5 Metrics Investors Expect to See in Your Forecast

Introduction: Don’t Pitch Without These Metrics in Your Forecast

You’ve got the vision. You’ve got traction.

You’ve polished your deck, refined your story, and set your fundraising target.

But then an investor asks:

“Can you walk us through your forecast—specifically your CAC, LTV, and payback period?”

And suddenly the room goes quiet.

Too many founders treat financial metrics like a post-pitch add-on.

But if you want serious investors to take you seriously, your forecast must speak their language.

And that language is metrics.

Why These Metrics Matter

Investors aren’t just looking for big growth curves or optimistic revenue charts.

They’re asking:

- Does this founder understand their business model?

- Can they track the numbers that drive growth and capital efficiency?

- Will their money be used wisely—or vanish in a black hole?

Your forecast isn’t just a finance doc—it’s a credibility tool.

The Metrics That Matter Most

Sure, every investor has their preferences.

But some metrics are non-negotiable if you’re pitching with a forecast.

In this blog, we’ll walk through the 5 key metrics every investor expects to see:

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

- Burn Rate

- Runway

- Revenue Growth (and how it’s built)

You’ll learn:

- What each metric means

- How to calculate them (without finance jargon)

- What benchmarks investors expect

- And how tools like PlanVista make these numbers easy to forecast, explain, and present with confidence

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is one of the first metrics investors will zero in on.

Why?

Because it tells them how much it actually costs you to win a customer.

And if your CAC is too high—or poorly calculated—it means you’re scaling something unsustainable.

What Is CAC?

CAC is the average amount you spend to acquire one paying customer.

At its simplest:

CAC = Total Sales + Marketing Costs / New Customers Acquired

This includes:

- Paid ads

- Sales team salaries

- Marketing software/tools

- Creative contractors

- Any campaign or lead gen expenses

Example:

You spend ₹1,50,000/month on sales + marketing

You acquire 100 new paying customers

Your CAC = ₹1,500

Why Investors Care About CAC

CAC tells them:

- If your growth is scalable

- How capital-efficient your GTM strategy is

- Whether you’ll need to raise again too soon

- If your unit economics work at larger scale

If your CAC is high and your revenue per customer is low? That’s a red flag.

If CAC is low but LTV or retention is poor? That’s still a problem.

Common Founder Mistakes

- Only counting ad spend (and ignoring salaries or software)

- Using leads instead of paying customers

- Basing CAC on one campaign (instead of blended across all channels)

- Guessing instead of pulling data

Your CAC must be defendable. If you can’t explain how it was calculated, you lose investor confidence instantly.

What a “Good” CAC Looks Like

It depends on your model. But here are rough expectations:

- SaaS: ₹1,500–₹5,000 per user is common

- D2C: Depends on AOV (should aim for <1/3 of LTV)

- B2B: Can be ₹20,000+ if LTV supports it

More important than the raw number is the CAC to LTV ratio—which we’ll cover next.

Founder Tip: Know Your Payback Period

CAC is one thing.

How fast you recover that cost is another key signal.

Payback Period = CAC / Monthly Revenue per Customer

If CAC = ₹3,000 and customers pay ₹1,000/month, your payback = 3 months.

Investors like payback periods under 6–12 months, depending on your model.

It means you can reinvest cash faster—and grow with control.

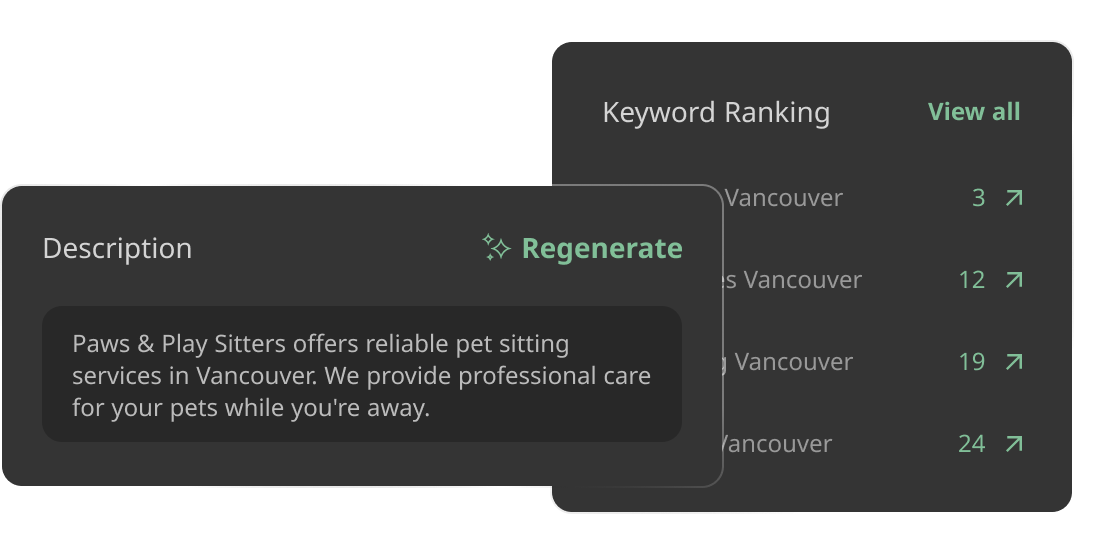

How PlanVista Helps

PlanVista tracks CAC by:

- Blending your total sales and marketing spend

- Mapping it against actual customer acquisition

- Visualizing CAC vs. LTV in real time

- Helping you model CAC across scenarios (e.g., if ad costs rise 20%)

You don’t have to build formulas or worry about spreadsheet errors.

Just input your channels—and let PlanVista show how efficient your customer growth really is.

Lifetime Value (LTV)

If CAC tells investors what it costs to win a customer, LTV tells them what that customer is worth to your business over time.

And if your LTV isn’t solid—or is based on wishful thinking—it can break your model, wreck your pitch, and derail your raise.

What Is LTV?

Lifetime Value (LTV) is the total revenue you expect to earn from a customer over their lifecycle.

Basic formula (for subscription or recurring models):

LTV = Average Revenue per Month × Average Customer Lifetime (in months)

Example:

Customers pay ₹1,200/month

They stay for 8 months on average

LTV = ₹9,600

For product-based or transactional businesses, LTV can be based on:

- Repeat purchase behavior

- Upsell and cross-sell potential

- Average order value over 6–12 months

Why Investors Care About LTV

LTV shows how much value each customer drives—especially in relation to CAC.

It helps them assess:

- Retention strength

- Monetization efficiency

- Scalability of your model

- How long it takes to recoup acquisition costs

If your LTV is too low—or based on unproven assumptions—your entire forecast gets questioned.

The Critical Ratio: LTV to CAC

LTV:CAC ratio = Lifetime Value / Customer Acquisition Cost

What investors like to see:

- 3:1 or better is ideal

- 2:1 is acceptable early stage

- 1:1 or lower? You’re burning capital without getting it back

Example:

CAC = ₹2,000

LTV = ₹8,000

LTV:CAC = 4:1 (strong)

This is how investors know you’re not just acquiring customers—you’re doing it profitably.

Common Founder Mistakes

- Assuming customers stay forever (bad churn logic)

- Overestimating average spend without real data

- Ignoring discounting, refunds, or drop-off

- Not segmenting by product or cohort (LTV isn’t always one-size-fits-all)

Investors will ask, “How did you get that LTV?” Be ready.

How to Improve LTV

- Increase average revenue per user (ARPU)

- Reduce churn (increase retention)

- Add upsell paths or bundles

- Extend subscription timelines or contracts

Even small improvements in retention can multiply your LTV—and instantly improve capital efficiency.

How PlanVista Helps

With PlanVista, you can:

- Model LTV based on churn, pricing, and user lifetime

- Adjust retention or pricing assumptions and see instant impact

- Track LTV vs. CAC side-by-side

- Forecast payback period without manual math

It’s designed to help founders build—and defend—unit economics that make sense.

Burn Rate

If there’s one number that shows whether you’re building with control or burning through cash—it’s burn rate.

This is one of the first metrics investors look for in your forecast.

Because if your burn is too high, they’ll wonder:

“Will my money even last long enough to create value?”

What Is Burn Rate?

Burn rate is the amount of money your startup is spending each month.

If you’re pre-revenue:

Burn = Total Expenses

If you’re earning money:

Net Burn = Total Expenses – Revenue

Example:

Expenses = ₹2,50,000/month

Revenue = ₹50,000/month

Net Burn = ₹2,00,000/month

Why Burn Rate Matters to Investors

Burn shows:

- How fast you’re spending

- How efficient your operations are

- If your funding ask aligns with your operating reality

- How long their capital will actually last

High burn with little traction?

Steady burn with improving LTV:CAC?

It’s not about being cheap—it’s about being efficient.

Burn Benchmarks by Stage

Every startup burns cash early—but here’s a general range:

- Pre-seed: ₹1–3L/month (lean team, MVP build)

- Seed: ₹3–10L/month (product + early GTM)

- Series A: ₹10–30L/month (growth hires, marketing, ops)

Investors want to see that your burn makes sense for your stage and goals.

Common Mistakes Founders Make

- Ignoring one-time costs (e.g., software licenses, legal fees)

- Forgetting to include founders’ salaries

- Underestimating marketing ramp-up or hiring delays

- Presenting burn without showing revenue offsets

Your burn isn’t just a line item—it’s your runway’s biggest threat or asset.

How to Lower or Stabilize Burn

- Delay hiring until metrics improve

- Use lean tools vs. enterprise software

- Outsource selectively

- Prioritize revenue-driving activities over vanity spend

Burn reduction doesn’t mean austerity—it means intentional scaling.

PlanVista Burn Tracking

With PlanVista, burn rate isn’t buried in a spreadsheet:

- It updates live as you add team members or adjust revenue

- You can model aggressive vs. lean burn scenarios

- See how every decision affects net burn and monthly cash

- Visualize burn vs. runway so you know when to fundraise

No more guessing. Just numbers you can explain and adjust with confidence.

Runway

Imagine you’re driving at full speed—but your fuel gauge is broken.

That’s what running a startup without knowing your runway looks like.

For investors, runway is one of the most critical numbers in your forecast.

Because it tells them how long their investment will last—and how much time you have to hit your next milestone.

What Is Runway?

Runway = Cash on Hand / Net Burn Rate

Example:

₹12,00,000 in the bank

Net burn = ₹2,00,000/month

Runway = 6 months

It’s a simple calculation—but a powerful insight.

Why Runway Matters to Investors

Runway helps them understand:

- If your fundraising ask is realistic

- How long you can operate without new capital

- Whether you’ll hit key growth targets before needing to raise again

- If you’re burning cash without a clear plan

Short runway = risky investment.

Long runway with no growth = capital inefficiency.

It’s not about just stretching time—it’s about maximizing what you achieve within that time.

What’s a Healthy Runway?

- < 6 months? Emergency mode—start raising yesterday

- 6–12 months? Stable, but start prepping to raise soon

- 12–18 months? Healthy cushion—ideal for Series A+

- 18+ months? Only if you’re growing responsibly

Investors typically want you to have 12–18 months of runway post-raise—enough time to hit traction and start the next round with leverage.

Mistakes Founders Make with Runway

- Calculating it without factoring future burn increases

- Forgetting upcoming one-time costs (launches, legal, etc.)

- Presenting it without showing fundraising milestones

- Assuming revenue will grow “just in time” to extend it

Hope is not a financial strategy.

Investors want to see math-backed confidence.

How to Extend Runway (Without Killing Growth)

- Delay non-critical hires

- Shift spend from awareness to conversion

- Introduce pre-paid plans or upfront revenue models

- Reevaluate tool stacks and vendors

Runway extension isn’t about survival—it’s about buying more time to grow smart.

How PlanVista Helps You Track and Adjust Runway

Inside PlanVista:

- Runway is calculated automatically as you input cash and burn

- You can visualize runway month by month

- Adjust spend, revenue, or team plans—and see runway change instantly

- Run side-by-side scenarios for short vs. long runway strategies

That means no broken formulas, no stale data—just a real-time view of your survival timeline.

Revenue Growth (and How You’re Getting There)

It’s no secret—revenue growth is one of the most powerful metrics in your forecast.

But investors don’t just want to see your revenue climb quarter over quarter.

They want to know how you’re achieving that growth—and whether it’s built on strategy, not just optimism.

Because big revenue numbers with shaky logic? Red flag.

Steady growth with clear levers? That’s investable.

What Is Revenue Growth?

Revenue growth is the rate at which your income increases over time.

Basic formula:

(This Month’s Revenue – Last Month’s Revenue) / Last Month’s Revenue × 100

Example:

Month 1 revenue = ₹1,00,000

Month 2 revenue = ₹1,20,000

Growth = (₹1,20,000 – ₹1,00,000) / ₹1,00,000 = 20%

But that’s just the surface.

What investors care about is the quality of that growth.

What Investors Want to See

They’re looking for:

- Consistent, compounding growth over time

- Growth tied to user acquisition or revenue per user, not just price hikes

- A clear understanding of what drives your growth: paid ads? referrals? product-led loops?

- Evidence that the model is repeatable and capital-efficient

Growth without strategy = chaos.

Strategy without growth = hesitation.

How to Forecast Growth That Builds Trust

Avoid saying “we’ll grow 15% MoM” without showing why.

Break growth into logical drivers:

- Number of new users/customers per month

- Average revenue per user (ARPU)

- Churn or retention rate

- Conversion from free to paid (if SaaS/freemium)

Show how you’ll:

- Scale user acquisition

- Improve monetization

- Reduce churn or expand accounts

Example:

You project ₹2,50,000/month by Month 6

Investors will ask:

- “How many users?”

- “At what price point?”

- “What’s your churn?”

If you can’t defend those assumptions, the forecast loses credibility fast.

Common Growth Forecast Mistakes

- Flat, generic “growth curve” with no input logic

- Assuming virality without data

- Unrealistic CAC for the projected scale

- Ignoring how long it takes to ramp channels or markets

If your forecast doesn’t reflect your actual traction and path to scale, it’ll collapse under pressure.

PlanVista’s Role in Revenue Forecasting

With PlanVista, you don’t just set a growth target—you build it from the ground up:

- Input pricing, customer volume, and churn

- Adjust channels and assumptions

- See how revenue, burn, and CAC interact

- Compare growth plans with different strategies (e.g., paid vs. organic)

It’s how founders go from “we’ll grow 20%” to “here’s how we’ll grow 20%—and why it’s realistic.”

How to Present Metrics Investors Actually Understand and Trust

You’ve built your forecast.

You’ve calculated CAC, LTV, burn, runway, and revenue growth.

But there’s one more critical step most founders overlook:

Presentation.

Because if your metrics aren’t presented clearly, consistently, and with context, investors won’t trust them—even if they’re technically correct.

Let’s fix that.

1. Put Key Metrics Front and Center

Don’t bury the numbers investors care about in your appendix.

In your deck or call:

- Include a dedicated “Unit Economics” slide

- Feature CAC, LTV, LTV:CAC ratio, payback period

- Include a simple burn + runway chart

- Add a monthly or quarterly revenue forecast table

Make your model part of your story—not an afterthought.

2. Show Your Assumptions, Not Just the Outputs

Smart investors don’t expect perfection.

They expect transparency.

Be ready to show:

- How you calculated CAC and LTV

- Your expected churn or retention assumptions

- Where your pricing and ARPU come from

- What channels are driving acquisition

This builds confidence in your thinking—even if the numbers evolve.

3. Use Visuals to Tell the Story

Metrics can be overwhelming in raw tables.

Use clean charts to show:

- Burn vs. revenue

- Runway over time

- CAC trends as you scale

- MRR or ARR growth

PlanVista helps here by auto-generating visuals that are pitch-ready and founder-friendly.

4. Be Honest About What You Know vs. What You’re Testing

If your CAC is based on early experiments—say so.

If your LTV is projected but not proven—own it.

Investors appreciate honesty. It tells them you’re aware, not naive.

5. Connect Metrics to Milestones

Bridge your numbers to your roadmap.

“With this ₹2 Cr raise, our burn gives us 16 months runway.

At our current CAC and LTV, we can grow to ₹1 Cr ARR and reach break-even by Month 15.”

When you tie metrics to outcomes, your pitch shifts from hopeful to strategic.

Founder Tip: Confidence Beats Complexity

Don’t over-explain or drown investors in detail.

Know your numbers cold, present them cleanly, and be ready for questions.

And remember:

It’s not about perfect forecasting—it’s about showing you think like a CEO.

PlanVista: Built to Help You Present Metrics That Win

Inside PlanVista, you can:

- Export key investor metrics with clean visuals

- Run custom scenarios for fundraising decks

- Update your forecast live before or after calls

- Show both strategy and discipline—without spreadsheet drama

This is how you stop pitching with guesswork—and start leading with numbers.

Conclusion: Metrics That Raise Capital and Build Credibility

Fundraising isn’t just about the story—it’s about the math behind it.

The best founders don’t just tell investors what they’re building.

They show how it grows, how it scales, and how it performs over time.

And they do it by mastering the five core forecast metrics that matter most:

- Customer Acquisition Cost (CAC) – How efficiently you attract customers

- Lifetime Value (LTV) – What each customer is worth over time

- Burn Rate – How fast you’re spending

- Runway – How long your capital will last

- Revenue Growth – Where you’re headed, and how you’ll get there

These aren’t “bonus” numbers.

They’re the foundation of investor trust.

What These Metrics Actually Signal

When presented right, these metrics tell investors:

- You understand your business model

- You know what drives growth (and what slows it)

- You’re capital-aware—not just capital-hungry

- You’re ready to lead with logic, not just passion

You don’t need to be perfect—you just need to be clear.

Even early-stage investors know the numbers will change.

They’re betting on how you think and how you adapt.

Make Metrics a Strategic Advantage

The founders who raise with confidence?

They walk into investor meetings already knowing:

- How much they’re burning

- When they need to raise again

- What success looks like in 6, 12, and 18 months

- How their model holds up under pressure

That’s not luck. That’s forecasting discipline.

And with tools like PlanVista, building and presenting these numbers isn’t a chore—it’s a competitive edge.

PlanVista Makes This Simple

PlanVista was built for founders—not finance pros.

It helps you:

- Input your assumptions (pricing, CAC, growth, churn)

- Auto-calculate and track CAC, LTV, burn, and runway

- Visualize and export clean, pitch-ready charts

- Stay ready to defend your model in every pitch or investor update

So when investors ask the hard questions?

You’ll have the real answers.

Final Takeaway

Don’t let metrics be the part of your pitch you “hope no one asks about.”

Make them the reason you close the deal.

Because when your numbers are grounded, clear, and well-presented—

You’re not just raising money.

You’re building trust.

Start presenting smarter with PlanVista. Try it free—no credit card required.

FAQs

Investors expect CAC, LTV, burn rate, runway, and clear revenue growth in your forecast.

It shows how efficiently you acquire paying customers—critical for evaluating scale potential.

Base it on actual churn, pricing, and retention—not guesses; tools like PlanVista help automate this.

It depends on your model, but investors want to see lean, intentional spending tied to milestones.

PlanVista auto-tracks CAC, LTV, burn, and runway with visual outputs built for founders and investors.