What Your Burn Rate Says About Your Startup

Introduction: Burn Rate Isn’t Just a Metric—It’s a Message

Ask most early-stage founders how much they’re spending, and they’ll give you a ballpark number.

Ask them what their burn rate is—and what it says about their strategy—and you’ll usually get a pause.

Burn rate isn’t just a financial metric.

It’s a loud signal to investors, your team, and even yourself.

It tells the story of how fast you’re building.

It reflects how intentionally (or recklessly) you’re spending.

It predicts how long your current cash will last—and what you’ll need next.

For a startup, burn rate answers the question:

“Can this business grow before it runs out of money?”

And that’s why it matters so much.

Because while revenue is the goal, burn is the reality.

What You’ll Learn in This Blog

We’re going deep into burn—not just how to calculate it, but how to read it.

You’ll learn:

- What burn rate actually measures (and why it’s not just spend)

- How your burn rate reveals strategy, not just costs

- The difference between healthy burn vs. reckless burn

- A real founder example of how tracking burn saved their funding round

- How tools like PlanVista simplify burn tracking, forecasting, and decision-making

- And why burn rate might be the single most underrated signal in your pitch

Whether you’re just starting out or ramping into a seed raise, understanding your burn is how you build—and lead—with clarity.

Let’s start by defining the term most founders think they understand, but rarely use properly.

What Burn Rate Actually Measures (And What Founders Get Wrong)

Burn rate is one of the most used—and misused—terms in startup finance.

Founders mention it casually.

Investors ask about it in nearly every pitch.

But very few founders can explain what burn rate actually tells you.

Let’s fix that.

The Simple Definition

Burn Rate is how much cash your startup spends each month to operate.

There are two types to know:

- Gross Burn

- Total monthly operating expenses

- Includes payroll, rent, tools, marketing, contractors, etc.

- Total monthly operating expenses

- Net Burn

- Gross Burn minus your monthly revenue

- Tells you how much cash you’re actually losing each month

- Gross Burn minus your monthly revenue

Example:

Gross Burn = ₹4,00,000/month

Revenue = ₹1,00,000/month

Net Burn = ₹3,00,000/month

What Founders Often Get Wrong

1. Confusing Gross and Net Burn

You need to track both.

Gross burn shows your cost structure.

Net burn shows your financial reality.

2. Leaving Out One-Time Expenses

If you pay ₹2L for a tech upgrade or legal fee, and don’t count it, you’re lying to yourself—and investors.

3. Only Looking at Burn Annually

Burn changes monthly. If you review it quarterly or yearly, you’re always reacting, never planning.

4. Guessing

Many early founders guess burn based on memory or their Stripe dashboard. That’s not forecasting—it’s freelancing.

Why Burn Rate Is So Important

Burn rate tells you:

- How long you can survive at your current pace

- Whether your costs match your stage

- When you need to raise again (runway)

- Whether you’re building toward sustainability—or drifting from it

It’s not just about cash. It’s about control.

Healthy Burn vs. Problematic Burn

- Healthy Burn: Tied to growth (e.g., sales team, marketing ROI, product dev)

- Unhealthy Burn: Untracked spending, bloated tools stack, premature scaling

Early burn is expected. But unexplained burn is a red flag

How to Know If Your Burn Is Too High

Ask:

- Is burn increasing faster than revenue?

- Are you hiring ahead of validation?

- Are you burning for vanity (press, events) instead of traction?

If yes, it’s time to rethink your financial strategy.

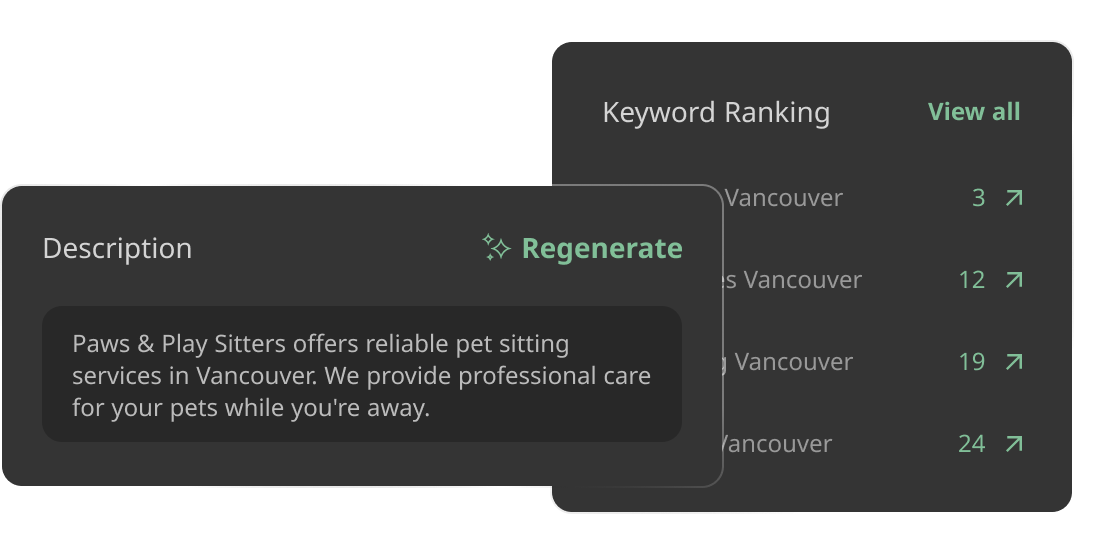

PlanVista: Burn Tracking That Makes Sense

PlanVista helps founders:

- Track gross and net burn in real time

- Model future burn as your team or marketing scales

- Compare lean vs. aggressive growth plans

- See exactly how burn impacts runway, CAC, and cash flow

No spreadsheets. No finance jargon. Just clarity.

How to Calculate Burn Rate Step-by-Step (Without Guessing)

Knowing your burn rate isn’t a nice-to-have—it’s how you avoid running out of cash before hitting your next milestone.

But here’s the thing:

Most founders calculate burn using rough mental math.

The result? Misaligned projections, cash shortfalls, and tough investor questions.

Let’s fix that with a straightforward, step-by-step approach.

Step 1: Identify Your Burn Type

Before you do anything, define what you’re measuring:

- Gross Burn: Your total monthly operating expenses

- Net Burn: Your gross burn minus any monthly revenue

You should know both.

Step 2: List All Monthly Operating Expenses

Start with a clean monthly view. Include:

- Salaries (founders + employees + contractors)

- Rent or co-working costs

- Software tools (SaaS subscriptions, licenses)

- Marketing spend (ads, freelancers, agencies)

- Legal, accounting, or admin costs

- Hosting or product infrastructure

- One-time expenses (spread out across months, if needed)

Example Breakdown:

- ₹2,00,000 salaries

- ₹40,000 tools

- ₹60,000 marketing

- ₹20,000 admin & infra

- ₹30,000 one-time costs averaged

Gross Burn = ₹3,50,000/month

Step 3: Factor in Monthly Revenue (If Any)

If you’re post-launch and earning revenue, subtract that from your gross burn to get net burn.

Example:

- ₹3,50,000 gross burn

- ₹1,00,000 monthly revenue

Net Burn = ₹2,50,000/month

This is the actual cash loss you need to cover.

Step 4: Watch Burn Trends, Not Just Snapshots

Burn rate should be tracked month over month, not just as a one-time snapshot.

Create a simple burn report:

- Track actual vs. forecasted burn

- Note any one-time spikes

- Include burn as a % of total runway

This helps you spot overspending early—and plan smarter.

Step 5: Always Tie Burn to Runway

Runway = Total Cash / Net Burn Rate

If you have ₹15,00,000 in the bank and burn ₹2,50,000/month, your runway is 6 months.

Knowing this is how you:

- Time your fundraising

- Avoid panic hiring freezes

- Make confident hiring and marketing decisions

What to Avoid

- Ignoring small recurring expenses (they add up)

- Forgetting revenue fluctuations

- Not including tax liabilities or delayed invoices

- Assuming burn will magically improve next quarter

PlanVista Makes Burn Easy

With PlanVista:

- Add expenses once, and get live gross/net burn calculations

- Automatically link burn to runway, revenue, and growth scenarios

- Visualize monthly burn changes, red flags, and future risks

- Export reports for investors, advisors, or internal planning

Burn clarity isn’t optional. It’s how smart founders lead.

What Your Burn Rate Tells Investors About Your Strategy

Before you even explain your product or pitch your vision, investors are already doing math in their heads.

One of the first numbers they lock onto?

Your burn rate.

Because beyond being a measure of how fast you’re spending, burn is a lens into how you operate as a founder.

Burn Rate = Strategic Signal

When investors review your burn rate, they’re asking:

- Is this founder building lean or scaling aggressively?

- Are they spending to unlock growth—or just to look big?

- Is their burn aligned with their current traction and milestones?

- Will this team run out of cash before hitting a meaningful inflection point?

In short:

Your burn rate tells them whether you’re in control—or just burning for momentum.

What Healthy Burn Looks Like (From an Investor’s POV)

- Tied to milestones

Spending is focused on building, acquiring users, or getting to PMF—not fluff.

- Controlled, but assertive

Not too conservative (stagnation), not reckless (burnout). Burn aligns with plan.

- Transparent and trackable

You know where money is going—and how it’s performing.

- Tied to runway and roadmap

Your burn matches the timeline needed to hit growth goals or fundraising windows.

Red Flags in Burn Patterns

- High burn with low traction

Investors see this as overconfidence—or lack of prioritization.

- Inconsistent monthly burn

Large, unexplained spikes suggest poor financial planning.

- No revenue offsets

If burn stays the same while revenue grows, you’re missing leverage.

- Runway < 6 months with no raise in motion

Big warning sign: you’re burning too fast without a safety net.

What Founders Should Communicate

When you share your burn rate, don’t just state it—frame it.

“We’re burning ₹2.5L/month, with a focus on product completion and early acquisition.

That gives us 9 months of runway, with a planned raise in Month 7.”

That signals:

- You understand the business model

- You know where your cash is going

- You’re building toward a clear goal—not just burning for optics

PlanVista’s Edge: Investor-Ready Burn Insights

PlanVista helps founders:

- Present clean monthly burn summaries

- Track how burn evolves as hiring, spend, and revenue shift

- Export visuals showing burn vs. runway over time

- Share numbers that answer investor questions before they’re asked

It’s not just about “showing numbers”—it’s about showing you know what they mean.

Burn rate on its own isn’t dangerous.

Unmanaged burn is.

The difference between founders who stay in control—and those who spiral into panic—is how they manage their spend in the early months.

You don’t need to be frugal. You need to be intentional.

Here are the most common mistakes founders make with burn—and how to avoid them before your runway disappears.

Mistake #1: Spending Ahead of Validation

You don’t need a full sales team, fancy SaaS stack, or premium office space to test your idea.

But many founders burn through capital on:

- Full teams before PMF

- Product features no one’s asking for

- Paid ads before organic traction

Fix: Tie spending to learnings, not comfort. Don’t scale what hasn’t been validated.

Mistake #2: No Burn Forecast

Tracking burn is great. But if you’re not forecasting how it evolves as you hire, launch, and scale—you’re blindfolded.

Example:

You hire 3 people in Month 4. Your burn goes from ₹2.5L to ₹5.5L.

But you don’t realize you just cut your runway in half.

Fix: Forecast burn monthly based on planned hiring, marketing, and growth. Use tools that update this live.

Mistake #3: One-Time Costs Not Accounted For

Legal fees, product licensing, team offsites—they add up.

Founders often forget these in monthly burn, then scramble when costs spike unexpectedly.

Fix: Spread large one-time expenses across months. Always buffer 10–15% for surprises.

Mistake #4: Hiring for Scale Instead of Fit

Hiring too early—or too senior—can drain your budget without driving growth.

Do you need a Head of Growth… or just someone who can run Google Ads for now?

Fix: Hire for fit, not title. Budget for outcomes, not structure.

Mistake #5: Assuming Revenue Will Save the Burn

“Let’s spend now. Revenue will come in Month 3.”

Maybe. Maybe not.

Fix: Burn planning should be based on actual runway—not hopeful timelines.

Mistake #6: Not Cutting When Needed

Founders delay tough calls because of sunk cost bias or team loyalty. But delay increases damage.

Fix: Know your must-haves vs. nice-to-haves. Set pre-agreed triggers to cut costs.

PlanVista Helps You Avoid All of This

With PlanVista, you can:

- Forecast burn month-by-month

- Model team additions and spending jumps

- Compare burn scenarios (lean vs. aggressive)

- Track your current vs. planned runway

You get ahead of burn, instead of reacting to it too late.

Aligning Burn Rate With Milestones—The Smart Way to Spend

Not all burn is bad.

Burning capital to reach a clear goal is what early-stage startups are built for.

But if your burn isn’t tied to milestones, it becomes aimless.

Burn + No Milestone = Waste

Burn + Strategic Milestone = Progress

Here’s how the smartest founders align their spending with the outcomes that matter most.

What Is a Burn-Linked Milestone?

A burn-linked milestone is a business objective you plan to achieve within a set amount of time and capital.

Examples:

- MVP launch

- First 100 paying customers

- 3-month retention proof

- ₹1L MRR

- Hiring a key technical lead

- Closing a partnership or pilot program

These aren’t just activities—they’re proof points.

Why This Matters to Investors

When investors see that your burn is driving toward something measurable, they see:

- You’re capital efficient

- You know what success looks like

- You’re less likely to come back with a weak justification for another round

“We’re burning ₹2.5L/month to hit 1,000 DAUs and ₹75k MRR by Month 6.”

That’s a plan, not a hope.

How to Align Burn With Milestones

- Map Your Key Milestones

- Product readiness

- User growth

- Revenue targets

- Market expansion

- Product readiness

- Estimate How Much Burn Each Will Require

- Hiring? Marketing? Infrastructure?

- Model each phase’s spend separately

- Hiring? Marketing? Infrastructure?

- Layer Into Your Forecast

- Show Month 1–3 = Build

- Month 4–6 = Grow

- Month 7 = Prepare for raise

- Show Month 1–3 = Build

- Measure Progress Often

- Did you hit the milestone?

- Did you overspend?

- Was the outcome worth the burn?

- Did you hit the milestone?

Founder Tip: Milestone-Based Forecasting Wins Pitch Rooms

Investors are tired of “We’ll grow 15% per month.”

They want to hear:

“We’re investing in user acquisition with a CAC of ₹1,200 and expect 750 paid users by Month 5.

That gets us to break-even on CAC by Month 7 and positions us for a ₹1.5Cr raise in Q3.”

Now your burn becomes a strategy, not a red flag.

What PlanVista Does Differently

PlanVista lets you:

- Build forecasts around specific milestones

- Tag team, product, or marketing investments to phases

- Monitor spend vs. progress in real time

- Export milestone-based budget visuals for your deck

It’s not just a spreadsheet. It’s a strategic compass.

How Burn Rate Visibility Makes You a Better Leader

Burn rate isn’t just for investors.

When you understand and communicate your burn clearly, you lead better.

Period.

Why? Because every major decision—product, hiring, marketing, fundraising—is ultimately a cash decision.

And when you don’t know your burn, you’re leading blind.

What Real Burn Visibility Looks Like

It means you can answer these questions instantly:

- What are we burning per month—gross and net?

- How does that change when we hire or scale marketing?

- What’s our current runway, and what milestone are we burning toward?

- What’s our backup plan if growth is slower than expected?

This isn’t about being a finance guru. It’s about being a founder who knows how to lead with data.

Burn Visibility Builds Internal Trust

Your team isn’t just following your product vision—they’re trusting you with their time, energy, and livelihood.

When you can clearly share:

- “Here’s how much we’re burning”

- “Here’s what we’re trying to achieve with it”

- “Here’s how we’re pacing toward that”

You build confidence.

You avoid surprise cuts, last-minute pivots, or vague financial updates.

Clarity kills chaos.

Burn Visibility Builds Investor Trust

You can’t just walk into a pitch and say:

“We’re spending ₹4L/month but haven’t figured out where the money’s going.”

That screams mismanagement.

Investors want founders who:

- Know their burn cold

- Can tie burn to outcomes

- Are already thinking about the next raise—before the money runs out

Visibility = readiness.

Readiness = trust.

Founder Tip: Review Burn Monthly With Your Team

Just 15 minutes each month:

- Show gross and net burn

- Highlight big shifts (hires, campaigns, ops)

- Reconnect it to roadmap or OKRs

- Share progress toward key financial milestones

This creates a team that respects cash—and helps you protect runway together.

How PlanVista Makes Burn Leadership Easy

Inside PlanVista, you can:

- Track monthly burn in real time

- Set alerts when burn or runway crosses thresholds

- Visualize spending spikes, hires, or delays

- Share updates easily with co-founders, team leads, or board members

You’ll stop leading from instinct—and start leading from insight.

When (and How) to Adjust Your Burn Rate

Burn rate isn’t set in stone.

In fact, one of the most valuable skills you can develop as a founder is knowing when to adjust your burn—and how to do it without derailing growth.

Because while steady burn might look stable on paper, real startups go through phases:

- Launch

- Learn

- Scale

- Reset

And each phase calls for a different burn strategy.

When to Increase Burn (Intentionally)

There are moments where increasing burn makes strategic sense:

- You’ve found product-market fit and need to grow faster

- You’ve just raised a round and have cash to deploy

- You’re testing a new channel or pricing strategy

- You’re investing in a key hire or infrastructure upgrade

Tip: Only increase burn when you’re clear on:

- What outcome it drives

- How you’ll measure impact

- How long the elevated spend will last

Example:

You increase marketing spend by ₹1L/month to test paid acquisition.

Track CAC, conversion, and LTV monthly.

If it pays off, scale. If not, revert.

When to Cut Burn (Without Killing Momentum)

Sometimes burn creeps up silently:

- Tool bloat

- Dead marketing spend

- Unused vendor retainers

- Team hires ahead of validation

Or the market changes:

Your fundraise stalls. CAC jumps. Churn increases.

These are signs it’s time to cut burn intentionally—not reactively.

How to Reduce Burn Strategically

- Audit tools and vendors

Cut what’s not being used or adding ROI

- Freeze hiring temporarily

Reassess who’s a must-have vs. waitlist

- Pause marketing channels with poor ROAS

Double down on what works

- Renegotiate vendor terms

Get lean without losing capability

- Delay roadmap features that don’t move metrics

Build for traction, not perfection

Cutting burn isn’t about panic.

It’s about regaining control—and preserving flexibility.

Communicate Burn Changes with Context

Whether you’re scaling up or pulling back, your team and investors need to know why.

Say:

“We’re increasing burn by 25% for 3 months to test new CAC strategies. We’ll reevaluate in Week 12.”

OR

“We’ve paused two hires and cut ₹80K/month to extend runway by 3 months as we push toward MRR targets.”

That kind of clarity builds trust—even in uncertain moments.

PlanVista Makes Adjustments Easy

With PlanVista, you can:

- See how burn shifts with every hire or cost change

- Model “what-if” scenarios for both scale-up and lean modes

- Forecast new runway instantly

- Share updated burn visuals in investor or team decks

It takes the guesswork—and stress—out of adjusting your burn strategy.

Conclusion: Burn Rate Is How You Lead With Clarity

Startups don’t die from bad ideas.

They die from bad timing, unclear spending, and running out of cash without a plan.

And at the center of all of that?

Burn rate.

Your burn rate doesn’t just show how fast you’re spending.

It reveals how well you understand your business, your strategy, and your priorities.

It’s the number that connects vision to execution—and execution to survival.

What You’ve Learned

Throughout this blog, we’ve covered:

- What burn rate really measures (and how founders get it wrong)

- How to calculate it step-by-step—accurately and consistently

- What your burn tells investors about your mindset and maturity

- Common mistakes that drain your startup early

- How to align burn with real milestones

- Why burn visibility turns you into a better internal and external leader

- And how to adjust burn without losing momentum

The key theme?

Burn isn’t just about cash—it’s about control.

Why Founders Who Understand Burn Win More

Founders who know their burn can:

- Plan ahead—not react

- Raise with credibility—not desperation

- Hire intentionally—not emotionally

- Lead confidently—not blindly

Even when markets shift or revenue lags, they know what they can afford to do, and what they can’t.

That kind of clarity gives you time, options, and leverage—all rare advantages in early-stage building.

How PlanVista Gives You Burn Control

With PlanVista, you’re not buried in spreadsheets.

You can:

- Track gross and net burn automatically

- Adjust hiring or marketing and see impact instantly

- Plan multiple spend scenarios based on growth or slowdown

- Tie burn to milestones, runway, CAC, and funding timelines

- Export clean visuals for investor decks or internal updates

Whether you’re pre-revenue or prepping for a Series A, PlanVista helps you lead with burn logic—not burn fear.

Final Takeaway

Burn rate is one of the most important—and overlooked—founder tools.

It’s not just about staying alive.

It’s about building with precision, adapting with clarity, and showing the kind of discipline investors bet on.

So track it.

Know it.

Use it.

Start managing smarter with PlanVista. Try it free—no credit card required.

FAQs

Burn rate is the amount of money a startup spends each month—either gross (total) or net (after revenue).

It shows how fast you’re spending, how long your runway lasts, and whether your spending aligns with real milestones.

Cut low-ROI spend, delay hires, and tie spending to measurable outcomes—not vanity projects.

Use tools like PlanVista to model burn, link it to hiring or revenue plans, and track impact over time.

It depends on your stage, but investors look for intentional spending tied to traction—not just aggressive burn without results.