Forecasting Mistakes That Are Costing Your Startup

Introduction: Why Bad Forecasting Is Quietly Killing Great Startups

Most startups don’t fail because the idea was bad.

They fail because they ran out of time—or money—before figuring it out.

And behind nearly every runway crunch, hiring freeze, or last-minute fundraise… there’s a broken forecast.

Ask any founder who’s been there, and they’ll say the same thing:

“We thought we had more time.”

Forecasting isn’t just a finance task—it’s a survival strategy.

Done right, it helps you:

- Raise the right amount

- Hire at the right time

- Adjust before things break

- And stay one step ahead of cash flow disasters

Done wrong?

It becomes a spreadsheet fantasy no one actually uses.

And that’s where most startups fall into trouble.

Because while most founders are smart, scrappy, and creative—they’re also moving fast. And in the rush, they skip the financial details or settle for assumptions that don’t hold up.

The result?

- CACs that were too optimistic

- Revenue growth that never showed up

- Costs that got underestimated

- Burn that spiraled quietly

- And months lost reacting instead of planning

But here’s the good news:

Most forecasting mistakes are avoidable—once you know what to watch for.

This blog is your warning system.

We’re going to walk through:

- The most common forecasting traps founders fall into

- How those mistakes silently wreck growth, fundraising, and momentum

- What you should be tracking instead

- A real founder story of how a “small error” almost derailed a $1M round

- And how tools like PlanVista can help you forecast accurately without drowning in Excel

If you’ve ever found yourself second-guessing your numbers, stalling your fundraise, or just wondering if your financial model is leading you—or misleading you—this post is for you.

Let’s make sure your forecast doesn’t cost you your runway.

Relying on One Scenario (And Why It’s a Trap)

If you’re building your financial plan around one forecast, you’re playing defense—whether you realize it or not.

Too many founders map out a single “ideal” trajectory:

- User growth looks great

- CAC stays flat

- Churn doesn’t spike

- Revenue climbs predictably

Sounds good… until reality hits.

One unexpected month, and suddenly:

- You’re behind on revenue targets

- Your burn rate is higher than planned

- That funding milestone you were banking on? Delayed

And because you only built one path, you have no fallback plan.

Why Single-Scenario Forecasting Is Risky

The startup journey is anything but linear.

There are months where:

- Customer acquisition slows

- A key hire pushes burn up

- A product delay stalls revenue

Investors know this.

Teams know this.

You should, too.

When you forecast only one scenario, you:

- Miss blind spots

- Underestimate risk

- Lose credibility when things don’t go as planned

The Smart Move: Scenario Planning

At a minimum, you should build three versions of your forecast:

- Base Case – What you realistically expect to happen

- Upside Case – If things go better than expected

- Downside Case – What if churn jumps? Or CAC spikes?

This isn’t about pessimism—it’s about control.

When you can show investors how you’ll handle the downside, they trust your upside more.

How to Create Scenarios Fast

You don’t need to rebuild your model from scratch three times.

Just tweak core drivers like:

- Monthly growth

- Customer retention

- Marketing spend

- Sales conversion rate

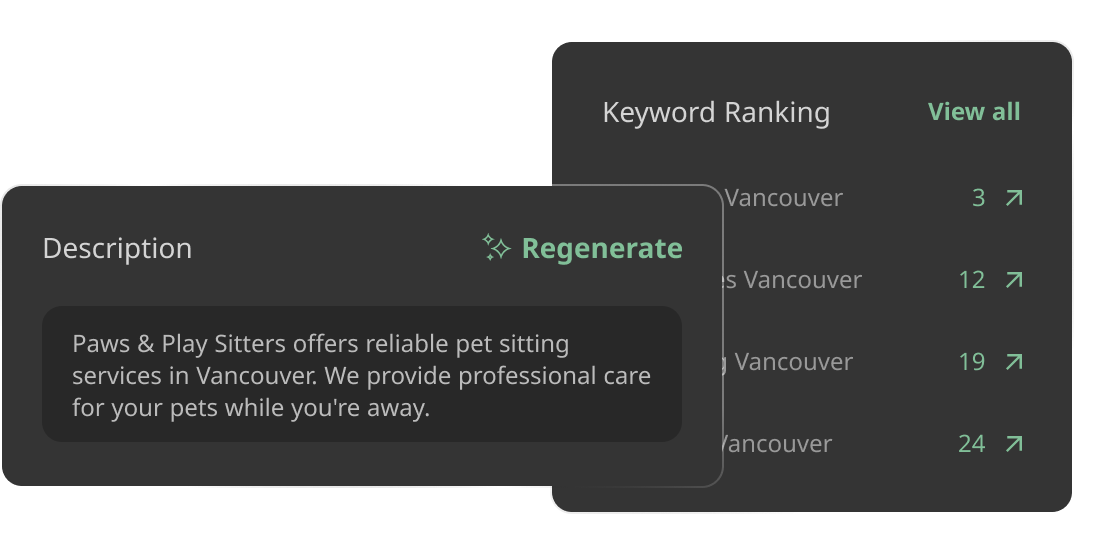

In PlanVista, for example, you can duplicate your base forecast, adjust a few sliders, and instantly compare:

- Revenue impact

- Burn and runway changes

- When you hit breakeven (or don’t)

Founder Tip: Use Scenarios in Your Deck

Don’t just keep these in your internal doc.

Show investors:

- “Here’s our base plan.”

- “If we grow faster, we raise less later.”

- “If CAC doubles, here’s how we extend runway.”

That’s not just planning—it’s leadership.

Overestimating Revenue Growth (And Underestimating the Fallout)

It’s the most common mistake in every startup pitch deck:

“We’re going to grow 20% month-over-month. Here’s how we hit ₹10 Cr in revenue in 18 months.”

Looks impressive on a slide.

But when the real numbers roll in? The gap is brutal.

And it doesn’t just make you miss goals—it impacts hiring, fundraising, burn, and trust.

Why Founders Overshoot Revenue

There are a few reasons:

- You’re optimistic (which is good, but dangerous in Excel)

- You assume growth continues linearly

- You base projections on a viral spike or short-term win

- You underestimate sales cycle length or buyer hesitations

- You don’t factor churn or plateauing conversion

The result?

You budget for headcount, tools, and scale—based on revenue that never shows up.

The Fallout of Inflated Forecasts

Here’s what happens when you overestimate growth:

- You run out of cash faster (you built for scale too early)

- You lose credibility with investors and your team

- You delay fundraising because your metrics don’t match your model

- You make poor timing decisions on hires, expansion, and marketing

In short: the damage isn’t just financial—it’s strategic.

How to Forecast Revenue Realistically

Start with what you can control and defend:

- Acquisition assumptions (traffic, leads, conversion rates)

- Sales cycles (especially in B2B)

- Retention curves (customers won’t stay forever)

- Real pricing dynamics (discounts, churn, upsell windows)

Then stress-test your logic:

- What’s your capacity to fulfill those sales?

- What’s your sales or marketing cost to get there?

- What % of leads convert? What % drop off?

If you can’t defend it to an investor, don’t forecast it.

Founder Tip: Use Benchmarks

Use data from:

- Your own growth history

- Public startup benchmarks (SaaS, D2C, etc.)

- Similar companies at your stage

If your forecast shows 10x revenue in 12 months, ask:

“Who else did this? And how?”

PlanVista can even suggest baseline growth assumptions based on your model and stage—so you’re not just guessing.

What Investors Want

They’d rather see:

- 10% MRR growth with realistic CAC

- A clear path to ₹1 Cr ARR

- Retention improving month by month

…than some fantasy chart that peaks at unicorn status by Q3.

Smart, grounded forecasts beat inflated ones every time.

Ignoring Cash Flow Timing—Why ‘Profit’ Doesn’t Mean You’ll Survive

Here’s a trap that’s crushed more startups than bad code or low retention:

Being “profitable” on paper—while going broke in real life.

It happens when founders focus on their Profit & Loss (P&L) statement and ignore the one thing that actually pays the bills: cash flow.

The Disconnect Between Profit and Cash

Your P&L might show a ₹2 lakh profit this month.

But if your clients haven’t paid yet—and you’ve already spent on ads, team, and tools—your bank balance could be dangerously low.

That’s because:

- Revenue is often recorded when earned, not when paid

- Expenses can hit your account before they show on your books

- Big one-time costs (inventory, tools, hiring) can wipe you out short-term

In short: profit tells you the story; cash tells you the truth.

Why Founders Miss This

Most first-time founders:

- Build forecasts only from a P&L perspective

- Don’t track cash inflow/outflow timing

- Assume investor funding = plenty of buffer

- Forget about taxes, delayed payments, or unexpected expenses

It feels like things are going great—until a vendor payment bounces or you realize you can’t cover next month’s payroll.

The Real Cost of Ignoring Cash Flow

- You misjudge your runway

- You hire before you can afford to

- You fundraise too late (under pressure)

- You panic and cut smart growth moves to stay alive

Cash crunches aren’t just operational—they wreck momentum, morale, and trust.

How to Fix It (Without an MBA)

You need a cash flow model in addition to your P&L. Here’s what to track:

- Starting bank balance

- Actual cash in (customer payments, investments)

- Actual cash out (vendors, team, tools, one-time spends)

- Ending cash each month

- Runway based on current burn

PlanVista handles this side by side with your forecast.

You input your assumptions once—it auto-generates cash flow timing, runway charts, and cash buffers.

Founder Tip: Model Delays and Buffers

If you’re B2B, assume some invoices will be paid late.

If you’re pre-launch, build in a 15% cost buffer.

If your sales cycle is slow, don’t expect cash from every deal this month.

Make it realistic—not optimistic.

Underestimating CAC and Overstating LTV—The Classic Combo That Breaks Investor Trust

If there’s one metric combo that will instantly raise red flags in any investor meeting, it’s this:

“Our Customer Acquisition Cost (CAC) is low, and our Lifetime Value (LTV) is huge.”

Sounds great—until the questions start:

- “How did you calculate LTV?”

- “What’s your payback period?”

- “What channels drive this CAC?”

Suddenly, the founder’s confidence fades—and so does the investor’s.

Why This Happens

Most early-stage founders:

- Pull CAC from just one ad campaign or early traction

- Forget to include costs like salaries, tools, or sales ops

- Assume customers will stay loyal for years without testing retention

- Use LTV = MRR × 24 months without proving the 24

The result?

A great-sounding LTV:CAC ratio (like 10:1)—but it’s built on wishful math.

Why It’s Dangerous

Bad CAC/LTV math leads to:

- Overconfidence in marketing spend

- Misleading fundraising decks

- Burn rates that get out of control fast

- Poor decisions around scaling channels or hiring sales teams

And when investors spot these mistakes, they start questioning everything else in your model.

What to Do Instead

Start with clean CAC math:

- Total marketing + sales spend (ads, salaries, tools, etc.)

- Divided by number of new paying customers

Example: ₹2,00,000 in monthly marketing and sales spend ÷ 100 new paying customers = ₹2,000 CAC

Then build an LTV that reflects real behavior:

- Avg monthly revenue per customer

- Times average retention in months (based on actual churn or early data)

- Include gross margin if you want the true net value

Example: ₹800/month × 6 months = ₹4,800 gross LTV

If you include 70% margin: LTV = ₹3,360

Now your LTV:CAC ratio is 1.68:1—not a fantasy, but a number you can grow from.

Founder Tip: Track Payback Period

Investors love this metric:

“How many months until the revenue from a customer covers the cost to acquire them?”

It tells them how fast your business can recycle capital.

If your CAC is ₹2,000 and customers pay ₹500/month, you break even in 4 months.

PlanVista tracks this automatically—so you can compare CAC, LTV, and payback side by side without wrangling formulas.

Don’t Oversell—Prove It

Great founders don’t inflate LTV or downplay CAC.

They show how both are improving:

- “Our CAC dropped 20% as we optimized paid channels.”

- “Our LTV is increasing as churn falls and ARPU rises.”

That’s what gets the nod in the pitch room.

Building Static Forecasts That Don’t Evolve With Your Startup

Here’s the hard truth:

Your startup changes faster than your spreadsheet.

New hires, pricing changes, customer feedback, growth spikes (or slowdowns)—they all impact your numbers. But if your forecast doesn’t update with your business, it becomes useless noise.

And yet, this happens all the time.

Founders build a beautiful model once.

Then don’t touch it again for six months.

Why Static Forecasts Are Dangerous

Your forecast should be your financial GPS—not a one-time pitch artifact.

If you’re still running with outdated:

- CAC assumptions

- Team cost projections

- Churn rates

- Revenue drivers

…then you’re making big decisions on old data.

The result?

- You overhire because your revenue model is inflated

- You under-raise because your burn rate’s off

- You miss red flags because your model isn’t tracking actuals

What a Living Forecast Looks Like

A healthy startup forecast:

- Updates monthly (at minimum)

- Tracks actual vs. projected performance

- Adjusts based on real results

- Adapts when pricing, hiring, or growth strategy shifts

This doesn’t mean rebuilding from scratch.

It means having a system that lets you:

- Change inputs quickly

- See impact instantly

- Keep your team and investors aligned

How Founders Fall Into the Static Trap

- You launched the model in Excel and it’s too painful to update

- Your assumptions weren’t clear, so now you’re not sure how to adjust

- You got busy with product, growth, or hiring

- You assume the original forecast is “close enough”

But in startup world, a small delta today becomes a big divergence in six months.

Why PlanVista Solves This Instantly

With PlanVista, your model is always live:

- Update growth, CAC, or churn with one click

- Add team members or adjust pricing instantly

- See the impact across cash flow, runway, and profitability in seconds

- Version your forecasts for each quarter—or even each investor conversation

It’s not just about automation.

It’s about staying agile and making sure your numbers match your momentum.

Founder Tip: Build Forecast Review Into Your Monthly Workflow

You don’t need to obsess daily. But do this each month:

- Compare actual vs. forecast (revenue, costs, churn)

- Adjust assumptions based on what actually happened

- Share insights with your team (even at a high level)

- Update your deck or investor reports with fresh data

This simple habit puts you in the top 10% of financially sharp founders—no spreadsheet sorcery required.

Not Using a Forecast as a Strategic Tool (And Treating It Like a Pitch Form)

Too many founders treat financial forecasting like a box to check for investors.

They build it to raise.

They polish it for a pitch.

They forget about it after the meeting.

Here’s the truth:

If your forecast only exists for funding, you’re missing its real value.

Your forecast isn’t just for pitching—it’s for leading.

The Forecast as a Strategic Weapon

When used right, a forecast helps you:

- Decide when to hire

- Know how long your cash will last

- Identify what spend is worth it—and what isn’t

- Set goals that actually align with capacity and runway

- Plan your next raise with confidence and control

It’s not just about “how much money are we making?”

It’s about how well do our decisions align with where we’re going?

Why Founders Fall Into the “Deck-Only” Trap

- You’re laser-focused on building and fundraising (understandable)

- You think “finance” is for later

- Your model is too fragile or hard to update

- You don’t realize how many strategic calls depend on financial clarity

The result? You start flying blind.

Burn accelerates, hiring gets misaligned, and decisions are reactive—not planned.

What Real Forecast-Driven Strategy Looks Like

Here’s how top founders use their forecasts week to week:

- Should we delay or accelerate this next hire?

- Can we increase our paid acquisition budget by 15% next quarter?

- What’s our real deadline to start raising the next round?

- Are we on track to hit our break-even or MRR goals?

When you know the answers to those questions, you lead with confidence—not guesswork.

How PlanVista Turns Forecasts Into Operating Systems

PlanVista isn’t just a model—it’s a strategy layer:

- Auto-syncs updates from your team’s inputs (pricing, hiring, CAC, etc.)

- Forecasts hiring impact on runway, not just headcount

- Helps you model strategic moves—new pricing, new markets, new channels

- Keeps metrics investor-aligned while still grounded in execution

It turns your forecast from a doc you dust off during a raise into a tool you rely on to run the company.

Founder Tip: Use Your Forecast in Every Major Decision

Before any big call—fundraising, hiring, pricing, or GTM expansion—open your model:

- Test the impact

- Review the risks

- Align the team

This isn’t “being corporate.”

It’s being smart.

Why Forecasting Discipline Signals Founder Maturity

Great founders aren’t just dreamers or builders.

They’re disciplined leaders who understand how to turn ambition into executable strategy.

And one of the clearest signals of that discipline?

A clean, accurate, and evolving financial forecast.

Investors, advisors, and senior hires all look for it—whether they say it or not.

Why Your Forecast Reflects More Than Just Numbers

When someone sees your forecast, they’re not just judging your math.

They’re asking:

- “Does this founder understand the economics of their own business?”

- “Can they think in terms of both vision and execution?”

- “Will they know when to pivot—or when to double down?”

- “Are they coachable, logical, and data-aware?”

A forecast is a mirror of how you lead.

If your model is full of fantasy or hasn’t been updated in months, it tells them you’re still guessing.

If it’s grounded, current, and ready for questions—it tells them you’re building with clarity.

Forecasting Is a Maturity Signal for VCs

Especially in early-stage rounds, VCs know the numbers will change.

They’re not investing in the forecast—they’re investing in your ability to manage change.

That means:

- You update your plan regularly

- You know where the key risks are

- You’ve built fallback paths

- You can speak confidently about CAC, runway, LTV, and burn

This gives them confidence that you’ll use their money wisely—and raise only when necessary.

Internally, It Builds Alignment and Trust

When your forecast is shared with your co-founder, team, or advisors, it:

- Aligns hiring and budget decisions

- Makes prioritization easier

- Builds trust through transparency

- Helps avoid last-minute chaos or missed targets

Forecasting is how founders become CEOs.

Founder Tip: Present Your Forecast Like a Plan, Not Just a File

- Walk your team through it monthly

- Include it in board updates

- Use it to guide OKRs, hiring, and marketing spend

- Show investors how it drives decisions, not just decks

This turns your model into a leadership tool—not just a financial artifact.

How PlanVista Supports This

PlanVista was built for this kind of founder discipline:

- Update in real time

- Show live dashboards to investors or team

- Model pivot plans or growth plays

- Forecast fast—so you can focus on the big calls, not fixing spreadsheets

Conclusion: Fix the Forecast, Fix the Business

Most startups don’t get derailed because they lacked ambition.

They get derailed because they made decisions based on broken numbers—or worse, no numbers at all.

And it’s rarely one big forecasting mistake that kills momentum.

It’s a series of small ones:

- Overestimating growth

- Underestimating CAC

- Ignoring cash flow

- Running on one scenario

- Letting the model go stale

- Treating the forecast as a pitch doc, not a decision engine

Each mistake adds friction.

Each one eats away at your runway, trust, and clarity.

Until you’re out of cash—or out of options.

But the good news? These mistakes are completely fixable.

The Shift You Need to Make

Stop thinking of forecasting as a fundraising requirement.

Start thinking of it as your founder GPS.

With a smart, living forecast, you can:

- Hire with confidence

- Fundraise with clarity

- Adjust spend proactively

- Stress-test decisions before they hurt

- Build investor trust before you even ask for money

Financial planning isn’t just about being “responsible.”

It’s how you keep building, growing, and leading—even when the unexpected hits.

PlanVista Helps You Build (and Maintain) Forecasts That Actually Work

Inside PlanVista, you can:

- Build multiple, realistic scenarios in minutes

- Track revenue, burn, CAC, LTV, and runway in one place

- Auto-generate cash flow and P&L forecasts from a single input

- Make fast updates when growth, costs, or hiring change

- Export clean, pitch-ready visuals for investor decks

No spreadsheet chaos. No math errors. No static models.

Just fast, accurate forecasting built for founders—not finance teams.

Final Takeaway

If you want to lead your startup with clarity, raise without scrambling, and make decisions like a founder who sees the whole board…

Start by fixing your forecast.

- Don’t wait until cash is low.

- Don’t wait until investors start poking holes.

- Don’t wait until a hire you can’t afford tips your burn into panic mode.

- Start now.

- Build something accurate.

- Update it often.

- Use it to lead.

Try PlanVista free today—no credit card required—and start planning smarter.

FAQs

Overestimating revenue growth without realistic assumptions or scenario planning.

Use real data, track actuals monthly, and model multiple scenarios—not just one.

They don’t reflect changing conditions, leading to bad hiring, spending, and fundraising timing.

Cash flow shows survival—profit shows performance; both are essential in planning.

PlanVista offers live models, real-time updates, scenario testing, and visual outputs tailored for founders.