Fundraising in 2025: What’s Changed for Startups

Introduction: Fundraising in 2025 — A Brave New Landscape for Startups

In the ever-evolving world of startups, 2025 marks a turning point in how early-stage and growth-stage companies approach fundraising. The economic aftershocks of recent global disruptions, the rapid integration of artificial intelligence (AI) into every industry, and the shifting mindset of investors have collectively reshaped the fundraising landscape. The days when a sleek pitch deck and a charismatic founder could quickly land a multi-million-dollar seed round are largely behind us. In their place stands a more calculated, data-driven, and expectation-heavy investment environment.

Startups now face a more discerning group of investors who are no longer swayed solely by innovation or market potential. Instead, they demand clear evidence of traction, revenue models, scalability, and—more than ever—resilience. While this new reality might seem daunting, it also creates opportunities for founders willing to adapt, embrace technology, and think strategically.

Adding to this mix is the growing reliance on digital tools and platforms that help streamline the fundraising process. AI-powered business planning solutions, like the PlanVista app, have emerged as essential resources for startups looking to stay competitive. These tools help founders generate detailed, investor-ready business plans, analyze funding gaps, and create data-backed growth forecasts—all crucial elements in today’s investment climate.

This blog explores what’s changed in startup fundraising as of 2025, the challenges entrepreneurs face, the role of AI in smoothing the process, and how tools like PlanVista empower founders to not only survive but thrive. Whether you’re a seasoned entrepreneur gearing up for another funding round or a first-time founder navigating the unknown, understanding the rules of the fundraising game in 2025 is more critical than ever.

The New Rules of Startup Fundraising in 2025

Fundraising in 2025 is no longer just a numbers game or a popularity contest—it’s a strategic process guided by hard metrics, clear value propositions, and thoughtful business execution. The startup funding landscape has matured considerably, making way for new rules that emphasize sustainability, scalability, and savvy.

1. Investors Now Demand More Than Just a Vision

Gone are the days when investors could be swayed by a compelling story or a futuristic idea. In 2025, investors expect startups to come to the table with evidence. This includes validated product-market fit, active user growth, early revenue figures, and a realistic go-to-market strategy. Due diligence processes have deepened, and founders are expected to understand the financial mechanics of their business thoroughly.

Investors are looking for strong unit economics, recurring revenue models, and tangible customer acquisition strategies. This shift has made financial literacy a core skill for any founder looking to raise capital.

2. Early-Stage Funding Has Tightened

The Series A crunch has intensified. While late-stage capital is flowing again—especially into companies demonstrating strong post-revenue growth—early-stage funding is more competitive than ever. Founders must now show significant progress before raising even a seed round.

Accelerators and incubators are evolving into proving grounds, where only the most promising startups earn access to broader investor networks. Founders are increasingly expected to bootstrap longer, proving traction before they can secure a formal round.

3. Alternative Financing Models Are on the Rise

With equity capital harder to obtain, alternative financing models like revenue-based financing (RBF), venture debt, and SAFE notes have become more attractive. These options provide flexibility and preserve equity for founders who want to grow without giving up large ownership chunks too early.

4. Global Expansion and Cross-Border Investments

Globalization is another defining trend. Investors are no longer confined to their local ecosystems. Tools like Zoom, digital data rooms, and AI-powered deal flow platforms have made cross-border investing seamless. In 2025, startups from Latin America, Southeast Asia, and Eastern Europe are receiving increased attention, thanks to growing markets and digital penetration.

For example, Latin America saw a 26% uptick in startup investments over the past year, signaling a diversification in global investor focus.

5. Transparency and ESG Are Table Stakes

Environmental, Social, and Governance (ESG) concerns are no longer optional. Investors want transparency—not just in business metrics but also in corporate ethics, sustainability practices, and social impact. Startups with ESG-aligned missions or sustainability frameworks are enjoying a funding edge.

Challenges Startups Face in 2025

As the startup ecosystem continues to evolve in 2025, securing funding has become both a science and an art—one with higher stakes and tougher odds. Founders aren’t just pitching ideas anymore; they’re navigating a minefield of economic uncertainty, valuation volatility, and investor skepticism. Understanding the key hurdles can make the difference between closing a round and closing shop.

1. Economic Uncertainty and Investor Caution

The global economy remains unpredictable in the post-pandemic, post-inflationary era. Although markets have shown signs of recovery, geopolitical tensions, interest rate fluctuations, and inconsistent consumer demand have all contributed to a more cautious investment environment.

Venture capital firms are deploying capital more slowly and carefully. Due diligence is more exhaustive, with investors taking longer to commit. Founders report extended funding timelines, often stretching several months longer than in previous years.

2. The “Down-Round” Dilemma

Valuations have become a sticking point. The high-flying valuations of 2020–2022 are largely gone, replaced by a sobering wave of down-rounds, where startups raise money at lower valuations than their previous rounds. This not only dilutes founder equity but can also tarnish a startup’s image in the eyes of future investors.

A notable example is the revival of the IPO market, where venture-backed firms like MNTN and Hinge Health are preparing to go public—albeit at significantly lower valuations than they once commanded. This trend underscores a broader recalibration across private markets.

3. Intense Competition in the AI Era

The AI gold rush has flooded the market with innovation, but also with noise. Standing out has become a challenge as thousands of AI-powered startups vie for the same investor attention. From AI-enhanced healthcare platforms to agentic sales automation tools, the pressure to differentiate is intense.

Investors are no longer impressed by AI buzzwords alone—they want to see how AI tangibly impacts business models, improves margins, or enables new capabilities. Generic AI claims don’t cut it anymore; startups must show clear, defensible value.

4. Evolving Investor Criteria

In 2025, many investors now operate with ESG (Environmental, Social, and Governance) checklists, deeper compliance expectations, and an appetite for startup transparency. There’s a growing preference for startups that have solid governance frameworks and prioritize ethical operations from the outset.

This new level of scrutiny can be especially challenging for early-stage startups that may not yet have the resources or infrastructure to meet these standards—but neglecting them can mean getting passed over.

5. Burnout and Founder Fatigue

The longer timelines, repeated rejections, and rising pressure are taking a toll on founders. Burnout is on the rise. More than ever, startup leaders must balance hustle with health—both for themselves and their teams. Mental resilience and strategic pacing have become essential entrepreneurial traits.

The Role of AI in Modern Fundraising

Artificial Intelligence isn’t just a buzzword in 2025—it’s a fundamental tool reshaping how startups approach fundraising. From identifying the right investors to optimizing pitch decks, AI has become a silent partner in the capital-raising process. For founders navigating an increasingly complex landscape, leveraging AI is no longer optional—it’s a competitive necessity.

1. Smarter Investor Matching

AI-powered platforms now use deep data analysis to connect startups with investors whose portfolios, stage preferences, and industry focus align with their business. Instead of the traditional shotgun approach—emailing hundreds of VCs and hoping one bites—founders can now rely on AI to target only the most relevant investors.

This precision not only saves time but also increases the quality of conversations. Startups are seeing higher response rates and more productive meetings, thanks to these intelligent matchmakers.

2. Pitch Deck and Narrative Optimization

Gone are the days of guesswork when it comes to crafting a pitch deck. AI tools now analyze successful investor presentations across industries to help founders structure compelling narratives. From suggesting slide order to flagging jargon and filler content, AI ensures that every word and visual supports the funding goal.

Founders can also use AI to simulate investor questions and prepare tailored responses—turning an average pitch into a strategic performance.

3. Accelerated Due Diligence

Investors, too, are leaning on AI to vet startups faster. Platforms powered by machine learning can evaluate a startup’s market potential, scan financial models, and benchmark metrics against industry standards. This speeds up the due diligence process while also raising the bar for founders, who must ensure their data is clean, consistent, and compelling.

Startups using AI to audit and organize their financials proactively are gaining favor with investors. Transparency and readiness signal maturity.

4. Forecasting and Risk Analysis

AI tools are now capable of generating dynamic financial forecasts, stress-tested across different economic scenarios. These forecasts can help startups plan their burn rate, assess risk factors, and optimize resource allocation—all critical factors for investor confidence.

Moreover, predictive analytics give founders real-time insights into how certain business decisions might impact future funding opportunities.

5. Real-World Success: Sweep’s AI Strategy

Take Sweep, a New York-based startup that raised $22.5 million in Series B funding. The company uses agentic AI to automate go-to-market workflows within CRMs like Salesforce and HubSpot. Investors were drawn to the measurable impact of Sweep’s AI integration—real-time updates, seamless data monitoring, and workflow automation.

This kind of practical, revenue-driving use of AI is exactly what excites investors in 2025. It’s not just about having AI; it’s about how it drives efficiency and profitability.

How PlanVista Empowers Startups

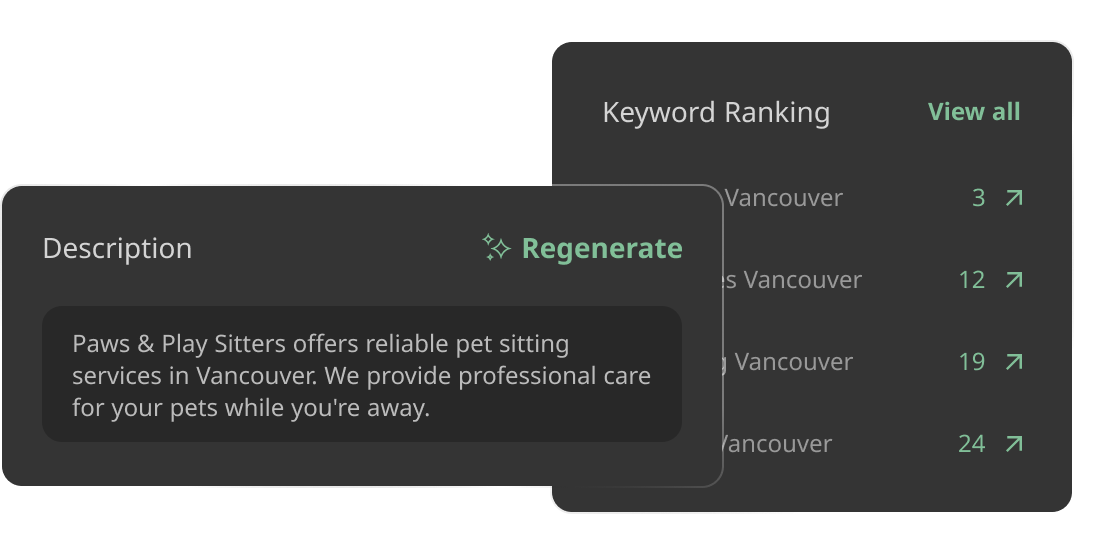

In the dynamic fundraising landscape of 2025, startups need more than grit and hustle—they need intelligent, data-driven tools to outpace the competition. That’s where the PlanVista app comes in. Built specifically for early-stage and growth-focused entrepreneurs, PlanVista is not just a business plan generator; it’s a full-scale AI-powered startup planning tool designed to help founders navigate every stage of the fundraising journey.

1. Instant, Investor-Ready Business Plans

Crafting a compelling business plan is often the first major hurdle in a startup’s funding journey. PlanVista’s AI business plan tool removes the guesswork by generating professional-grade, investor-ready business plans in minutes. It helps founders articulate their vision with clarity while including all the essentials investors expect—market analysis, revenue projections, go-to-market strategy, and financial modeling.

Unlike template-based tools, PlanVista customizes every plan based on industry, business stage, and market trends. This ensures each plan aligns with investor expectations and showcases the startup’s unique potential.

2. Strategic Startup Planning

Fundraising isn’t just about raising capital—it’s about building a sustainable business. PlanVista helps founders think beyond the pitch by offering strategic planning features that guide growth trajectory, milestone mapping, and risk analysis.

Whether you’re projecting customer acquisition costs, modeling your burn rate, or planning market expansion, PlanVista provides the analytical backbone to help you make data-driven decisions. It’s like having a fractional CFO in your pocket.

3. AI-Powered Insights into Investor Trends

One of PlanVista’s standout features is its ability to analyze current investor behavior and funding trends. The platform continuously scans funding databases, VC activity, and sector-specific investment patterns to offer real-time insights. This helps founders understand what types of startups are getting funded, what metrics matter most, and how to position themselves competitively.

Imagine knowing that SaaS companies with ARR over $100k are closing faster, or that sustainability-focused startups are trending with impact investors. PlanVista delivers these insights directly, allowing startups to tailor pitches and strategies for maximum relevance.

4. Customizable Pitch Decks and Templates

PlanVista doesn’t stop at business plans. It also offers pitch deck templates that are not only professionally designed but dynamically populated with the startup’s actual data. Founders can tweak and refine their story using AI recommendations that align with industry norms and VC preferences.

From storytelling frameworks to slide-by-slide guidance, PlanVista ensures that your pitch is coherent, compelling, and ready to impress.

5. Seamless Collaboration and Export

Startups don’t work in silos—and neither does PlanVista. The app allows for team collaboration, investor-specific plan exports, and version tracking. You can share tailored plans and decks with different investor groups, adapting language and focus without losing consistency.

Fundraising Strategies That Work in 2025

While the landscape of startup fundraising in 2025 has shifted, success is still very much possible for those who adapt. With investor scrutiny at an all-time high and technology reshaping how deals are made, today’s founders need to master not just the art of storytelling, but also the science of strategy. Here are five highly effective fundraising strategies that are getting real results for startups right now.

1. Start With “Warm” Introductions, Not Cold Pitches

In 2025, warm introductions are gold. Investors receive hundreds of cold pitches every month—and the odds of getting noticed without a personal connection are slim. Founders who tap into their networks, alumni groups, accelerator communities, or LinkedIn to seek introductions stand a better chance of landing a meeting.

If you don’t have a direct connection, using tools like PlanVista can help by identifying mutual contacts and guiding outreach messaging based on investor profiles and preferences.

2. Leverage Milestones for Momentum

Rather than waiting until you “need money,” savvy startups time their fundraising efforts around key milestones—like product launches, user growth benchmarks, or revenue spikes. These events build credibility and create urgency.

Investors want to join a winning team, not rescue one. Announcing a successful pilot program or landing a major customer while in the middle of fundraising can serve as powerful leverage.

3. Build a Strong Data Room Early

In 2025, due diligence begins the moment an investor shows interest. Founders who proactively organize their data room—complete with financials, cap tables, customer metrics, legal docs, and team bios—signal professionalism and reduce friction.

PlanVista helps automate this by aligning your business plan with the typical VC checklist, ensuring all essential documentation is in place before those investor meetings happen.

4. Use Traction Metrics to Tell Your Story

Numbers speak louder than adjectives. Instead of saying “we’re growing fast,” show month-over-month user growth, conversion rates, or customer lifetime value. These metrics paint a far more compelling picture and help investors gauge momentum and market fit.

Use visuals in your pitch deck to highlight key KPIs. PlanVista’s pitch deck builder integrates live data visuals to make these numbers pop.

5. Develop a “Rolling Raise” Strategy

The traditional model of raising a lump sum in a single round is giving way to rolling fundraising. This approach allows startups to bring investors in over time—often through convertible notes or SAFEs—while maintaining growth momentum and flexibility.

It’s especially effective in volatile economic conditions, allowing startups to build relationships and raise incrementally, without losing months to fundraising marathons.

Why First-Time Founders Need More Support Than Ever

2025 is an incredible year to launch a startup—but it’s also one of the toughest years in recent memory for first-time founders. The fundraising ecosystem, while more data-rich and tech-enhanced, has also become more demanding. Investors expect seasoned responses, strategic clarity, and financial precision—even from entrepreneurs who are still learning the ropes.

The reality is this: first-time founders are often underestimated. Without a track record, they must work twice as hard to earn investor trust. And with early-stage funding becoming more selective, the learning curve has never been steeper.

This is where support systems become critical. Mentorship, accelerators, and strategic tools like the PlanVista app can dramatically level the playing field. While mentors provide guidance and perspective, tools like PlanVista handle the heavy lifting—transforming abstract ideas into structured plans, creating financial forecasts, and offering pitch-ready materials that align with investor expectations.

First-time founders also face challenges in storytelling. Explaining a complex business model, market opportunity, and competitive edge—all within a 10-slide deck—can be overwhelming. AI-powered insights from PlanVista help distill that complexity into clarity, so founders can articulate their vision with confidence.

Most importantly, support helps first-time founders avoid common pitfalls: undervaluing their startup, over-promising in pitch meetings, or entering negotiations unprepared. By using smart tools and seeking out experienced voices, new entrepreneurs can close those knowledge gaps quickly.

In today’s market, being a first-time founder isn’t a disadvantage—it’s an opportunity to build smarter from day one. With the right support system, and the right platform like PlanVista, they can turn fresh perspective into fundraising power.

Fundraising in 2025 isn’t just about capital—it’s about clarity, credibility, and execution. The rules have changed, and so must the mindset of every founder hoping to succeed in this new era. Investors are more cautious, funding cycles are longer, and the bar for business fundamentals has never been higher. But for startups willing to adapt, this environment isn’t a dead end—it’s a roadmap to building more resilient, scalable, and impactful companies.

The common thread among today’s successful startups isn’t just innovation. It’s preparedness. Founders who enter fundraising conversations with detailed financials, realistic growth projections, and well-crafted go-to-market plans are the ones securing checks. Those who can demonstrate traction—not just talk about potential—stand out in a saturated field.

Technology, particularly artificial intelligence, is leveling the playing field. It’s giving smaller, scrappier startups access to tools that once belonged exclusively to large companies or seasoned founders. From automating investor research to generating pitch-perfect business plans, AI is reducing the friction of fundraising—and empowering founders to move faster and smarter.

PlanVista is at the heart of this transformation. It’s more than a business plan generator—it’s an all-in-one AI business planning solution tailored to the unique needs of today’s entrepreneurs. Whether you’re preparing for your first seed round or plotting your Series B strategy, the PlanVista app offers a powerful suite of tools to help you stay investor-ready, strategic, and confident.

In a market where every decision counts, PlanVista ensures you don’t waste time chasing misaligned investors or producing documents that fall flat. Instead, you build a business plan that works as hard as you do—guided by AI, fueled by data, and tailored for results.

So if you’re a founder preparing to raise capital, don’t just go in with an idea. Go in with a plan—the right plan. With PlanVista, you can tell your story clearly, back it with numbers, and present it with the polish that today’s investors demand.

Ready to power your next raise? Try PlanVista and start your journey to smarter, faster fundraising today.

FAQs

Investor expectations have shifted towards proven traction, strong financials, and clear growth strategies. The bar for early-stage startups is significantly higher.

AI can streamline business plan creation, match startups with ideal investors, optimize pitch decks, and forecast financial outcomes, saving time and boosting efficiency.

PlanVista is an AI-powered business planning app that helps startups create investor-ready plans, analyze growth opportunities, and stay aligned with market expectations.

Yes, but it’s more competitive. Startups must show meaningful progress, product-market fit, and strong planning to stand out in early-stage fundraising.