The Simplest Way to Estimate Your Startup Budget

Introduction: Startup Budgeting Doesn’t Have to Be Complicated

If the words “startup budget” make you think of massive Excel files, awkward math, or CFO-level planning—you’re not alone.

Most early-stage founders don’t come from finance.

They come from product, design, engineering, marketing—backgrounds where fast action and problem-solving are the norm.

So when it comes time to plan your first year’s budget, you either:

- Overcomplicate it with unnecessary detail

- Guess numbers just to get it over with

- Delay it altogether (and hope things work themselves out)

But here’s the truth: a simple, accurate startup budget might be the most powerful tool you have.

It’s how you:

- Know what you can afford

- Avoid overspending on things that don’t move the needle

- Stay focused as you grow

- And most importantly—extend your runway and avoid early-stage panic

Whether you’re pre-launch or already acquiring users, a lean budget helps you operate with confidence.

And no, you don’t need a finance degree to get it right.

Why You Can’t Afford to Ignore Your Budget

Your budget isn’t just about controlling costs. It’s about enabling decisions.

Without a budget, you might:

- Hire before your cash flow can handle it

- Spend on tools you don’t need

- Undershoot how much you should raise

- Miss your real break-even point by months

That’s how startups spiral—not because they didn’t have a great idea, but because they ran out of cash without knowing why.

A smart budget prevents that.

It doesn’t need to be perfect. It just needs to be clear, grounded, and easy to update.

In this blog, you’ll learn:

- The fastest way to build a startup budget from scratch

- What to include (and what to skip)

- The key mistakes to avoid

- A real founder story of how better budgeting saved a launch

- How tools like PlanVista can simplify and automate the process

- Tips to evolve your budget as your startup scales

Let’s make budgeting simple—and powerful—for real-world founders like you.

Start with Revenue—Even If You’re Pre-Launch

Most founders begin budgeting by listing expenses.

That seems logical—but it’s actually backward.

Your budget should start with revenue, because your income is what defines how much you can safely spend, how long your cash will last, and when you’ll need to raise.

And yes, even if you’re pre-launch or pre-revenue—you still need to map out how you expect to make money.

Why Revenue Comes First

Your revenue forecast tells you:

- If your business model makes sense financially

- What you can afford across headcount, tools, marketing, etc.

- Whether you’re planning for lean growth or aggressive scaling

- How fast you’ll burn through capital

Without a revenue plan, your budget is just a burn list.

How to Forecast Revenue (Even at Day Zero)

Start simple. Identify:

- Your pricing model (subscription, one-time fee, freemium, etc.)

- Your volume assumption (how many units, users, clients per month)

- Growth expectations (e.g. 10% month-over-month is common early)

- Potential delays (don’t assume everyone pays upfront)

Example:

You plan to launch in Month 2

Price = ₹999/month

Start with 10 users, grow by 20% per month

That’s ~₹60,000 MRR by Month 6 if growth holds

Even rough numbers give you clarity.

What If You’re Not Sure Yet?

Then forecast based on goals.

Ask yourself:

- “How many customers would I need to break even by Month 6?”

- “If I charge X, and get Y clients, how much can I reinvest?”

- “What’s my minimum viable income to stay alive for 12 months?”

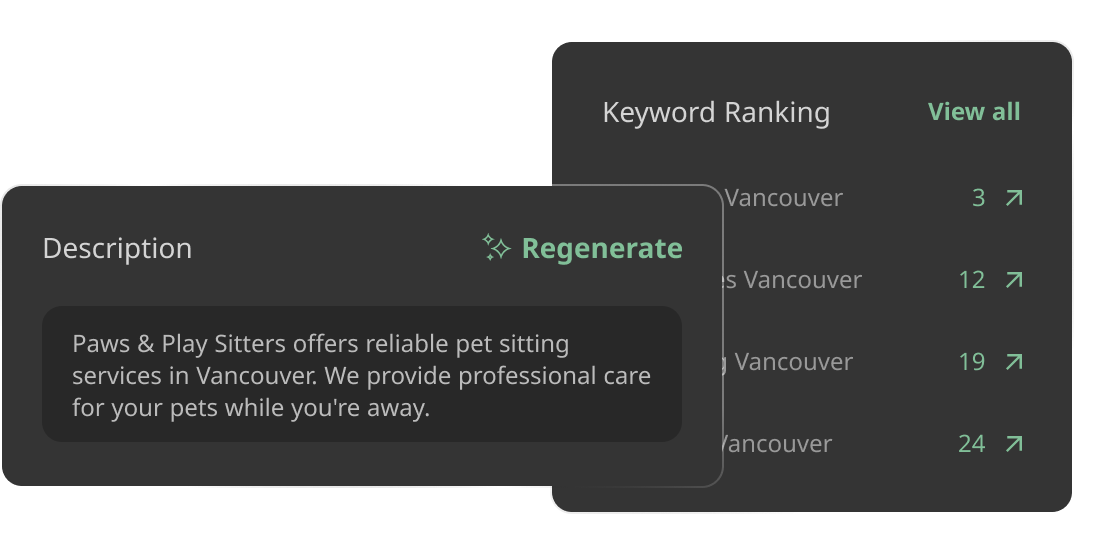

This is where tools like PlanVista help:

You can choose your business model, input early estimates, and instantly see monthly revenue projections—no formulas required.

Founder Tip: Don’t Forecast Unrealistically

You’re not Netflix by Month 3. Be grounded.

Investors and advisors prefer a modest forecast with clear logic over an overly ambitious one that falls apart when questioned.

If your launch is delayed or churn is higher than expected, your budget should still work. That’s why it’s a forecast—not a fantasy.

Revenue as a Budget Benchmark

Once you’ve mapped expected revenue month by month, you can plan:

- How much to spend (and on what)

- When to spend more (e.g., post-revenue ramp-up)

- Whether you’ll need outside funding—or can bootstrap longer

It’s the first input that informs every financial decision to follow.

Map Your Expenses—And Keep It Lean

Once you’ve estimated your revenue, it’s time to get real about your expenses.

This is where most first-time founders either:

- Overcomplicate the model with too many line items

- Or wildly underestimate how much they’ll spend

Your goal isn’t to build a corporate finance doc.

It’s to clearly understand what it takes to run your startup month to month—and how those costs evolve as you grow.

Step 1: Categorize Your Costs

Break your expenses into two simple categories:

1. Fixed Costs (don’t change month to month):

- Salaries or founder draws

- Rent or coworking

- Core software/tools (Slack, Zoom, hosting, etc.)

- Legal or accounting retainers

- Internet, domain renewals, basic ops

2. Variable Costs (scale with activity):

- Marketing spend

- Customer support costs

- Transaction fees (e.g., Stripe)

- Inventory or fulfillment (if applicable)

- Sales commissions or contractor payments

Mapping it this way gives you clarity on your baseline burn—and how much extra spend you take on when you scale.

Step 2: Estimate Monthly Spend

Start lean. Ask:

- What are the absolute essentials we need to survive and grow?

- Can we delay any hires or purchases until later months?

- What’s our minimum marketing/test budget?

Try building Month 1–3 with just survival-mode costs.

Ramp in hires, spend, and tools only when revenue starts catching up.

Example:

₹40,000: Founders’ living stipend

₹5,000: Tools & subscriptions

₹10,000: MVP hosting

₹25,000: Paid ads

₹5,000: Legal and admin

Total = ₹85,000/month

That’s your baseline burn.

Step 3: Think in Runway

Runway = Current capital / Monthly burn

If you’re starting with ₹10 lakh in the bank and burning ₹85K/month, you’ve got ~11–12 months of runway.

This single number should drive every decision you make.

If your burn increases, your runway shortens—unless revenue starts matching pace.

PlanVista Pro Tip: Visualize Expense Growth

With PlanVista, you can:

- Add new expenses by category

- Schedule when they kick in (e.g., hire in Month 4)

- Forecast total burn and see how runway shortens or extends

- View side-by-side comparisons of fixed vs. variable costs

No spreadsheet wrestling. Just clean insights.

Founder Tip: Budget for Change

Startups change monthly. Add a 10–15% buffer to account for:

- Unexpected tool upgrades

- Emergency contractor help

- Marketing tests that underperform

A lean budget doesn’t mean unrealistic—it means you plan for pivots without panicking.

Calculate Burn and Runway—The Two Numbers That Matter Most

There are a lot of startup metrics you could track.

But when it comes to budgeting, burn rate and runway are the two that keep your business alive.

These aren’t investor buzzwords—they’re survival metrics.

They tell you:

-

- How fast you’re spending

- How long you’ve got before you run out of money

- How fast you’re spending

- And when to make the next critical move (hire, cut, or raise)

Let’s break them down.

What Is Burn Rate?

Burn rate is the amount of money your startup spends each month.

If you’re pre-revenue, it’s simply your total monthly expenses.

If you’re generating revenue, your net burn is:

Burn Rate = Total Monthly Expenses – Monthly Revenue

Example:

You spend ₹2,00,000/month

You earn ₹50,000/month

Net burn = ₹1,50,000/month

This number tells you how fast you’re using your capital.

What Is Runway?

Runway is how many months you have before your cash runs out—at your current burn rate.

Runway = Cash in Bank / Net Burn Rate

Example:

₹12,00,000 in the bank

Net burn = ₹1,50,000/month

Runway = 8 months

This is your timeline to:

-

- Reach revenue targets

- Cut costs

- Reach revenue targets

- Or raise your next round

If your burn goes up but revenue doesn’t?

Runway shortens.

Why These Two Numbers Matter

These metrics guide real decisions:

- Can we afford to hire this month?

- Should we delay that feature launch?

- Is this the right time to start raising capital?

- How much can we spend on growth?

You don’t need to obsess daily—but if you don’t know your burn or runway right now, you’re flying blind.

How to Track Them Without Getting Lost in Sheets

Inside PlanVista, you get:

- Automatic burn rate calculations (adjusted as your expenses or revenue changes)

- Visual runway timeline (updated in real time as you tweak inputs)

- Monthly breakdowns that let you see exactly where your money is going

- Cash vs. accrual tracking so you don’t confuse “profit” with actual cash

No complex formulas. No broken tabs.

Just numbers you can trust—ready for any investor, co-founder, or decision.

Founder Tip: Plan for Your Raise—Not From Panic

If your runway is 7–9 months, start planning your raise now.

Fundraising takes time. If you wait until you have 2 months left, you’ll be negotiating from fear—not strength.

A good budget helps you raise at the right time, with the right numbers to back your ask.

Turn Your Budget Into a Living Financial Model

A startup budget is only as good as its ability to evolve.

That’s why it’s not enough to build a one-time spreadsheet and call it done.

You need to turn your budget into a living, breathing financial model—something you actually use to run the company.

This doesn’t mean you need a finance team.

It means your budget needs to reflect real decisions, not just static assumptions.

What’s the Difference Between a Budget and a Financial Model?

- Budget = Snapshot

What you plan to spend over a certain period

- Financial Model = Forecast

How your business behaves over time based on real inputs

Your financial model includes:

- Revenue growth

- Expense scaling

- Burn and runway dynamics

- Hiring plans

- Fundraising timelines

It’s not just about watching costs—it’s about predicting outcomes.

Why Static Budgets Break Fast

Startups change fast. If your budget doesn’t:

- You overspend without noticing

- You miss warning signs when burn spikes

- You delay adjusting pricing, hiring, or marketing

- You under-raise—or raise too late

A spreadsheet that worked in Month 1 will be outdated by Month 3 if you don’t update it.

Building a Model That Evolves

You want a system that:

- Lets you adjust revenue, pricing, CAC, churn, or growth in minutes

- Automatically updates your forecast and runway

- Helps you test “what if” scenarios without rebuilding formulas

- Keeps investor and team conversations consistent

That’s where tools like PlanVista shine.

What PlanVista Does Differently

With PlanVista, you can:

- Start with a lean budget

- Layer in revenue assumptions, CAC, LTV, and team costs

- Adjust spend, hiring, and product launch timing in real time

- Visualize how every change affects burn and runway

- Build multiple scenarios (base case, aggressive, fallback) instantly

It’s like turning your basic budget into a decision dashboard.

Founder Tip: Treat Your Model Like a Product

Would you ship a product and never touch it again?

Of course not.

Treat your model the same way:

- Review it monthly

- Refactor assumptions as you learn

- Iterate based on real results

- Share insights with your co-founder or early team

This keeps your plan aligned with what’s really happening—not just what you hoped would happen.

When your model is live, your decision-making improves:

- You can say yes or no to opportunities faster

- You know exactly when you’ll need more capital

- You lead with confidence—not reaction

Founder Story—How a Lean Budget Saved a Product Launch

Meet Karan, Founder of SkillNest

Karan was building SkillNest, an online platform helping small-town creators teach skills like design, coding, and language learning.

With a 3-person team and an MVP almost ready, they were gearing up for launch in 60 days.

They had ₹9 lakh in the bank—enough to sustain for about 6–7 months, they thought.

Karan’s plan was simple:

- Finish the product

- Spend ₹2–3 lakh on performance marketing

- Raise a pre-seed round once they had traction

But things didn’t go that smoothly.

What Went Wrong

As launch neared:

- Dev work took 3 weeks longer than planned

- A key hire quit, and they had to spend on contractors

- Ad costs were higher than expected

- A last-minute tool upgrade cost ₹40,000 upfront

The burn rate jumped—and runway shrank fast.

By Month 2, they had burned through ₹4 lakh without a single paying user.

The team felt the stress.

Karan was scrambling between team updates, investor calls, and marketing tests that weren’t converting.

The Turning Point: Building a Real Budget

Karan realized their “budget” was just a rough doc in Google Sheets—full of outdated assumptions and no visibility into runway.

So he took a step back and rebuilt it using PlanVista.

He started with:

- Their current expenses

- Projected revenue over the next 3 months

- New contractor rates and team costs

- CAC and LTV benchmarks based on initial data

In one afternoon, he had:

- A clear burn rate

- Visual runway timeline

- Realistic launch-to-revenue forecast

- Three budget versions based on ad spend and pricing tiers

The Result

With a clear view of cash flow:

- He cut non-essential spend and paused non-urgent dev work

- Shifted launch strategy to focus on partner-driven growth (lower CAC)

- Delayed fundraising by 30 days and raised with more traction

- Shared weekly budget updates with the team—building trust and alignment

They didn’t just survive launch—they grew smarter through it.

Why It Worked

Karan didn’t magically raise more money.

He didn’t find some secret growth hack.

He simply got clear on:

- What they were spending

- What they could afford

- And what needed to change—fast

That clarity created calm.

And that calm helped the team execute.

How PlanVista Makes Startup Budgeting Fast, Flexible, and Founder-Friendly

Most founders don’t have time—or energy—for complex budgeting.

You’re juggling product, growth, hiring, and maybe even fundraising.

But you still need a clear view of your finances to make smart calls.

That’s exactly where PlanVista comes in.

It gives you startup-ready budgeting tools that are:

- Simple to set up

- Easy to adjust

- Powerful enough to guide big decisions

Here’s how it helps.

1. Get Set Up in Under an Hour

Forget staring at a blank Excel sheet wondering where to begin.

PlanVista walks you through a guided setup based on:

- Your startup stage

- Your business model (SaaS, D2C, B2B, etc.)

- Your pricing, user estimates, and expense types

It then builds your revenue and cost forecast in real time—no formulas, no friction.

2. Real-Time Burn and Runway Tracking

Once your assumptions are in, PlanVista auto-calculates:

- Monthly and cumulative burn

- Runway (based on real revenue and spending)

- Revenue vs. cost growth curves

- When you’ll need to raise next (and how much)

You don’t have to build separate models or plug in complex math.

It’s all visualized—and always current.

3. Easy “What-If” Budgeting

Need to test a new hire or adjust pricing?

Want to cut ad spend or delay a launch?

PlanVista lets you:

- Duplicate your forecast with one click

- Adjust any driver (team, CAC, churn, pricing, etc.)

- Instantly compare how each version affects runway and growth

It’s scenario planning made easy—and actually useful.

4. Team-Friendly and Investor-Ready Outputs

Whether you’re updating a co-founder, advisor, or investor:

- PlanVista generates clean visuals and charts

- Lets you export P&L, cash flow, and key metrics

- Helps you look organized, clear, and confident—even if you hate spreadsheets

Founders love how it “makes them look like a pro” in every deck or call.

5. Built for First-Time (and Busy) Founders

No finance background? Perfect.

PlanVista:

- Explains every input in simple terms

- Offers startup-specific metric guidance (CAC, LTV, payback, margin)

- Auto-saves everything to avoid version confusion

- Keeps your model lean and agile—just like your business

Founder Tip: Let Your Budget Do More Than Just Forecast

Use PlanVista for:

- Monthly financial reviews

- Board or investor updates

- Hiring plans and capital raise decisions

- Keeping your team aligned on what matters most

Your budget becomes a tool for leadership—not just a file on your desktop.

Conclusion: Budgeting Is How You Stay in the Game

You don’t need a finance degree to run a smart startup.

But you do need a budget that gives you clarity—before the cash runs out.

Because here’s what every founder learns eventually:

Startups don’t die because of lack of vision.

They die because of poor visibility.

And your budget? That’s your visibility tool.

It’s how you:

- Make faster, smarter decisions

- Control burn instead of reacting to it

- Plan your next raise with confidence

- And avoid the kind of surprises that drain momentum and morale

Simple > Complex

You don’t need a 20-tab spreadsheet with macros.

You just need a simple model that answers key questions:

- What are we making?

- What are we spending?

- How much time do we have?

- What happens if we grow—or don’t?

Keep it clean. Keep it updated. Keep it close.

A Good Budget Becomes a Great Leadership Tool

When your budget is built right, it:

- Aligns your team

- Builds investor trust

- Guides strategic choices

- Prepares you for pivots, hires, launches, and raises

It turns financial planning from a stress point into a strength.

Why PlanVista Is the Smart Move

With PlanVista, founders get:

- Quick startup-ready budget setup

- Automated burn, runway, and revenue forecasts

- Easy scenario planning

- Visuals for decks, team updates, and investor calls

- Confidence to lead without the spreadsheet mess

Whether you’re pre-revenue or scaling fast, PlanVista helps you:

- Forecast better

- Spend smarter

- And grow with control

Final Takeaway

You don’t have to master finance.

You just need to understand your numbers well enough to lead with clarity.

Because the founders who win?

They don’t just raise capital—they respect it.

They build budgets that keep them in control.

They adjust before it’s too late.

They plan based on facts—not just hope.

Start planning smarter with PlanVista. Try it free—no credit card required.

FAQs

Start with projected revenue, add lean expenses, and use tools like PlanVista to guide you.

Include fixed costs, variable costs, marketing, salaries, and a buffer for unexpected changes.

Base it on defendable assumptions, real costs, and early revenue logic—not overly optimistic growth.

A budget is a snapshot of planned spend; a financial model forecasts how those numbers evolve over time.

It simplifies setup, tracks burn and runway, runs “what-if” scenarios, and gives visual outputs for fast decisions.