Best Business Plan Formats Investors Love in 2025

Introduction – Why Business Plan Formats Matter More Than Ever in 2025

If you’ve ever pitched a business idea, you know the tension that comes right before you hit “send” on your business plan. Will they read it? Will it stand out in a sea of other pitches? Will it make them curious enough to call you back?

Here’s the truth: in 2025, the content of your business plan matters, but the format can make or break whether investors even give it a chance. Investors are drowning in proposals. They skim dozens every week. They don’t just want another thick PDF with dense text and generic tables—they want a plan that grabs attention in seconds, tells a clear story, and presents data in a way that’s both credible and engaging.

Think of it like this: if your business plan is your startup’s “resume,” the format is the suit you wear to the interview. You could have the best experience in the world, but if you show up in wrinkled clothes from 2002, you’re sending the wrong message before you even speak.

What’s changed? For one, technology has raised expectations. In 2010, a neatly formatted Word document was fine. By 2020, sleek PDF designs were the gold standard. But now, in 2025, investors expect clickable, visually-rich, and often interactive documents—especially if you’re in tech, e-commerce, or any industry where innovation is the selling point. A business plan isn’t just a report anymore—it’s a presentation, a sales tool, and a credibility test.

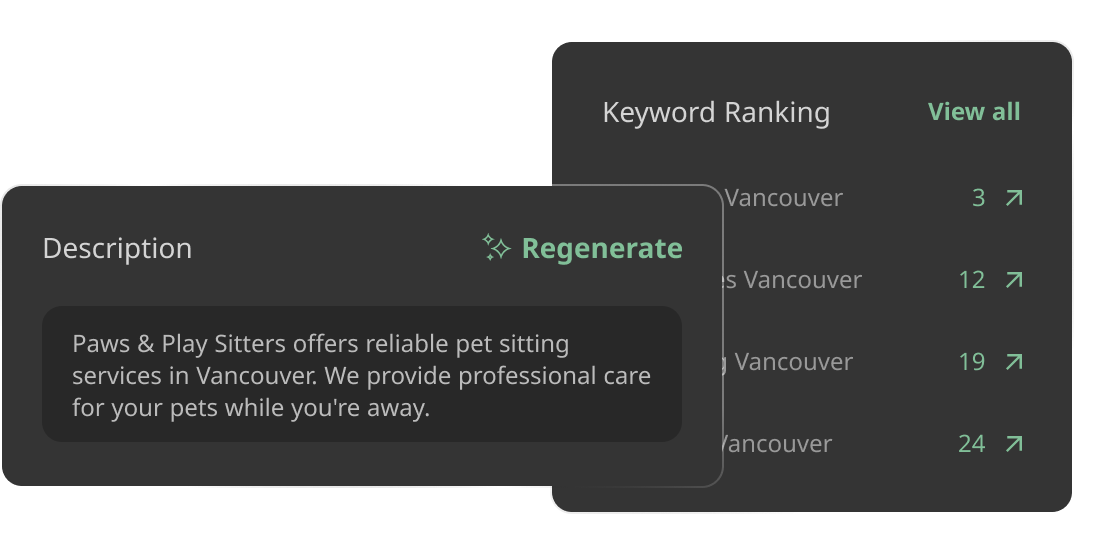

And here’s where it gets exciting: you don’t need a design degree or weeks of free time to create these formats anymore. Modern AI business plan generators—like the PlanVista app—can turn your raw ideas into investor-ready formats in a fraction of the time. Whether you need a detailed financial report, a one-page snapshot, or a live data dashboard, you can have it done in hours, not weeks.

Over the next six sections, we’re going to break down the best business plan formats investors love in 2025—why they work, where they shine, and how to choose the right one for your stage and audience. From reinvented traditional plans to narrative-driven presentations, you’ll see exactly how to match your format to your funding goals.

By the time you finish this guide, you won’t just understand the different formats—you’ll know how to use them as strategic tools that make investors want to engage with you. And, of course, we’ll talk about how the right AI tools can make creating them faster, smarter, and more effective than ever.

The Traditional Business Plan — Reinvented for 2025

The traditional business plan has been the backbone of fundraising for decades. It’s the “full novel” version of your business story: detailed, structured, and comprehensive. But in 2025, even this classic format has had to evolve.

In the past, a traditional business plan might have been 30–40 pages of text-heavy sections, starting with an executive summary and ending with appendices. While that structure still works, the presentation is no longer optional—it’s essential. Today’s traditional plans are often modular, interactive, and highly visual.

What’s New in 2025:

- Clickable navigation menus so investors can jump straight to the sections they care about.

- Embedded financial models instead of static tables.

- Infographics and charts replacing long narrative explanations.

- Mobile optimization so it reads well on any device.

Why Investors Still Love It:

Traditional plans remain essential for larger funding rounds, institutional investors, and situations where compliance matters—like applying for bank loans or grants. They demonstrate that you’ve done thorough market research, understand your competition, and have a solid operational and financial strategy.

Challenges:

The main challenge with traditional plans is the time and effort required. Without the right tools, creating one from scratch can take weeks—and even then, the result can feel dated if the design is neglected. This is why pairing your writing with an AI business plan tool like PlanVista can be a game-changer. It speeds up drafting, suggests professional layouts, and even generates charts from your financial data.

Real-World Example:

A sustainable packaging startup in London used PlanVista to create their Series A plan. They kept the classic structure but swapped dense text for clean visuals, embedded competitor analysis charts, and linked to prototype videos. The result? Their plan was described by an investor as “the most digestible 35 pages I’ve ever seen”—and they closed $5.2 million in funding in under two months.

When to Use This Format:

- You’re raising $1M+ and need to prove deep market knowledge.

- You’re pitching to banks, grant providers, or conservative investors.

- You have complex operations that require detailed explanation.

In 2025, the traditional business plan is not dead—it’s simply evolved. Think of it as a hardcover book with the polish of a digital magazine. When done right, it still delivers the thoroughness investors need, but in a way that’s easy to navigate and visually engaging.

The Lean Startup Plan

In the fast-moving world of startups, agility is king. You can’t afford to spend months perfecting a 40-page document if your business model might pivot next quarter. That’s why the Lean Startup Plan has become a go-to format for early-stage founders in 2025.

Originally inspired by Eric Ries’s Lean Startup methodology, this format strips your plan down to the essentials: the problem you’re solving, your solution, your target market, your revenue model, and your key metrics. Instead of sprawling sections, you get a tight, focused document—usually one to five pages—that’s quick to read, easy to update, and designed for action.

What Makes It Lean:

- Concise problem-solution framing – You open with the pain point and immediately show how your product addresses it.

- Key metrics over long explanations – Instead of paragraphs on market research, you present the core numbers: market size, growth rate, acquisition cost, lifetime value.

- Milestones, not just projections – Investors see exactly what you plan to achieve in the next 3, 6, and 12 months.

- Built-in flexibility – Easy to adjust as you gather more data or change direction.

Why Investors Love It:

Early-stage investors, particularly angel investors and seed funds, review dozens of proposals in a short time. They don’t want to sift through dense reports—they want to see if you get the fundamentals. The lean plan’s brevity forces you to clarify your thinking and avoid fluff, which also makes it faster for investors to evaluate your potential.

Challenges:

The very thing that makes the lean plan appealing—its brevity—can also be a drawback. Without careful balance, it can feel too high-level and leave investors wanting more detail. That’s why many founders use a lean plan as the first touchpoint, followed by a more detailed plan if the investor shows interest.

2025 Updates to the Lean Plan Format:

- Use visual frameworks like the Lean Canvas or Business Model Canvas embedded directly into the document.

- Integrate click-to-view appendices so the investor can explore more detail without cluttering the core document.

- Employ real-time data snippets if possible, showing live user signups or revenue trends.

Real-World Example:

A fintech startup in Singapore used PlanVista’s lean plan template to apply for a regional accelerator. Their 3-page plan used a colorful Lean Canvas graphic, highlighted early traction with screenshots of their app, and outlined three upcoming growth milestones. It took less than a week to prepare, but it stood out from the dozens of black-and-white Word docs the accelerator typically receives. They were invited straight to the pitch round—no follow-up questions needed.

When to Use This Format:

- You’re in pre-seed or seed stage with limited data but a strong concept.

- You need to pitch multiple investors quickly.

- You’re testing multiple funding channels (accelerators, crowdfunding, angel investors) and want a flexible core document.

In 2025, the lean plan isn’t just a shortcut—it’s a strategic asset for founders who need to move fast. And when you create it with an AI startup planning tool like PlanVista, you can turn raw ideas into a polished, investor-ready lean plan in a matter of hours—freeing you to focus on building your business instead of wrestling with formatting.

The One-Page Investor Snapshot

In 2025, when investors are busier than ever, sometimes you only get a single shot—a quick glance at your idea before they move on to the next pitch in their inbox. That’s where the One-Page Investor Snapshot comes in. Think of it as the “business résumé” of your startup: short, sharp, and strategically designed to make an immediate impression.

What It Is:

The One-Page Investor Snapshot is exactly what it sounds like—a single, visually engaging document that distills your entire business into its most essential elements. This isn’t about cramming your 40-page plan into microscopic font. It’s about prioritization: only the most critical and compelling details make it onto the page.

Typical Sections Include:

- Company Overview – A quick, one-sentence mission statement that’s memorable and clear.

- Problem & Solution – The pain point you’re solving and how you uniquely address it.

- Market Opportunity – Key stats about your target audience and market size.

- Product or Service Snapshot – High-level features and benefits, ideally with a product image.

- Competitive Advantage – Why you’re better, faster, or smarter than the competition.

- Key Metrics – Early traction data like revenue to date, active users, or growth rates.

- Funding Needs & Use of Funds – How much you’re raising and what it will fuel.

Why Investors Love It:

- Instant Clarity – They can understand your business in under two minutes.

- Easy to Share – Perfect for forwarding to other partners or decision-makers.

- Memorability – The right design elements make your brand and value proposition stick.

Challenges:

The biggest challenge with a one-pager is the ruthless editing it requires. You have to strip away non-essential details without losing your story’s impact. Founders often try to include too much and end up with a cramped, hard-to-read document. The best one-pagers embrace white space, use concise copy, and rely heavily on visuals to communicate big ideas.

2025 Trends in One-Page Plans:

- Infographic Styles – Using icons, charts, and minimal text to guide the reader’s eye.

- QR Codes – Linking to a pitch deck, video demo, or live metrics dashboard.

- Interactive PDFs – Allowing clickable sections for deeper dives without clutter.

Real-World Example:

A health-tech founder in Berlin used PlanVista’s one-page template to create a clean, infographic-style plan for a networking event. The document featured bold visuals, a market size chart, and a QR code linking to a short video demo. It stood out so much that one investor reportedly told her, “I didn’t even need to finish my coffee before deciding to meet you.” She left the event with four investor meetings booked.

When to Use This Format:

- For initial outreach to investors, especially at networking events or cold outreach.

- As a follow-up “leave-behind” after a pitch presentation.

- For platforms or competitions that require ultra-short submissions.

The One-Page Investor Snapshot is the ultimate teaser—its job is to spark curiosity, not to close the deal. In 2025, pairing it with a more detailed plan (traditional, lean, or hybrid) is key. With the PlanVista app, you can create one-page plans that are visually stunning and strategically structured in minutes—so you can spend less time designing and more time building investor relationships.

The AI-Driven Live Plan

The business world changes daily—and so should your business plan. That’s the philosophy behind the AI-Driven Live Plan, a 2025 innovation that transforms your plan from a static document into a real-time, living strategy tool.

Instead of being a snapshot in time, a live plan connects directly to your operational data—sales figures, user metrics, inventory levels, marketing KPIs—and updates automatically. Investors can log in and see current numbers, not last quarter’s estimates.

Core Features:

- Live Financial Dashboards – Revenue, expenses, and profit/loss charts updated daily or weekly.

- Automated Market Trends – Pulled from research databases to keep your competitive analysis fresh.

- Progress Tracking – Visual milestone checklists with percentage completions.

- Investor Access Control – Share full access or select views, maintaining data privacy.

Why Investors Love It:

- Transparency – They see exactly how your projections match reality.

- Trust – Real-time data builds credibility and reduces perceived risk.

- Engagement – Investors can check in without waiting for quarterly updates.

Challenges:

Setting up a live plan requires integration with your existing tools (CRM, analytics platforms, accounting software) and strong data security. It’s not ideal for founders without solid operational systems in place.

Real-World Example:

A SaaS startup in San Francisco used PlanVista’s live plan integration to connect their Stripe payments, HubSpot CRM, and Google Analytics. During investor calls, they could pull up live churn rates, acquisition costs, and MRR growth. This instant transparency impressed investors and helped them close a $3M seed round without a formal second meeting.

When to Use This Format:

- For tech-savvy investors comfortable with dashboards.

- When your business model depends on fast-moving metrics.

- To maintain ongoing investor engagement after funding.

The Narrative-First Plan

Numbers are vital—but in 2025, storytelling is a powerful differentiator. The Narrative-First Plan flips the traditional order: instead of leading with market stats, you start with a compelling founder story, customer journey, or vision for the future.

Why It Works:

Humans remember stories better than spreadsheets. A strong narrative makes the data more relatable and emotionally engaging, which can tip the scales in your favor when investors are deciding between similar opportunities.

Core Elements:

- The Hook – An emotional or intriguing opening that frames the problem.

- The Journey – How you discovered the solution, with personal or customer anecdotes.

- The Vision – What the world looks like when your business succeeds.

- The Proof – Traction, data, and market validation that back up your story.

Challenges:

Lean too far into storytelling without substance, and it can feel like fluff. The narrative must be backed by solid evidence, especially when dealing with analytical investors.

Real-World Example:

An eco-fashion founder used PlanVista to craft a narrative-first plan that opened with her childhood experience in a textile-producing region overwhelmed by waste. The emotional lead-in set the stage for a data-rich analysis of sustainable fashion’s market growth. Investors commented that the story “made the numbers stick.”

When to Use This Format:

- For consumer-focused products with strong emotional appeal.

- When competing in crowded markets where differentiation is key.

- When your personal brand or journey adds credibility.

The Visual-First Business Plan

Some investors are highly visual thinkers—they process charts faster than paragraphs and grasp concepts better through diagrams than descriptions. For them, a Visual-First Business Plan can be the ultimate communication tool in 2025.

Unlike traditional text-heavy plans, a visual-first plan relies on infographics, icons, charts, and diagrams to convey your business model, market opportunity, and growth strategy. It’s designed so an investor could flip through it in under 10 minutes and still walk away understanding the essence of your business.

Core Elements:

- Data Visualizations – Pie charts, bar graphs, and trend lines for market size, revenue forecasts, and user growth.

- Process Diagrams – Illustrating product development, customer journeys, or supply chain flow.

- Competitive Landscape Charts – Positioning your business visually against competitors.

- Milestone Timelines – Showing progress and future targets in a single glance.

Why Investors Love It:

- Instant Impact – Well-designed visuals make complex ideas instantly understandable.

- Memorability – Investors are more likely to remember a striking chart than a paragraph of text.

- Efficient Communication – Saves time for busy decision-makers.

Challenges:

Over-reliance on visuals without enough explanation can lead to misunderstandings. It’s important to provide clear captions and supporting text so the visuals are not open to misinterpretation.

2025 Best Practices:

- Use consistent branding—colors, fonts, and icon styles should match your company’s identity.

- Keep text minimal but meaningful.

- Use PlanVista’s automated chart generator to instantly turn raw data into investor-ready visuals.

Real-World Example:

A renewable energy startup in Amsterdam used a visual-first plan to win over European investors. Their plan featured an interactive map of potential installation sites, a circular flow diagram of their energy cycle, and a timeline of expansion phases. Investors praised the clarity and efficiency, saying it “felt more like a guided tour than a report.”

When to Use This Format:

- For industries with complex processes that can be simplified visually.

- When pitching at events where investors may only have minutes to review your material.

- As a complement to a more detailed written plan.

Conclusion – Choosing the Right Format for Your Funding Success

Choosing the right business plan format in 2025 isn’t just about style—it’s about strategy. Each format we’ve discussed serves a specific purpose:

- Traditional Plan – Depth and structure for large funding rounds.

- Lean Plan – Speed and flexibility for early-stage pitches.

- One-Page Snapshot – Instant clarity for initial outreach.

- Pitch Deck Hybrid – Storytelling plus depth for live pitches.

- AI-Driven Live Plan – Real-time data transparency for ongoing engagement.

- Narrative-First Plan – Emotional connection that makes numbers memorable.

The best founders match their format to their audience, funding stage, and business complexity. In many cases, it’s wise to have more than one format ready—use the one-pager to open doors, the hybrid deck to build interest, and the traditional plan or live dashboard to close the deal.

The good news is that creating multiple formats doesn’t have to mean starting from scratch. With an AI business plan tool like the PlanVista app, you can generate one master plan and instantly adapt it into different formats—saving time, ensuring consistency, and giving each investor exactly what they need to say “yes.”

In 2025, a great business plan isn’t just a document—it’s a dynamic communication tool. Pick the right format, tell your story well, and back it up with clear, credible data. When you do, you won’t just get an investor’s attention—you’ll keep it.

FAQs

The best format depends on your stage and audience—many early-stage founders use lean or one-page plans, while larger rounds benefit from hybrid or traditional plans.

A one-pager is great for initial interest, but most investors will request a detailed plan before committing.

Yes, especially for institutional funding, bank loans, and grants where depth and structure are essential.

AI tools like the PlanVista app can speed up drafting, format professionally, create visuals, and update data in real time.

Yes—different investors prefer different formats, so having multiple versions can improve your chances of getting funded.