How to Create a Financial Forecast in Under 30 Minutes

Introduction: Fast, Focused Forecasting for Founders Who Can’t Afford to Waste Time

If you’re building a startup, you already know how fast things move.

You’re shipping features, talking to users, scrambling for traction—and somewhere in that chaos, you’re supposed to deliver a “financial forecast” that doesn’t sound made up.

But here’s the problem: most first-time founders either overcomplicate it or avoid it entirely.

They think forecasting means building a massive spreadsheet model, hiring a CFO, or spending hours trying to predict the future.

And in the process, they burn time, get stuck, and often end up with something that’s bloated, outdated, or just plain wrong.

The truth? You don’t need a finance degree or a 12-tab Excel file to build a useful financial forecast.

You just need a framework that’s fast, focused, and founder-friendly.

That’s what this blog is all about.

Why Forecasting (Quickly) Matters—Even If You’re Pre-Revenue

Let’s be clear: a forecast isn’t just for investors.

It’s a decision tool. A way to:

- Understand how much cash you’ll need (and when)

- Spot hidden costs before they wreck your runway

- Know what “traction” should actually look like

- Build credibility with anyone you’re trying to raise money from or partner with

If your business plan is your story, your forecast is the proof you’ve thought it through.

And if you’re raising, you can’t skip this step.

Investors will expect a clear financial picture—no matter how early you are.

But You Don’t Need to Spend Days on It

You just need to:

- Identify your core revenue drivers

- Map your expected costs

- Build a simple monthly model

- Project how long your cash will last

- Know your key assumptions (and be ready to defend them)

And guess what? That can be done—in under 30 minutes.

Especially if you use a tool like PlanVista, which automates the heavy lifting, keeps your model flexible, and gives you exports you can drop straight into your pitch deck.

In this guide, you’ll learn:

- The fastest way to build a basic forecast—even if you hate numbers

- How to project revenue, expenses, and cash flow without overbuilding

- The common traps that make early forecasts useless (and how to avoid them)

- A real founder example who used a 30-minute forecast to raise $150K

- How PlanVista helps you forecast faster—and smarter—without spreadsheets

So if your investor just asked for a forecast by tomorrow—or you’re finally ready to stop guessing your burn rate—this blog’s for you.

Define Your Forecasting Goal and Time Frame (5-Minute Setup)

Before you start plugging numbers into any tool, spreadsheet, or slide, you need to answer two quick questions:

- What’s the purpose of this forecast?

- What time period are you forecasting for?

This sounds obvious, but skipping this step is one of the most common reasons founders waste time on financial models that don’t actually help them.

Question 1: What’s the Purpose?

Ask yourself—why are you building this forecast?

Your answer will shape everything:

- Investor Pitch? You’ll want to focus on revenue potential, unit economics, and runway.

- Loan Application? You’ll need to emphasize profitability and repayment ability.

- Internal Planning? You’ll want a model that helps you manage burn, prioritize hires, or decide when to scale.

If you’re not clear on the purpose, your forecast becomes bloated fast—filled with metrics you don’t need and missing the ones you do.

Tip: Don’t try to build one forecast for all purposes.

Start with one clear goal—then adapt from there if needed.

Question 2: What’s the Time Frame?

For early-stage startups, keep it simple:

- Monthly forecast for the next 12 months = ideal for most use cases.

- Add an optional year 2–3 projection if investors ask for it, but don’t overbuild long-term guesses.

Why monthly? Because your startup will change fast—and monthly granularity helps you catch risks and adjust quickly.

Avoid quarterly-only models unless you’re later-stage or already have solid revenue data. You need more frequent visibility when you’re still figuring things out.

What This Step Looks Like in Practice

Let’s say you’re a SaaS founder gearing up to raise your pre-seed round.

Your answers:

- Purpose: Show investors a clear revenue path and cash needs for the next 12–18 months.

- Time Frame: 12-month monthly forecast with an optional high-level 2-year projection.

Now you know what to build—and what to ignore.

You’re not forecasting just to “check the box”—you’re building a model that supports real decisions and raises investor confidence.

Tools Like PlanVista Make Setup Instant

Inside PlanVista, you can set your forecasting time frame and goal with just a few clicks.

It then guides you through relevant inputs—skipping unnecessary ones based on your focus.

This means no wasted time, no irrelevant tabs, and no overthinking your setup.

Projecting Revenue in Minutes (Even If You’re Pre-Revenue)

Projecting revenue doesn’t have to be a guessing game—or a 15-tab spreadsheet situation.

Even if you’re pre-launch, you can build a smart, credible revenue forecast in under 10 minutes by breaking it down into simple drivers and keeping your assumptions clear.

Here’s how.

Step 1: Define Your Revenue Streams

Start by listing how your business makes (or plans to make) money.

Keep it high-level:

- Product sales

- Subscriptions

- Service fees

- Ad revenue

- Licensing

If you only have one, great. If you have two or three, list them separately. Don’t try to bundle everything together—it muddies your model and hides insights.

Step 2: Identify Your Revenue Formula

Each stream needs a simple formula.

For example:

- SaaS subscription model:

Monthly Revenue = Active Customers × Price per Month

- Marketplace model:

Monthly Revenue = Transactions × Commission Rate

- E-commerce:

Monthly Revenue = Units Sold × Price per Unit

Your goal is to turn your forecast into math—something you can adjust and explain clearly.

Step 3: Add Your Assumptions

Now plug in your best-guess assumptions based on:

- Pre-launch waitlists

- Past pilot tests

- Industry benchmarks

- Founder intuition (yes, it’s okay—just be transparent about it)

Example:

If you’re launching a subscription app, your forecast might look like this:

- Month 1: 50 users at $10 = $500

- Month 2: 80 users at $10 = $800

- Month 3: 120 users at $10 = $1,200

- And so on…

Keep it simple. Investors don’t expect precision—they want logic and transparency.

Step 4: Show Growth (But Keep It Grounded)

Avoid hockey-stick fantasy curves.

Instead, use modest, believable month-over-month growth—especially if you’re pre-revenue.

5%–15% monthly growth is realistic for many early startups, depending on your acquisition strategy and budget.

If you show 50% growth month after month with no marketing budget? Expect questions.

Step 5: Stress-Test Your Numbers

Ask yourself:

- How many leads or signups will you need to hit this?

- What’s your expected conversion rate?

- How will pricing or churn affect your monthly revenue?

Even if you don’t have hard data, build a rough funnel and gut-check your logic.

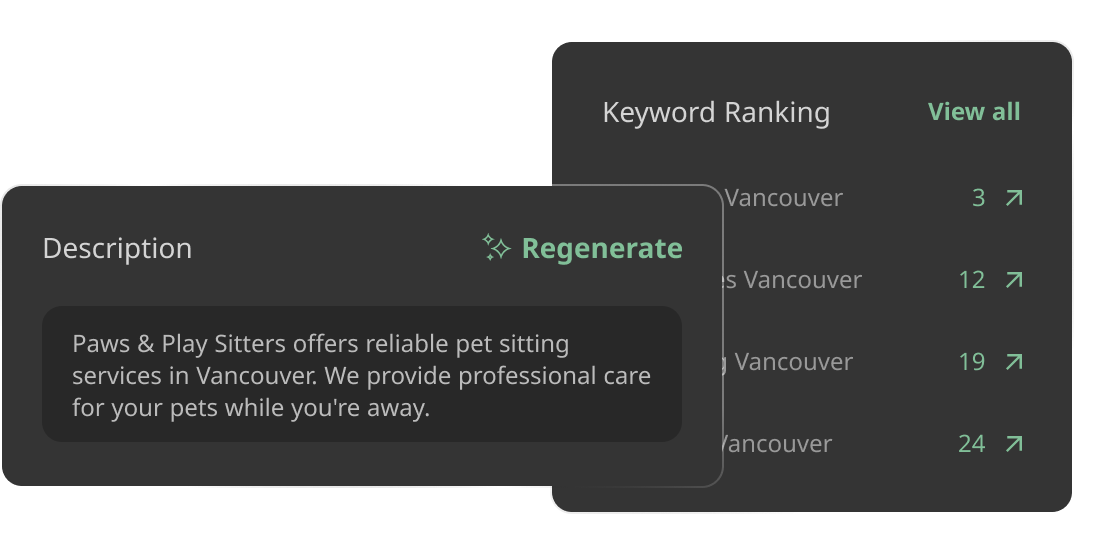

PlanVista Makes This Step Instant

With PlanVista, you can input your revenue model once, and the system will:

- Auto-calculate monthly projections

- Show year-over-year growth trends

- Let you adjust assumptions with sliders, not formulas

- Generate investor-ready charts in seconds

No spreadsheets. No math gymnastics. Just clarity.

Estimating Expenses and Burn Rate in Minutes

Once you’ve mapped out revenue, the next step is understanding your costs—and how quickly you’re burning through cash.

This is where many forecasts go off the rails. Founders either:

- Overcomplicate the model with hundreds of line items, or

- Underestimate costs and give investors unrealistic profit expectations

Let’s fix both—fast.

Step 1: Break Costs Into Two Buckets

To keep things clean, start with two categories:

- Fixed Costs – Stay relatively the same month to month

- Variable Costs – Scale with your revenue or users

Fixed Costs Examples:

- Salaries (founders + team)

- Rent (if you have it)

- Software subscriptions

- Insurance

- Accounting/legal services

Variable Costs Examples:

- Cost of Goods Sold (COGS)

- Payment processing fees

- Marketing spend (performance-based)

- Customer support costs (if tied to usage)

You don’t need a detailed P&L here—just enough to model your burn realistically.

Step 2: Use Simple Monthly Estimates

For each line item, estimate your monthly spend. Example:

| Expense | Monthly Cost |

| Founder salary | ₹75,000 |

| Developer (contract) | ₹60,000 |

| Hosting + SaaS tools | ₹10,000 |

| Marketing spend | ₹20,000 |

| Other overhead | ₹15,000 |

| Total | ₹180,000 |

This gives you your monthly fixed burn.

Step 3: Calculate Your Burn Rate

Burn Rate = Total Monthly Expenses – Monthly Revenue

If you’re pre-revenue, burn = expenses.

If you have early revenue, subtract it from your monthly costs to see how fast you’re spending capital.

This number tells you:

- How long your current cash will last (runway)

- When you’ll need to raise more

- Whether you’re scaling too fast—or not fast enough

Step 4: Add a Margin of Safety

Things cost more than you expect.

Add a 10–15% buffer to your monthly burn forecast to account for:

- Unexpected software needs

- Legal or compliance fees

- Support costs from early growth

- Employee benefits or team tools

This helps you avoid nasty surprises—and builds investor trust.

PlanVista Simplifies All of This

Inside PlanVista, you can:

- Input your fixed and variable costs using clean, guided templates

- Auto-calculate monthly burn and forecast runway

- Adjust numbers in real time with intuitive sliders

- Visualize your cost breakdown instantly

No spreadsheets. No manual formulas. Just fast, reliable visibility into what it takes to keep your startup running.

Building a Simple P&L and Cash Flow Snapshot (Without the Overkill)

At this point, you’ve got the essentials:

- Revenue projections

- Estimated expenses

- Monthly burn rate

Now, let’s turn that into a simple Profit & Loss (P&L) and cash flow snapshot—so you can see whether you’re headed toward sustainability or a short runway.

You don’t need complex accounting skills or 10-line item categories.

Here’s how to do it in minutes.

Step 1: Create a Lean Profit & Loss Statement (P&L)

A P&L shows whether your business is profitable over a set period—monthly, quarterly, or annually.

Start with this format:

| Month | Revenue | COGS | Gross Profit | Operating Expenses | Net Profit |

| January | ₹50,000 | ₹15,000 | ₹35,000 | ₹40,000 | ₹-5,000 |

| February | ₹75,000 | ₹22,500 | ₹52,500 | ₹45,000 | ₹7,500 |

| March | ₹100,000 | ₹30,000 | ₹70,000 | ₹50,000 | ₹20,000 |

Key Terms:

- COGS: Costs that scale with revenue (product costs, shipping, transaction fees)

- Operating Expenses: Salaries, marketing, rent, tools, etc.

- Net Profit: The amount left after everything

This snapshot helps you track when you’ll break even—and how far you are from profitability.

Step 2: Build a Simple Cash Flow Tracker

Cash flow shows what’s actually coming in or going out of your bank account.

It’s different from P&L because it considers timing (e.g., revenue booked vs. cash received).

Basic monthly view:

| Month | Starting Cash | Cash In | Cash Out | Ending Cash |

| January | ₹400,000 | ₹50,000 | ₹80,000 | ₹370,000 |

| February | ₹370,000 | ₹75,000 | ₹90,000 | ₹355,000 |

| March | ₹355,000 | ₹100,000 | ₹100,000 | ₹355,000 |

This is where you’ll track runway and see how long your startup can operate before needing more funding.

Step 3: Forecast Runway

Use this simple formula:

Runway = Cash on Hand / Monthly Net Burn

If you have ₹600,000 in the bank and burn ₹100,000 per month, you’ve got 6 months of runway.

Investors will ask for this—plan accordingly.

PlanVista Does the Math for You

Inside PlanVista, your inputs (revenue, expenses, pricing, CAC, etc.) automatically generate:

- A full P&L statement

- Cash flow projections

- Burn rate visualizations

- Runway timelines

You can adjust scenarios live and instantly download investor-ready outputs—no formatting required.

Founder Story—How One Lean Forecast Secured $150K in Seed Funding

Meet Arjun, Founder of SkillRite

Arjun was building SkillRite, a micro-learning app for upskilling blue-collar workers across India.

He had early traction—1,200 users from a pilot run—but when he started pitching to angel investors, he kept hearing the same thing:

“Your idea sounds solid, but where’s the financial clarity?”

His pitch deck had a “market size” slide and some vague talk about subscriptions—but no real financial model.

The Problem: No Forecast, No Funding

Without numbers, investors had no way to gauge:

- How much money he’d need (and why)

- What revenue looked like at scale

- Whether his plan was even remotely viable

So Arjun took a weekend to fix it.

He didn’t have a finance background—but he had urgency.

The Fix: A 30-Minute Forecast Built in PlanVista

Instead of diving into Excel hell, Arjun opened PlanVista and started fresh.

Here’s what he did in under 30 minutes:

- Defined his model: ₹99/month per user, direct-to-consumer, with 10% month-over-month user growth.

- Estimated CAC at ₹30 based on early ad tests.

- Mapped expenses: Part-time dev, basic marketing, server costs, and founder salary.

- Built a 12-month forecast showing:

- Monthly revenue

- Monthly burn

- Net cash flow

- Break-even point by month 11

- Monthly revenue

He also exported clean graphs and cash runway visuals, ready to drop into his pitch deck.

The Result: Confidence and Clarity That Closed the Round

With a forecast grounded in real data, Arjun:

- Presented a believable growth story

- Clearly explained how ₹150K would extend his runway by 18 months

- Showed how investor capital would be used across hiring, acquisition, and product development

His updated pitch got serious nods—and within six weeks, he closed his $150K pre-seed round from two angel syndicates.

More importantly, Arjun now uses that forecast weekly to make real decisions:

- When to increase ad spend

- When to hire

- When to raise again

The Takeaway

Arjun didn’t raise capital because he built a massive model.

He raised because he built a lean, clear forecast grounded in reality—and investors could trust it.

That’s the power of a financial forecast built for speed, not spreadsheets.

How PlanVista Helps You Forecast in Minutes, Not Days

Let’s face it—most forecasting tools were built for accountants, not startup founders.

They’re clunky, overbuilt, and require hours (or days) to set up.

That’s not helpful when you’re juggling product sprints, investor calls, and early traction all at once.

PlanVista flips that experience on its head.

It’s built specifically for founders who need to forecast fast, adjust often, and look sharp in investor conversations—without touching a spreadsheet.

Here’s how it works.

1. Get Started in Under 5 Minutes

No complicated onboarding.

No finance degree required.

PlanVista gives you:

- Clean, guided prompts

- Lean templates for SaaS, marketplaces, D2C, services, and more

- Step-by-step support to build revenue, cost, and cash flow models from scratch

You just answer simple questions—and PlanVista turns your answers into financial clarity.

2. Real-Time Adjustments (Without Rebuilding Your Model)

Markets change. Messaging evolves. CAC jumps.

With PlanVista, you can:

- Tweak your assumptions live

- Adjust growth rates, pricing, or headcount

- See how changes affect your runway and revenue in real time

No formulas. No manual syncing. Just instant results.

3. Clear, Visual Outputs (That Investors Actually Read)

Once your forecast is ready, PlanVista gives you:

- Investor-ready P&L, burn rate, and cash flow views

- Interactive charts and clean tables

- One-click exports for pitch decks or investor follow-ups

You look polished—without hiring a finance team or wasting days formatting slides.

4. Forecast for Multiple Scenarios—Fast

Wondering what happens if your CAC doubles?

Or if you grow 10% slower than expected?

PlanVista lets you:

- Build multiple forecast versions

- Compare best-case, base-case, and worst-case

- Make decisions with confidence, not guesses

5. Built-In Metrics That Matter

PlanVista automatically calculates:

- CAC, LTV, gross margin, and churn

- Runway and monthly burn

- Break-even point

You get full financial visibility—without the spreadsheet struggle.

6. Always Investor-Ready

The real win?

Your forecast is always up to date, aligned with your pitch, and ready to send when that investor intro lands in your inbox.

PlanVista makes sure you’re not scrambling at the last minute.

Conclusion: Forecast Fast, Stay Funded, and Always Know Your Numbers

A financial forecast isn’t just a pitch deck checkbox—it’s your operating playbook.

It tells you:

- How long you’ll last with your current cash

- What kind of growth you need to survive (and scale)

- When you’ll need to raise again—and how much

- Whether your assumptions are actually working in the real world

And yet, too many founders skip it—or spend so long building one that it’s outdated by the time it’s done.

Here’s the truth: you don’t need complexity. You need clarity.

Forecasting Should Fuel You, Not Frustrate You

You’re already managing a hundred moving parts.

Your financial forecast should make decisions easier—not harder.

It should answer questions like:

- “Can I afford to hire now?”

- “Do I have enough traction to raise?”

- “What’s our cash position if growth slows?”

With a lean, 30-minute forecast, you stay focused on what matters—and investors take you seriously because you’ve done the work founders often avoid.

Why This Process Works

In this guide, we broke the forecast process into quick, clean steps:

- Set your time frame and forecasting goal

- Project revenue using simple math, even pre-launch

- Estimate expenses to understand your burn rate

- Build a lean P&L and cash flow view

- Use tools (like PlanVista) to make it repeatable, scalable, and investor-ready

You don’t need a CFO to build a smart forecast. You just need the right structure—and a tool that moves at startup speed.

PlanVista Makes Forecasting a Founder Strength

With PlanVista, you can:

- Build a lean forecast from scratch in under 30 minutes

- Adjust it monthly (or weekly) as your startup evolves

- Generate clean, pitch-ready financial docs with zero formatting headaches

- Stay on top of your runway and CAC without living in a spreadsheet

Because the best founders don’t just raise—they operate with precision.

Final Takeaway

Don’t wait until your bank balance drops or your investor asks for numbers you can’t back up.

Build your forecast now—while you’re calm, clear, and focused.

Make it your startup’s financial GPS, not a post-funding afterthought.

And if you want to move faster, skip the spreadsheets, and stay investor-ready 24/7?

Plan smarter with PlanVista. Try it now—no credit card required.

FAQs

PlanVista is a business planning tool that helps founders create lean, investor-ready forecasts and models in minutes.

Yes—PlanVista offers guided templates and real-time adjustments without any manual spreadsheets.

Absolutely—PlanVista helps you build forecasts even if you’re still pre-launch or testing your model.

Yes—PlanVista lets you model best-case, base-case, and worst-case outcomes instantly.

Yes—PlanVista offers a free trial, no credit card required.