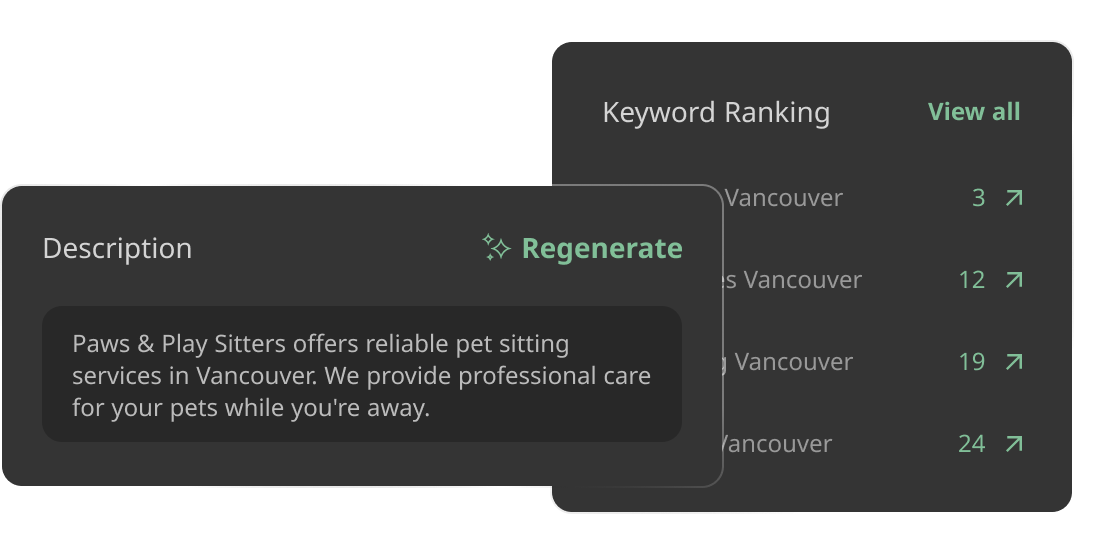

In platforms like PlanVista, AI shows up in several useful ways:

- Assumption intelligence: You say you’re a SaaS company at pre-seed, and it recommends starter metrics (like MRR growth or churn benchmarks)

- Auto-calculations: You enter pricing, users, CAC—and PlanVista fills in revenue, LTV, and margin for you

- Scenario modeling: AI generates alternate projections instantly (e.g., what happens if CAC jumps 20% or churn cuts retention by 15%)

- Data syncing: Pulls in real-time sales or expense data from integrations (optional), so your plan updates itself

It’s not about the software making decisions for you—it’s about reducing the guesswork and busywork, so you can focus on the strategic calls.

Why This Matters for First-Time Founders

Most founders:

- Don’t have time to update forecasts weekly

- Aren’t sure which metrics are “normal” or “red flags”

- Don’t feel confident defending their financial logic to investors

AI solves these pain points by:

- Providing starting points based on other startups like yours

- Keeping all metrics consistent (no more “wait, that CAC doesn’t match the deck”)

- Giving you real-time insight into how your numbers affect your survival

It’s like having a financial analyst sitting beside you—without paying for one.

Does AI Actually Make Financial Forecasting More Accurate?

Let’s get to the heart of it:

Does AI-powered planning really make your financial forecast more accurate—or is it just faster?

The short answer: Yes, it can boost accuracy—if you use it the right way.

Let’s break down what “accuracy” means in startup forecasting (and what AI can and can’t do for it).

What Does “Accurate” Even Mean in Startup Finance?

Startup financials aren’t about precision—they’re about assumption alignment and forecast discipline.

You’ll never get your revenue or CAC numbers exactly right six months from now.

But a solid financial plan should:

- Reflect reality as you know it today

- Stay consistent across key metrics

- Be flexible enough to adjust quickly when new data comes in

In that context, AI improves accuracy in three key ways:

1. Smarter Baseline Assumptions

Most early-stage founders guess when it comes to:

- CAC

- Churn

- Conversion rates

- Pricing impacts

AI-powered platforms like PlanVista use aggregated startup data to give you intelligent starting points.

Instead of asking, “What’s a good churn rate?”, it suggests:

“SaaS startups at your stage usually see 8–12% monthly churn.”

That gets you closer to a believable model—faster.

2. Real-Time Calculations That Reduce Human Error

Spreadsheets break.

One wrong cell can throw off your entire burn forecast, mislead investors, or cause you to miscalculate your raise.

AI tools:

- Link inputs and outputs automatically

- Adjust downstream metrics in real time (like how a CAC increase affects runway)

- Keep math and formatting consistent, no matter how many changes you make

That means less manual error—and fewer sleepless nights wondering if your numbers are wrong.

3. Scenario Planning That Actually Helps You Prepare

AI platforms let you instantly create multiple forecast versions:

- Base case

- Best case

- Conservative fallback

And then compare:

- What’s our cash position if CAC rises 20%?

- What happens to runway if revenue stalls for 2 months?

That’s not just accuracy—it’s resilience.

But Here’s What AI Won’t Do

- It won’t magically know your actual growth rate (that’s still your call)

- It won’t replace your judgment or strategy

- It won’t fix unrealistic expectations if you start with fantasy numbers

AI can’t replace financial thinking. But it can make it clearer, faster, and much more reliable.

Common Financial Planning Mistakes AI Helps You Avoid

Let’s face it: most founders aren’t financial pros.

You’re building product, finding customers, pitching investors—and somewhere in between, you’re expected to forecast revenue, manage runway, and model fundraising timelines.

That’s where mistakes happen.

The good news?

AI-powered tools like PlanVista are designed to help you avoid the most common traps founders fall into when building financial plans manually.

Here are the big ones—and how AI solves them.

Mistake 1: Wild, Unjustified Assumptions

Manual planning often starts with gut guesses:

- “Let’s say 20% growth per month sounds good.”

- “We’ll convert 10% of site visitors to customers.”

- “Churn? Uh, maybe 5%?”

The problem?

If investors ask where those numbers come from—you freeze.

AI Fix:

PlanVista uses industry benchmarks based on company stage and model.

So you start with credible, data-backed assumptions—not guesses.

Mistake 2: Math Errors That Break the Model

One wrong formula in Excel and your whole forecast collapses:

- Burn rate jumps for no reason

- CAC-to-LTV ratios look broken

- Runway math doesn’t track

These mistakes aren’t just embarrassing—they’re misleading.

AI Fix:

PlanVista handles all the calculations behind the scenes.

You update one metric (like pricing), and the rest of your model adjusts instantly and correctly.

No broken formulas. No investor red flags.

Mistake 3: Inconsistent Metrics Across Models

You’ve got one CAC in your deck, another in your spreadsheet, and a different one in your investor doc.

That inconsistency kills credibility.

AI Fix:

PlanVista links all your metrics across your forecast.

You enter CAC once, and it’s consistent across your pitch deck, cash flow, and LTV model.

No more copy-paste chaos.

Mistake 4: Ignoring Worst-Case Scenarios

Most founders build one optimistic forecast—and avoid “what-if” thinking because it’s too hard to model.

AI Fix:

PlanVista lets you build and compare multiple scenarios instantly.

You can create:

- Base Case

- Aggressive Growth

- Conservative Survival Mode

And actually see how each one affects your runway and capital needs.

Mistake 5: Letting the Model Go Stale

Manual models get outdated fast.

You adjust your business, pricing, team—but your forecast still reflects last quarter’s assumptions.

AI Fix:

AI-powered models update as you tweak inputs.

PlanVista reminds you to review critical drivers and makes updates painless.

Founder Story—How AI-Powered Planning Helped One Startup Raise Faster and Pivot Smarter

Meet Aarav, Founder of EduFlex

Aarav launched EduFlex, a B2B platform for live virtual training in Tier 2 and Tier 3 Indian cities.

Early traction looked good:

- 40+ small institutes onboarded

- ₹3.5 lakh in MRR within 6 months

- Positive user feedback and low churn

But when he started raising his ₹1.2 Cr pre-seed round, the feedback from investors was blunt:

“You have a great product. But your financial model is too vague. What’s your actual runway? How do CAC and payback compare?”

Aarav was still using an Excel forecast built by a freelancer.

It was full of locked cells, manual errors, and outdated numbers.

He couldn’t adjust the growth rate without breaking the whole model.

The Problem: He Couldn’t Defend His Numbers

Every investor meeting ended with more questions than confidence.

He knew the business had potential—but he was presenting:

- An unrealistic CAC

- Flat revenue assumptions that didn’t match user growth

- No alternative scenario planning if growth slowed

The model made his startup look risky—even though it wasn’t.

The Shift: Moving to PlanVista

Frustrated, Aarav rebuilt his entire forecast using PlanVista in one weekend.

He:

- Entered his pricing, user growth, and spend

- Got intelligent CAC and churn suggestions based on his stage and model

- Created three forecast versions (base, growth, fallback)

- Generated investor-ready charts and cash flow projections automatically

He even used PlanVista to simulate:

- A pivot to direct-to-institute licensing (vs. per-student billing)

- What funding ₹1.2 Cr would do to his runway under each model

The Result: Raised in 3 Weeks With Full Confidence

With his AI-powered model:

- Aarav defended his LTV:CAC ratio with confidence

- He clearly explained his capital efficiency and breakeven timeline

- He showed how different pricing models impacted revenue and cash flow

One investor told him:

“This is one of the clearest financial plans I’ve seen from a founder this early.”

He closed the round in 3 weeks.

The Bigger Win: Planning Became a Strategic Asset

Today, Aarav uses PlanVista not just for investors—but for internal decisions:

- Hiring plans

- Expansion timing

- Adjusting spend based on cash flow stress tests

He checks the dashboard weekly. His co-founder uses it for team planning.

What used to be a static spreadsheet is now a real-time decision engine.

What to Look for in an AI-Powered Financial Planning Tool

There’s a growing wave of tools claiming to offer “AI-driven financial planning”—but not all of them are built with founders in mind.

Some are just glorified Excel templates. Others are too complex for early-stage teams.

What you need is something smart, fast, and founder-friendly.

So how do you pick the right one?

Here are six features to look for if you want a tool that actually helps you plan better—not just automate complexity.

1. Built for Startup Models (Not Corporate Finance)

You shouldn’t have to translate your startup’s growth strategy into corporate finance terms.

Look for a platform that:

- Supports SaaS, marketplace, D2C, services, or pre-revenue planning

- Speaks your language: CAC, LTV, burn rate, churn, runway

- Doesn’t require a finance background to use

PlanVista, for example, tailors every forecast flow to your business type and stage.

2. Assumption Intelligence

Any tool can let you input numbers.

The best ones help you start with smart, realistic defaults.

You want:

- CAC, LTV, churn, and margin benchmarks by industry

- Suggestions based on your startup’s current stage

- Alerts when your assumptions are out of range

This is how you avoid building fantasy models investors won’t trust.

3. Real-Time Sync Across Metrics

Your CAC affects your payback period.

Your pricing changes your revenue forecast.

Your runway depends on burn.

If your tool doesn’t update everything in sync, you’re stuck playing spreadsheet whack-a-mole.

PlanVista auto-updates all connected metrics instantly—no broken formulas.

4. Scenario Planning and Comparisons

Founders don’t need one forecast.

You need three:

- Conservative

- Base case

- Aggressive growth

And you need to compare them quickly:

- What happens if you delay fundraising?

- What if churn doubles for two months?

- How long can you stretch your current capital?

A good AI platform makes this as easy as clicking a button.

5. Clean, Investor-Ready Outputs

You don’t just need internal clarity—you need to look sharp when pitching.

Look for features like:

- Auto-generated P&L and cash flow statements

- Burn rate visuals

- Custom export templates for decks or updates

No more copying from Excel to Google Slides.

6. Founder-First User Experience

You’re not an accountant. Your tool shouldn’t act like one.

Look for:

- Simple onboarding

- Clear explanations of every metric

- Guidance at every step

The tool should feel like a co-pilot—not another job.

Bonus Tips—How to Make the Most of AI in Your Financial Planning

You’ve seen what AI-powered planning can do.

But just using a smart tool isn’t enough—you need to use it well to actually gain an edge.

Here are 6 expert-level habits and strategies to help you get the most value out of AI-powered financial planning tools like PlanVista.

1. Don’t Set It and Forget It—Review Monthly

AI makes updating fast, but you still have to check in.

Schedule a 30-minute “finance check-in” every month to:

- Compare actual vs. forecasted numbers

- Adjust assumptions like CAC, churn, or team costs

- Review runway, burn rate, and cash flow

This keeps your plan real—not a dusty file on your desktop.

2. Build and Compare Multiple Scenarios

Never bet everything on your “ideal case.”

Use AI tools to model:

- Base case (most likely outcome)

- Aggressive case (best case if all goes right)

- Conservative case (what happens if things slow down)

PlanVista lets you duplicate and tweak these instantly—and show investors how you’ve stress-tested your plan.

3. Keep a Living Record of Assumptions

AI helps automate logic, but you need to own the thinking behind your inputs.

Create a simple doc that explains:

- Why you chose a certain CAC

- How you priced your product

- What drove your churn estimate

If investors challenge your numbers, you’ll have answers that build trust.

4. Sync It With Real Data When Possible

PlanVista can integrate with real-time tools (like Stripe, QuickBooks, or CRM data) to pull actuals into your model.

This keeps your forecast:

- Grounded in real revenue and spend

- Up to date without manual effort

- Easy to adjust as things evolve

The more you automate inputs, the sharper your planning becomes.

5. Use Visuals in Team and Investor Updates

Founders often keep financials hidden in backend tools or decks.

Instead:

- Pull your P&L or cash flow visuals directly from PlanVista

- Use them in team meetings to align hiring or spend decisions

- Add them to investor updates to reinforce traction and credibility

Good financial visuals turn complex planning into strategic clarity.

6. Let AI Handle the Math—But Own the Strategy

AI won’t tell you whether to delay a hire or scale your marketing.

But it will show you what those decisions mean financially—instantly.

Use that speed and accuracy to:

- Lead with more confidence

- Plan proactively, not reactively

- Stay ahead of your board, burn, and bank balance

Conclusion: The Future of Financial Planning Is Smart, Fast, and Founder-Led

As a founder, you wear a lot of hats—visionary, builder, marketer, recruiter.

But whether you like it or not, your ability to manage financial planning can make or break your startup.

The good news?

You don’t need to be a finance expert anymore.

With AI-powered tools like PlanVista, you can:

- Model faster

- Forecast smarter

- Adjust with clarity

- And build trust with investors—without touching a single spreadsheet

Because in today’s startup environment, static Excel files won’t cut it.

Markets shift fast. Fundraising windows are tight. Your team expects clarity.

If your plan can’t keep up, you’ll end up guessing instead of leading.

Accuracy Isn’t Just About the Math

AI doesn’t magically “get your forecast right.”

But it helps you:

- Start with stronger assumptions

- Stay consistent across metrics

- Adjust fast when the market changes

- Avoid errors that break trust or kill deals

That’s what real financial accuracy looks like—aligned, agile, and grounded in logic.

PlanVista Helps You Plan Like a Pro—Without Being One

PlanVista is built for founders who:

- Are tired of spreadsheets

- Need to raise, grow, or pivot fast

- Want clarity without complexity

It gives you:

- Intelligent assumption guidance

- P&L and cash flow automation

- Scenario planning tools

- Visuals that make you look pitch-ready

All in a tool that’s as founder-friendly as your product roadmap.

Final Takeaway

If your current financial model feels like a burden…

If you’re avoiding updates because it’s too time-consuming…

If you’re unsure what numbers actually matter for your next raise…

It’s time to switch to a smarter way to plan.

Because the founders who stay funded, scale wisely, and lead with confidence?

They don’t just build great products—they run great numbers.

Start planning smarter with PlanVista. Try it free—no credit card required.

FAQs

It’s a smarter way to forecast using automation, real-time data, and intelligent assumptions.

Yes—AI reduces guesswork, human error, and outdated assumptions.

Absolutely—tools like PlanVista let you test and compare multiple forecast models instantly.

Yes—AI helps with the math, but your strategy and inputs still matter.

Yes—PlanVista is built for founders who want fast, smart, and investor-ready financials.