How to Conduct Market Research Without Hiring an Agency

Introduction: Taking Control of Market Research—No Agency Required

Every successful business begins with a solid understanding of its market. Yet, for many entrepreneurs, especially those just starting out, market research can feel like a complicated and expensive hurdle. The phrase “market research” often conjures images of high-priced agencies, complex analytics, and a budget that only established companies can afford. But the truth is, you don’t need a big budget—or even an agency—to understand your audience, competition, or market trends. With the right approach and tools, anyone can conduct effective, insightful market research independently.

Whether you’re launching a new product, exploring a business idea, or looking to refine your services, market research is your compass. It tells you where your potential customers are, what they want, how your competitors operate, and where opportunities lie. Skipping this step is like setting sail without a map—you might make progress, but you’re unlikely to reach your destination efficiently.

Today’s digital landscape has democratized market research. Thanks to a wide range of accessible tools and platforms, small business owners, solopreneurs, and startup teams can collect data, spot trends, and validate ideas without outsourcing. Online surveys, social media insights, search trend analysis, and competitive intelligence platforms make it easier than ever to gather and interpret meaningful information. Best of all, many of these tools are either free or extremely affordable—perfect for lean operations trying to make every dollar count.

Why does this matter? Because being close to your market gives you a distinct advantage. When you handle research yourself, you’re not only saving money—you’re also staying intimately connected to your customer base. You’re listening firsthand to their concerns, behaviors, and preferences. That connection is invaluable when shaping your offerings, refining your messaging, or pivoting your business strategy. And in a world where customer expectations are constantly shifting, staying agile and informed is essential.

Throughout this guide, we’ll show you how to conduct thorough market research step by step without hiring an agency. We’ll break down real-world methods that anyone can use—from defining objectives and surveying potential customers to analyzing competitors and interpreting data. You’ll learn how to turn insights into actionable strategies that improve your products, messaging, and business decisions.

You’ll also discover how using the right digital tools—like a business plan generator or startup planning tool—can simplify the research process and integrate your findings into a robust business strategy. Platforms like the PlanVista app, for example, can help you turn raw research into structured, data-driven plans without needing an MBA or a marketing team.

If you’re ready to make smarter business decisions, reduce your risk, and build something your audience truly wants—without breaking the bank—this guide is for you. Let’s dive into the how-to of DIY market research, and empower you with the knowledge and confidence to take charge of your own business insights.

Defining Your Research Objectives and Target Audience

Before you dive into surveys, interviews, or analytics dashboards, you need to start with a clear direction. That means defining your research objectives and pinpointing your target audience. Think of this step as laying the foundation for everything else. Without it, you’ll gather data that’s vague, irrelevant, or just plain unhelpful.

What Are You Trying to Learn?

Start with a simple question: What do I want to know? Maybe you’re trying to determine if there’s demand for your new product. Maybe you want to understand why your sales are stagnating. Or maybe you’re exploring new market segments. These are all valid reasons, but each requires a different approach.

Some common objectives include:

- Understanding customer pain points

- Validating a new product idea

- Identifying market trends or changes

- Gauging customer satisfaction

- Benchmarking against competitors

Write your objectives down, and be specific. “I want to understand why my customers are choosing a competitor’s service” is much more actionable than “I want to learn about the market.”

Know Your Ideal Customer

Once your goals are clear, you need to define who you’re researching. This is your target audience—the specific group of people your product or service is designed to serve. It’s tempting to say “everyone,” but that’s a fast track to generic results.

Instead, develop one or more buyer personas. A buyer persona is a semi-fictional profile of your ideal customer based on real data. It includes information like:

- Age, gender, and income

- Job title and industry

- Lifestyle and values

- Goals and frustrations

- Where they spend time online

Let’s say you’re launching an AI-powered personal finance app. Your ideal user might be a millennial professional, aged 25-35, tech-savvy, earning $60,000+, and looking to optimize spending and save for future goals. Knowing this helps you ask the right questions and gather relevant insights.

Use the 5 Ws Framework

To further refine your focus, apply the 5 Ws:

- Who is your target customer?

- What problem are they trying to solve?

- Where do they look for solutions?

- When do they need your product or service?

- Why would they choose you over a competitor?

Answering these questions helps you not only direct your research but also begin to shape messaging and strategy down the line.

Real-World Example

A startup selling eco-friendly pet supplies might define its audience as environmentally conscious pet owners, aged 30-50, who shop online and value sustainability. Their research objective could be: “To understand purchasing behaviors and pain points among eco-conscious dog owners in the U.S.”

With a goal and persona this specific, they can tailor survey questions, search forums for relevant discussions, and even conduct interviews that generate meaningful insights—without hiring a pricey firm.

Defining your research objectives and your audience is the first critical step in conducting effective DIY market research. Get this right, and every method you use afterward will be sharper, faster, and more useful.

DIY Methods for Gathering Quantitative Data

With your research goals and audience clearly defined, it’s time to gather the numbers—quantitative data. This type of data answers questions like how many, how often, or how much. It’s measurable, and it helps you spot patterns, test hypotheses, and make decisions with confidence.

Fortunately, you don’t need a team of analysts or an agency retainer to collect this kind of data. All you need are the right tools and a bit of creativity.

Online Surveys: Your First Go-To Tool

Surveys are one of the easiest and most effective ways to collect quantitative data. Platforms like Google Forms, SurveyMonkey, and Typeform make it easy to design surveys that are engaging and mobile-friendly. These tools often offer analytics dashboards to help you interpret responses.

To get the best results:

- Keep it short—5 to 10 questions max

- Use closed-ended questions (e.g., multiple choice, Likert scales)

- Ask one question at a time to avoid confusion

- Pilot your survey with a small group first

Share your survey with your email list, social media followers, or niche online communities like Reddit or Facebook groups relevant to your market.

Polls and Quick Feedback Tools

If you’re looking for ultra-fast insights, try tools like Twitter/X Polls, Instagram Stories, or LinkedIn Polls. These platforms let you gather quick responses and test assumptions almost in real time. They’re informal but can be a goldmine for spotting trends or gauging opinions before a product launch.

For example, a startup testing two logo designs can post a side-by-side poll on Instagram and get hundreds of responses within hours—without spending a dime.

Web and Social Analytics

Already have a website or a social presence? Then you’re sitting on a treasure trove of data.

- Google Analytics reveals how users interact with your website—where they come from, what they click, how long they stay.

- Meta Insights (Facebook & Instagram) and LinkedIn Analytics offer rich demographic and engagement data.

- Twitter/X Analytics helps identify what content resonates with your audience.

These tools can show what content drives the most engagement, what landing pages convert best, and even what time your users are most active—insights you can use to fine-tune everything from product offerings to marketing strategies.

Google Trends and Keyword Research

If you’re trying to gauge interest in a topic or understand how people search for solutions, tools like Google Trends and Ubersuggest are indispensable.

Google Trends lets you see the popularity of search terms over time and across regions. Want to know if interest in “sustainable baby products” is growing? A quick check will tell you.

Meanwhile, Ubersuggest or even the free version of SEMrush can help you identify which keywords are being searched and how competitive they are.

Real-World Example

A boutique fitness startup used Google Forms to survey 300 potential users about workout preferences. They discovered that 70% wanted virtual classes over in-person sessions, directly influencing their service model—and saving them from investing in costly physical locations.

Collecting quantitative data doesn’t have to be overwhelming. With free or low-cost tools and a well-defined plan, you can gather insights that rival what agencies charge thousands for.

Collecting and Using Qualitative Insights

While quantitative data gives you the “what,” qualitative data delivers the “why.” It reveals the thoughts, emotions, and motivations behind customer behaviors—insights that numbers alone can’t explain. And just like with quantitative research, you don’t need a consultant to access this rich layer of information. All it takes is curiosity, structure, and the right channels.

The Power of Conversations

At the heart of qualitative research are direct conversations. Think interviews and focus groups. These methods allow you to dive deep into how people think about a problem, how they evaluate solutions, and what influences their decisions.

Start by identifying people who closely match your ideal customer persona. Reach out to current customers, email subscribers, or social followers. Offer a small incentive (like a gift card or free trial) in exchange for 20–30 minutes of their time.

Ask open-ended questions like:

- What made you decide to try our product?

- What alternatives did you consider?

- What do you like or dislike about your current solution?

- What would make your experience better?

Record the sessions (with permission) so you can analyze them later for recurring themes and keywords.

Focus Groups—Virtual and In-Person

Focus groups can be just as effective over Zoom or Google Meet as they are in person. Bring together 5–8 people, give them a product or concept to react to, and encourage discussion. Watch how they interact with each other’s ideas—it often surfaces insights that wouldn’t come out in a one-on-one setting.

You can also use tools like Lookback.io or Dovetail to record sessions and highlight notable responses.

Social Listening: Insights from the Wild

Qualitative data isn’t limited to structured interviews. Every tweet, comment, review, and post your audience shares online is a potential data point. This is where social listening comes in.

Monitor platforms like Reddit, Quora, Facebook groups, and even Amazon product reviews in your niche. Look for:

- Common complaints

- Desired features

- Unmet needs

- Emotional language

Free tools like AnswerThePublic or Google Alerts can help surface popular questions and discussions in your space. For more detailed insights, paid tools like Brand24 or Hootsuite Insights can track keywords and sentiment.

Case Study: Real Emotions, Real Decisions

A startup building an app for freelancers ran virtual interviews with ten participants. Through these conversations, they discovered their audience didn’t just want invoice tracking—they felt anxious about unpredictable cash flow and overwhelmed by taxes. This emotional insight led the team to add features for automated savings and tax reminders, aligning more deeply with user needs.

Turn Feedback into Strategy

Don’t just collect feedback—categorize it. Group your findings into themes like pricing, features, user experience, and emotional drivers. This makes it easier to spot patterns and act on what you learn.

By combining these qualitative insights with your quantitative data, you create a full picture of your customer’s world. That clarity is powerful—and achievable without an agency.

Analyzing Competitors Without Professional Help

Competitor analysis is one of the most valuable components of market research—and one that many DIY entrepreneurs underestimate. Understanding what your competitors are doing, what’s working for them, and where they’re falling short can give you a strategic edge. Best of all, you can do this yourself using public data and digital tools, no agency needed.

Start with a Simple SWOT Framework

Begin your analysis by listing your top 3–5 competitors. These could be direct competitors offering similar products or indirect ones serving the same need differently.

For each, perform a basic SWOT analysis:

- Strengths: What are they doing well? (e.g., product quality, branding, user experience)

- Weaknesses: Where are they lacking? (e.g., poor customer reviews, limited features)

- Opportunities: What trends could they take advantage of?

- Threats: What could disrupt their business?

A SWOT analysis helps you identify where your business can differentiate and capitalize.

Website and SEO Audits

Your competitor’s website is a goldmine of insight. Analyze their design, content, calls-to-action, pricing structure, and customer support. Ask:

- What’s their unique value proposition?

- Are they targeting a specific niche?

- How easy is it to navigate or make a purchase?

Use free tools like SimilarWeb, Ubersuggest, or Wappalyzer to dig deeper:

- Where do their visitors come from?

- What keywords are driving their traffic?

- Which technologies are they using?

These tools can show traffic estimates, popular pages, and backlink profiles—all of which help you understand their growth engine.

Monitor Their Social Media and Content Strategy

A quick scan of your competitor’s social media presence can reveal their brand voice, customer engagement, and marketing tactics. Are they using videos, how-to content, influencer partnerships, or customer testimonials?

Track:

- Posting frequency and consistency

- Engagement levels (likes, shares, comments)

- Most successful content formats

- Customer complaints or praise in comments

Tools like BuzzSumo or Social Blade can help you identify top-performing content and trends over time.

Read Reviews and Customer Feedback

Online reviews—whether on Google, Amazon, Yelp, or Trustpilot—offer unfiltered insights into customer experiences. Pay close attention to recurring complaints and praise.

Look for:

- Product features customers love or hate

- Common customer service issues

- Suggestions for improvement

- Gaps in the market they’re not addressing

Take note of language customers use—it can help you refine your messaging and positioning later.

Leveraging Free and Low-Cost Tools for Smarter Research

One of the biggest myths in entrepreneurship is that market research has to be expensive. The reality? With today’s tech, you can run comprehensive research campaigns using free or budget-friendly tools that offer surprising depth and accuracy. In fact, many startups and solopreneurs gather better insights using these tools themselves than by outsourcing to a one-size-fits-all agency.

Let’s look at some of the most powerful and affordable tools for each stage of the research process.

Surveys & Polling Tools

- Google Forms: Free, simple, and integrates with Google Sheets for easy data analysis.

- Typeform: Known for beautiful, user-friendly surveys that boost completion rates.

- SurveyMonkey: Offers a freemium model and analytics dashboards with key insights.

Use these platforms to test product ideas, measure brand awareness, or gather demographic info directly from your audience.

Social Listening & Trend Analysis

- Google Trends: Tracks interest in search terms over time and compares regional popularity.

- AnswerThePublic: Visualizes what questions people are asking about your topic or niche.

- Reddit: Search niche communities for real, unfiltered conversations about products, problems, and preferences.

These tools help you uncover emerging trends, understand customer pain points, and monitor buzz around keywords relevant to your industry.

SEO and Website Analysis

- Ubersuggest (by Neil Patel): Excellent for tracking competitor keywords, backlinks, and content ideas.

- SimilarWeb: Offers free website traffic estimates, audience data, and traffic sources.

- Wappalyzer: Shows which technologies and platforms competitors are using.

Understanding what’s driving traffic and conversions for others can help you reverse-engineer strategies for your own growth.

Social Media Analytics

- Meta Business Suite (Facebook & Instagram): Detailed insights into post reach, engagement, and audience demographics.

- Twitter/X Analytics: Track tweet performance, profile visits, and follower growth.

- LinkedIn Analytics: Offers breakdowns of content performance and audience industry data.

These platforms help you assess what content resonates, who your audience is, and how you compare with competitors.

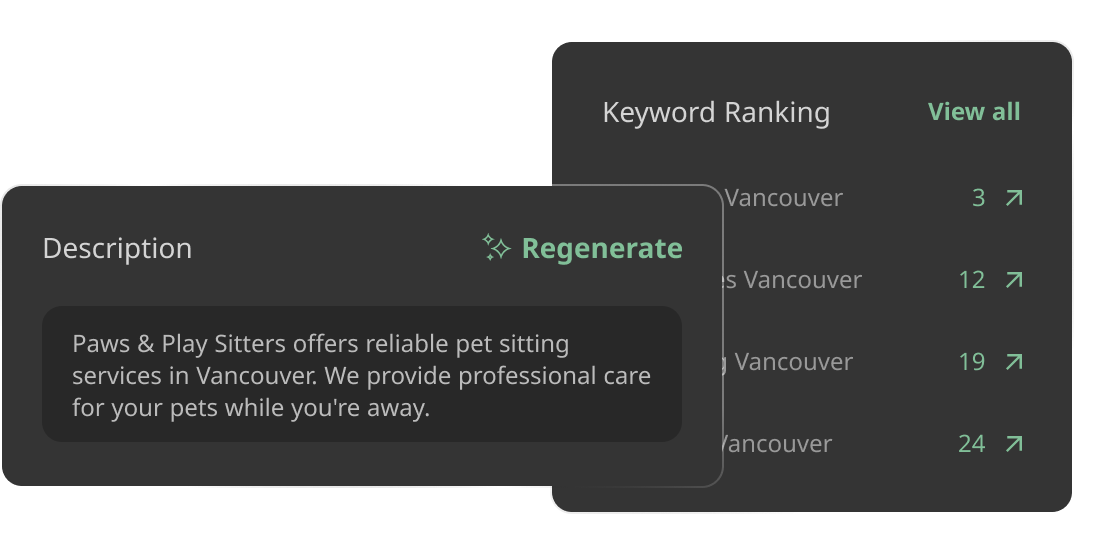

Planning & Integration Tools

After gathering all your data, the next step is organizing it into a usable strategy. That’s where platforms like the PlanVista app come in. As a powerful AI business plan tool, PlanVista helps you integrate your research directly into structured plans. Whether you’re building a pitch deck, testing assumptions, or refining your go-to-market strategy, PlanVista takes your findings and helps you turn them into actionable business models.

By combining these tools with a startup planning tool like PlanVista, you save hours of manual work while ensuring your plans are backed by real insights—not guesses.

Conclusion: You Don’t Need an Agency to Do Market Research Right

Market research is often framed as an intimidating, resource-heavy process—one that requires professional agencies, expensive data sets, and a team of analysts to get right. But as we’ve seen, that’s simply not true. Today’s entrepreneurs have more access than ever to powerful tools, platforms, and strategies that make it possible to gather deep, actionable market insights without spending thousands or handing over control.

By defining your research objectives clearly and identifying your target audience, you set a strong foundation. Using free and affordable tools like Google Forms, Typeform, Ubersuggest, and Google Trends, you can collect quantitative data that shows you what’s happening. Then, by conducting interviews, monitoring online communities, and reading reviews, you tap into qualitative insights that explain why it’s happening.

You don’t need to be a data scientist to analyze this information either. With a simple framework and the right mindset, you can draw meaningful conclusions, identify patterns, and make smart decisions based on actual customer behavior—not guesswork. Analyzing your competitors and leveraging social analytics give you a window into what works and what doesn’t in your space. And best of all, integrating this knowledge into your business strategy is easier than ever.

This is where your research pays off.

When you apply these insights to your business plan, you don’t just create a document for investors. You create a living strategy—a blueprint for decision-making, product development, marketing, and growth. That’s how successful companies operate: not on hunches, but on real-world validation and market understanding.

And here’s the thing: you don’t have to do it all manually.

The PlanVista app is designed for exactly this purpose. As an AI business plan tool, PlanVista lets you import your market research directly into a professional, investor-ready business plan. It helps you connect the dots between customer insights and business strategy—whether you’re just starting out or scaling up. It’s not just a business plan generator; it’s a full startup planning platform that saves time, reduces complexity, and brings clarity to your entrepreneurial journey.

So if you’re ready to take what you’ve learned, build smarter strategies, and launch with confidence, don’t wait for the perfect moment—or the perfect budget.

Start your market research today. Take control. Use the tools. Ask the questions. Analyze the responses. Then, plug those insights into PlanVista and build a plan that’s not just theoretical—but grounded in reality.

Your market is out there waiting. Don’t just guess what it wants—know it. And turn that knowledge into a business that delivers real value.

FAQs

Market research helps startups understand their target audience, assess competition, and validate ideas—ensuring better business decisions and reducing risk.

Yes, with free and affordable tools like Google Forms, Ubersuggest, and Google Trends, anyone can collect and analyze market data effectively.

Quantitative research focuses on numbers and trends, while qualitative research explores emotions, motivations, and customer opinions.

PlanVista helps you integrate your research findings directly into a structured business plan, making it easier to apply insights and impress stakeholders.