How to Align Your Business Plan with Market Reality

Introduction: Why Most Business Plans Fall Apart When They Hit the Market

Here’s a hard truth first-time founders often learn the hard way:

Your business plan might look great on paper, but the market doesn’t care.

You might spend weeks—or months—building the perfect business plan:

- Detailed projections

- Flawless customer personas

- Polished slide decks

- Impressive go-to-market strategies

But once you actually step into the market, things rarely go as planned.

Customers don’t respond the way you expected.

Acquisition channels underperform.

Your carefully modeled CAC and LTV numbers crumble under real-world conditions.

And that’s the moment most founders realize they made a dangerous mistake:

They built a business plan based on assumptions—not on reality.

The Trap of Planning in a Vacuum

This is one of the most common startup killers.

Founders get stuck planning inside a vacuum, relying on desk research, gut instinct, or what worked for someone else.

They skip the critical steps of:

- Testing their assumptions

- Validating customer behavior

- Stress-testing their go-to-market approach in the real world

The result?

Plans that fall apart fast when reality hits.

Aligning Your Business Plan with Market Reality Is Not Optional

The startups that survive—and raise capital—aren’t the ones with the prettiest plans.

They’re the ones who:

- Align their plan with customer behavior, not assumptions

- Build flexibility into their model

- Use data to drive pivots

- Make strategic planning a continuous, evolving process

And that’s what this blog is about.

In this post, you’ll learn:

- The most common ways founders create plans that don’t match market reality (and how to avoid them)

- A step-by-step process to align your business plan with real market data

- A founder story of how misalignment almost killed a startup—and how they recovered

- How tools like PlanVista make it easier to create, test, and adjust your plan without chaos

- Pro tips to make your business plan a living, breathing decision engine—not just a document

Because if your business plan can’t survive contact with the market?

It’s not a business plan—it’s a fantasy.

Let’s fix that.

The Common Disconnect—Why Most Business Plans Fail in the Real World

It’s a pattern startup mentors, investors, and accelerators see over and over again.

Founders show up with a slick business plan, packed with:

- Market sizing stats

- Revenue forecasts

- Customer personas

- Channel strategies

On paper, it all looks impressive.

But when they launch?

Reality hits them like a freight train.

Where the Disconnect Happens

1. Building on Assumptions, Not Data

Most startup business plans are built on educated guesses, not validated insights.

Founders assume:

- Who the customer is

- What the pain point is

- How the customer buys

- What price they’ll pay

Without testing these assumptions in the wild, your plan is just a hypothesis.

2. Over-Reliance on Vanity Metrics and Market Size

Many plans lean heavily on total addressable market (TAM) slides, theoretical customer personas, or industry trends.

While these make for pretty pitch deck slides, they rarely translate into actionable, real-world traction.

Investors see it all the time—and they know the difference between slides and substance.

3. Ignoring the Customer’s Actual Behavior

Founders often assume their customers will behave logically—that they’ll see the value, click the ad, convert on the landing page, and pay for the product.

In reality, customers are messy, distracted, skeptical, and loyal to the status quo.

If your plan isn’t grounded in how your customer actually behaves, it will crumble.

4. Static Plans That Don’t Adapt

Many founders treat their business plan as a one-and-done task.

Once written, they stop updating it—ignoring what customer interviews, experiments, or sales conversations are telling them.

Plans that don’t evolve with data become dangerous blind spots.

5. Skipping Early Experiments and MVP Testing

Some founders build the entire product or platform before ever testing basic assumptions like:

- Will people pay for this?

- What’s the best acquisition channel?

- How much will it cost to acquire a customer?

By skipping early experiments, they fly blind—and crash hard.

The Startup Reality Check

Your business plan is only as strong as the real-world data that feeds it.

If you build your plan in a vacuum, it’s destined to fail in the field.

Smart founders flip the script:

- They start with a lean, assumption-based plan.

- They test, learn, and refine the plan as they gather data.

- They treat the plan as a living document that evolves with the market.

How to Align Your Business Plan with Market Reality (Step by Step)

So, how do you make sure your business plan isn’t just a polished deck of assumptions—but a living plan that reflects how the market really works?

Here’s a founder-tested, step-by-step process to do exactly that.

Step 1: Identify Your Riskiest Assumptions First

Every business plan contains assumptions.

The trick is to identify which ones, if wrong, could sink your startup.

Examples:

- Do customers really feel this pain?

- Will they pay this price?

- Can I reach them through this channel?

- Is my CAC realistic?

List your top 5–7 assumptions—the ones that could break your model.

Step 2: Design Simple, Fast Experiments to Test Assumptions

Now, stop guessing and start testing.

You don’t need a perfect product to do this.

Use low-fidelity tests like:

- Landing pages with call-to-actions

- Pre-order campaigns

- Smoke tests with ad traffic

- Customer interviews with open-ended, unbiased questions

- Price sensitivity tests

The goal?

Get real-world data fast—before you spend months building or scaling.

Step 3: Let Data, Not Ego, Update Your Plan

When the data comes in (and it will often surprise you), update your business plan accordingly:

- Adjust your target customer profile

- Refine your value proposition

- Change your pricing model

- Pivot your acquisition channel assumptions

This is where most founders struggle—clinging to their original plan instead of letting the market guide them.

Step 4: Build Flexibility into Your Financial Model

Instead of creating rigid 5-year forecasts, create lean, dynamic models that let you adjust:

- CAC based on real campaign data

- LTV as you learn about retention and upsell potential

- Burn rate forecasts that reflect actual spend and acquisition costs

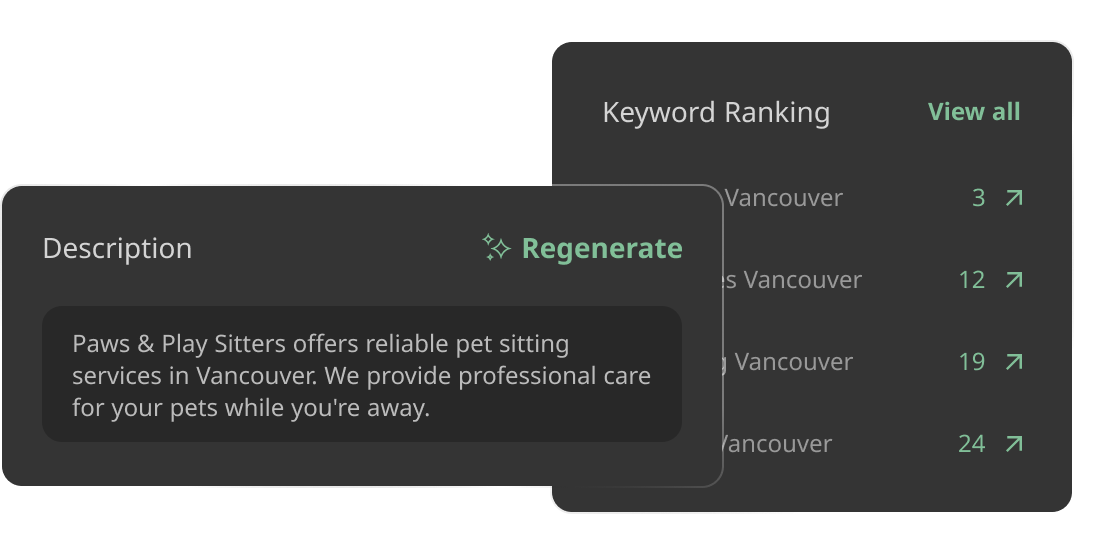

Tools like PlanVista make this easy—letting you adjust variables and instantly see how it impacts your runway and growth.

Step 5: Make Continuous Market Validation a Habit

Alignment with market reality isn’t a one-time checklist.

Build it into your startup’s DNA:

- Monthly customer interviews

- Quarterly pricing tests

- Ongoing channel experiments

- Regular updates to your plan based on sales data, feedback, and product usage

This keeps your plan fresh, real, and tied to what customers are actually doing—not what you hope they’ll do.

Common Mistakes Founders Make When Trying to Align Plans with the Market

Even founders who try to build market-aligned business plans can fall into traps that derail their progress.

Here are the most common mistakes—and how to avoid them.

Mistake 1: Over-Relying on Surveys Instead of Behavior

Founders often default to surveys, assuming what people say they’ll do is what they’ll actually do.

But surveys rarely reflect real behavior.

People say yes to polite questions but act differently when their wallet is involved.

How to avoid it:

Focus on behavior-based validation:

- Pre-orders

- Demos with purchase intent

- Actual conversions from test ads

Real behavior > nice survey responses.

Mistake 2: Testing Everything at Once (Or Nothing at All)

Some founders try to test every assumption at the same time—spreading themselves too thin.

Others do the opposite—over-planning and testing nothing until they feel “ready.”

How to avoid it:

Prioritize your riskiest assumptions and test them one at a time.

Use a lean validation sprint to move fast without overextending.

Mistake 3: Ignoring Negative Signals (Clinging to the Plan)

One of the hardest founder habits to break is ignoring uncomfortable feedback that challenges the plan they worked hard on.

Founders fall in love with their own idea—and dismiss what the market is telling them.

How to avoid it:

Build detachment into your process.

View every test as a learning opportunity, not a validation of your genius.

If the data contradicts your plan, update the plan.

Mistake 4: Waiting Too Long to Adjust Financial Models

Many founders wait until they have significant revenue before adjusting financial models.

This leads to surprise burn rate issues, unrealistic CAC assumptions, or investor pitches that don’t hold up.

How to avoid it:

Start modeling early—even with rough data.

Use tools like PlanVista to keep your financial assumptions flexible and tied to actual customer behavior.

Mistake 5: Assuming Market Fit Is Static

Some founders assume once they’ve found some traction, they’re done with validation.

But markets change, competitors evolve, and customers shift priorities.

What worked at 10 customers might break at 100.

How to avoid it:

Keep your plan—and your understanding of your market—alive.

Build regular validation cycles into your operations.

Never assume you’re “done” validating.

Founder Story—How One Startup Turned Their Assumption-Led Plan into a Market-Aligned Growth Machine

Meet Priya, Founder of QuickFleet

Priya launched QuickFleet, a B2B logistics optimization SaaS, with a strong belief:

Small courier businesses needed an all-in-one platform to manage deliveries, drivers, and routes.

Her early business plan looked perfect on paper:

- Defined TAM: $15B courier industry

- Assumed customer: Small courier businesses

- Pricing: $99/month subscription

- Acquisition strategy: Google Ads and LinkedIn outreach

Confident in her model, she built the product, created a pitch deck, and started pitching investors.

The Problem: Market Reality Didn’t Match the Plan

But within weeks of launching her beta, cracks appeared:

- Small courier companies weren’t buying.

- They were reluctant to adopt new software—and pushed back on the $99/month price.

- Her ads weren’t converting.

- Cold emails led to dead ends or polite rejections.

Her business plan was based on logical assumptions—but not real-world data.

Investors weren’t impressed either. They pushed back on her CAC assumptions, market fit, and revenue model.

The Pivot: Aligning with Market Reality

Instead of doubling down on the failing plan, Priya took a hard pause.

She listed her riskiest assumptions and ran a lean validation sprint.

What she discovered changed everything:

- Her real customer wasn’t small courier companies—it was mid-sized e-commerce brands running their own deliveries.

- These companies were actively looking for route optimization—and had budget flexibility.

- They preferred usage-based pricing, not flat monthly fees.

Armed with this new data, she reworked her business plan:

- Customer profile: E-commerce brands with in-house delivery fleets

- Pricing model: Usage-based, starting at $0.25 per delivery

- Go-to-market: Partnerships with e-commerce platforms and logistics consultants

- Key metrics: Cost per acquired customer, delivery volume per customer, retention rate

She also rebuilt her financial model based on real sales conversations and adjusted her CAC projections using actual pilot campaign data.

The Result: A Business Plan Investors Could Trust

With her market-aligned plan, Priya:

- Landed three anchor e-commerce clients who validated the model

- Reduced CAC by 60% through focused partnerships

- Updated her pitch deck to reflect customer traction and data-driven financial models

When she returned to investors, the response was completely different.

She raised a $400K pre-seed round within 2 months.

The Lesson

Priya didn’t succeed by building a perfect plan on assumptions.

She succeeded by letting the market rewrite her plan.

By testing, adjusting, and updating her business plan as she learned, she turned it into a living, market-aligned growth engine.

For first-time founders, that’s the difference between a plan that collects dust—and a plan that drives funding, sales, and growth.

How PlanVista Helps You Keep Your Business Plan Market-Aligned and Investor-Ready

Aligning your business plan with market reality isn’t a one-time activity—it’s an ongoing discipline.

But for most founders, keeping their plan updated, flexible, and data-driven is a struggle:

- Spreadsheets get messy

- Decks get outdated

- Customer insights live in notebooks or Slack messages, not in the plan itself

That’s where PlanVista makes a huge difference.

PlanVista is designed for startup founders who want to create business plans that are not only investor-ready—but market-tested and adaptable.

Here’s how PlanVista supports you at every step.

1. Lean Planning Templates Built for Testing and Learning

PlanVista prompts you to start with your key assumptions—not a bloated business plan.

You can quickly map out:

- Customer segments

- Problems you’re solving

- Assumed channels

- Revenue models

It encourages you to identify your riskiest assumptions and prioritize validation.

This helps you move fast—without skipping critical thinking.

2. Dynamic, Living Plans That Evolve with Every Learning

As you learn from customer conversations, pilots, and experiments, PlanVista lets you:

- Instantly update your plan

- Adjust your target customer profiles

- Modify your pricing models and CAC based on real data

- Revise your go-to-market strategies

Your plan stays alive, visible, and relevant—whether you’re raising capital, onboarding a new hire, or prepping for a customer pitch.

3. Financial Modeling That Adapts to Market Data

PlanVista’s built-in forecasting tools make it easy to:

- Update your CAC, LTV, churn rates, and revenue projections as you collect real-world data

- Run scenario planning to model pivots or pricing experiments

- Track burn rate and runway with clarity

No more static financial models.

PlanVista lets you keep your numbers tied to actual market conditions—not guesses.

4. Investor-Ready Outputs at Every Stage

When it’s time to pitch, PlanVista lets you:

- Export lean, clean business plans and decks

- Create customer-facing one-pagers

- Generate investor-friendly financial snapshots

All your messaging and numbers stay consistent, polished, and backed by data—not assumptions.

5. Keeps You Accountable to Market Reality

Founders often get stuck in their heads.

PlanVista helps you stay grounded by:

- Encouraging monthly plan reviews

- Logging new customer insights directly into your plan

- Using real data to update your strategic priorities and forecasts

It becomes the heartbeat of your startup planning—not just a document, but a decision engine.

Pro Habits to Keep Your Business Plan in Sync with Market Reality—Every Month

Startups that win don’t just create better plans—they build better planning habits.

Here are pro-level founder habits that help you keep your business plan alive, relevant, and aligned with the market every month.

1. Block a Monthly “Reality Check” Session

Schedule a standing 60-minute strategy session every month (or every sprint).

- Review your plan’s core assumptions.

- Analyze new customer feedback, sales data, and experiments.

- Adjust your plan, forecasts, and priorities accordingly.

This ensures your plan reflects the latest market reality—not last quarter’s guesses.

2. Make Customer Learning a Weekly Ritual

Don’t wait for your metrics dashboard to tell you you’re off course.

- Schedule at least 2–3 customer or prospect conversations every week.

- Use what you learn to challenge your assumptions, refine your value prop, and update your business plan.

Customer conversations are the fastest way to keep your plan grounded.

3. Integrate Plan Updates into Team Standups

Your team should always know what the current plan is—and why.

- Use your business plan in weekly standups or team meetings.

- Highlight what’s changed, what’s working, and what needs testing next.

- Let your team challenge or improve the plan with fresh insights from the field.

4. Log Key Learnings into Your Plan (Not Just Slack)

Most teams let customer insights live in Slack threads, Notion pages, or team chats.

- Use a tool like PlanVista to log key learnings and instantly update your assumptions, models, and strategies.

- This keeps your plan—and your decisions—fueled by real-world data.

5. Treat Your Plan Like a Sales and Investor Asset—Not Just an Internal Document

Use your updated, market-aligned plan to:

- Build trust with investors in updates and pitches.

- Support sales conversations with proof of traction, updated pricing, and market insights.

- Show partners you’re serious and data-driven.

Your plan becomes a tool for growth, not just internal alignment.

Conclusion: Making Market-Aligned Planning a Founder Habit, Not a One-Off Task

Your business plan isn’t supposed to be perfect—it’s supposed to evolve.

That’s what separates startups that survive from those that stall.

They don’t create a static plan and hope it holds up.

They build a plan that adjusts every time the market gives them new information:

- From customer interviews

- From pilot launches

- From channel experiments

- From pricing tests

They treat their plan as a living, breathing decision engine—updated monthly, sometimes weekly.

The Most Successful Founders Make Market Alignment a Habit

It’s not about guessing better.

It’s about learning faster—and letting those learnings drive your next strategic move.

Here’s how the best founders keep their plan in sync with the market:

- Validate assumptions relentlessly.

- Update pricing, channels, and financial models as they gather data.

- Use their plan to align teams, investors, and partners.

- Review and refine their plan regularly—not just during fundraising.

Why Tools Like PlanVista Give You an Unfair Advantage

PlanVista helps founders make this habit effortless by:

- Turning your business plan into a dynamic, easy-to-update dashboard.

- Helping you forecast financial scenarios based on real data—not guesses.

- Giving you the tools to instantly create investor-ready or customer-facing versions of your plan.

- Keeping you accountable to market-aligned decisions every week, month, and quarter.

Your Plan Shouldn’t Break When It Hits the Market

If your business plan can’t survive contact with customers, investors, or partners—it’s not the market’s fault.

It’s a sign your plan was built on assumptions, not data.

But when you build your plan to flex, evolve, and adjust with every new insight?

That’s when your plan becomes your superpower.

It lets you:

- Raise capital with confidence

- Close deals with clarity

- Align your team with purpose

- Pivot faster when needed—without chaos

Final Takeaway

Your plan isn’t supposed to predict the future.

It’s supposed to help you navigate it.

So if your business plan is sitting in a folder, untouched since your last pitch?

It’s time to revive it, ground it in data, and make it your go-to decision engine.

PlanVista makes that easy.

Start your market-aligned business plan today—free to try, no credit card required.

FAQs

PlanVista is a startup business planning tool that helps founders create, test, and adjust investor-ready business plans in real-time.

Yes—PlanVista guides you to validate assumptions, update plans based on data, and keep your strategy aligned with customer behavior.

Absolutely—PlanVista includes built-in financial modeling and forecasting tools designed for founders.

No—PlanVista helps founders create plans they can use for sales, partnerships, investor updates, and team alignment.

Yes—PlanVista offers a free trial with no credit card required.