How to Handle Investor Objections During Your Pitch

Introduction

Walking into a pitch meeting with investors is one of the most exciting—and nerve-wracking—moments in a startup founder’s journey. You’ve fine-tuned your business plan, rehearsed your pitch, and are ready to share your vision with the people who could help make it a reality. But then come the objections. “How big is this market, really?” “Why should we trust your team?” “Is your valuation realistic?” Suddenly, your adrenaline turns into anxiety. Sound familiar?

Handling investor objections is not about being perfect or having every answer at your fingertips. It’s about preparation, confidence, and empathy. Objections aren’t signs of rejection—they’re signs of interest. Investors ask tough questions because they want to see how you think, how you respond under pressure, and how well you understand your business. In many ways, how you handle these objections can be more telling than your pitch deck itself.

In this guide, we’ll explore the most common investor objections and how to respond to them with clarity and conviction. We’ll look at real-world scenarios where startup founders turned tough questions into funding opportunities. We’ll also highlight how using tools like a business plan generator or an AI business plan tool—like the PlanVista app—can help you anticipate and address objections before you even step into the room.

If you’re preparing for a pitch, or just want to be better at communicating your value to stakeholders, mastering objection handling is essential. Let’s dive into the strategies that can transform investor doubt into investor confidence—and ultimately, commitment.

Common Types of Investor Objections and What They Really Mean

Investor objections are rarely just surface-level criticisms—they’re signals of what matters most to potential backers. When investors question you during a pitch, they’re not trying to trip you up; they’re probing for risk. They want to know if your startup is worth the gamble. Understanding the underlying motivations behind these objections is key to crafting persuasive, trust-building responses.

Let’s look at some of the most frequent objections and decode what investors are really asking:

1. “The market seems too small.”

On the surface, this sounds like skepticism about your industry. But what they’re really asking is, “Is this worth my time and capital?” A small market might mean limited growth potential, so this is your chance to present hard data. Use market research to show how your niche is growing, evolving, or how your product can expand into adjacent markets. Tools like the PlanVista app, which include market analysis templates, help clarify and visualize your market opportunity with professional polish.

2. “Your team doesn’t have the experience.”

Investors bet on people just as much as they do on ideas. If your team is new to startups or lacks domain-specific experience, counter by emphasizing complementary strengths, your advisors’ credibility, or past accomplishments. Highlight your team’s passion, commitment, and growth mindset. A strong business plan generator can help document your team’s competencies clearly, aligning your narrative with investor expectations.

3. “I’m not sold on the business model.”

This isn’t a dead-end; it’s a nudge to explain your logic. Investors want to know how your company makes money, scales, and remains sustainable. Break down your revenue streams, unit economics, and pricing strategy. This is where having a solid, AI-driven business plan tool shines—it ensures every part of your model is consistent and well-justified.

4. “There’s too much competition.”

Rather than dismiss competition, embrace it. Investors know that if there’s no competition, there’s probably no market. Use competitor analysis to position your startup uniquely—highlight your value proposition, technology, customer experience, or go-to-market strategy. Competitive matrices, like those generated by startup planning tools, help you stand out visually and factually.

5. “The valuation seems too high.”

Valuation objections often stem from a mismatch between perceived risk and projected returns. Be ready with your justification: comparable company valuations, traction metrics, and a breakdown of how you arrived at your number. It’s not just about the figure; it’s about your reasoning.

Understanding these objections helps you prepare proactive answers. Anticipating concerns allows you to address them in your pitch before investors even raise them. And with the right startup planning tools, like PlanVista, your business plan can do some of the heavy lifting by preemptively answering key questions.

Next, let’s dig into how you can prepare strategically for these objections—turning tough questions into golden opportunities.

Strategic Preparation: How to Anticipate Investor Objections Before They Happen

Preparation is your first and best defense when it comes to handling investor objections. The more legwork you do ahead of your pitch, the more confidently you can respond to concerns—and, even better, the more likely you are to preempt them altogether. Objections often stem from gaps in your narrative, unclear data, or unexplained risks. By strategically preparing for these potential pain points, you reduce friction and build trust from the outset.

1. Map Out the Common Objections

Start by reviewing the typical concerns investors have: market size, team credibility, revenue model, scalability, competition, and valuation. Go through each category and ask yourself: “What would an investor question about this part of my plan?” Write out hypothetical objections and brainstorm strong responses.

Better yet, get feedback from mentors, advisors, or use AI business plan tools like PlanVista to simulate investor-like scrutiny. The PlanVista app helps surface weak spots in your business plan through automated analysis, prompting you to strengthen areas that may draw red flags.

2. Use Data to Fortify Your Pitch

Opinions don’t win over investors—data does. Whether it’s user growth, conversion rates, cost of acquisition, or market trends, everything should be backed by metrics. Include third-party research to validate your assumptions. A data-driven approach makes your responses more credible and compelling.

Business plan generators can help organize and present your data in investor-ready formats, making your pitch not just more persuasive, but more professional.

3. Role-Play Investor Scenarios

Conduct mock pitch sessions with your team or advisors acting as skeptical investors. Record these sessions and take note of which objections fluster you or require stronger responses. Rehearse how to remain calm, composed, and concise under pressure. This practice is invaluable when you’re in a real pitch meeting.

You can even go a step further by using startup planning tools that include objection libraries—collections of common investor pushbacks and sample answers to help you train.

4. Prepare Visual Aids That Preempt Questions

Sometimes the best way to prevent objections is to answer them before they’re asked. Visual aids like charts, graphs, competitive matrices, and business model canvases clarify your vision and reduce the room for doubt. Tools like PlanVista automatically generate these visuals from your inputs, streamlining your preparation and ensuring your presentation is coherent and investor-focused.

5. Know When to Say “Let Me Get Back to You”

Despite your best efforts, you may encounter an objection you’re not prepared for. Don’t panic. It’s far more professional to admit you don’t have an immediate answer than to improvise a weak or inaccurate one. Follow up promptly with a detailed response. This shows maturity, honesty, and dedication.

Preparing strategically for investor objections is more than a safety net—it’s a chance to refine your pitch, understand your business more deeply, and present yourself as a founder who is not just passionate, but exceptionally prepared.

Up next: how to respond to investor objections in real time—without getting defensive.

Live Handling: Responding to Investor Objections with Confidence and Clarity

No matter how well-prepared you are, the real test comes when you’re in the room. Investor objections can come fast and unexpectedly, and how you respond in real time can significantly impact their confidence in you and your startup. Think of this as a live interview—not just about your idea, but about your temperament, adaptability, and leadership.

1. Listen First, Then Answer

When you hear an objection, resist the urge to interrupt or jump in defensively. Pause, listen carefully, and make sure you fully understand the concern. Sometimes, asking clarifying questions like “Can you elaborate on what you’re most concerned about?” shows maturity and gives you a moment to collect your thoughts.

This technique also buys time and ensures your answer addresses the root of their concern—not just the surface-level comment.

2. Validate the Concern

Acknowledging an investor’s objection doesn’t weaken your case—it strengthens your credibility. Say things like, “That’s a valid point,” or “We’ve thought a lot about that.” It shows you’re open to feedback, not threatened by it. Investors appreciate founders who are coachable and pragmatic.

3. Respond with Specifics

Avoid vague reassurances. Instead of saying, “We have a strong team,” say, “Our CTO scaled a tech platform to 500,000 users in a previous startup, and our COO led operations at a logistics firm with $10M in annual revenue.” Specific examples and metrics demonstrate depth and realism.

Tools like the PlanVista app can help you build these specifics into your business plan and pitch materials, giving you quick-reference data to use in live conversations.

4. Bridge to Strengths

Once you’ve addressed the objection, pivot the conversation back to your core strengths. For instance, if the investor is concerned about competition, respond with your competitive advantage and then reinforce your unique go-to-market strategy. This technique keeps the pitch positive and forward-looking.

5. Don’t Take It Personally

Investor objections can feel like personal criticisms, especially if you’ve poured your heart into your startup. But they’re not. They’re part of the game. Keeping your cool, staying respectful, and maintaining a sense of composure—even when you’re challenged—demonstrates leadership under pressure.

6. Know When to Defer

If you’re caught off guard by a particularly technical or detailed question, it’s perfectly acceptable to say, “That’s a great question—I want to make sure I get you the most accurate information. Can I follow up after this meeting with more detail?” Just be sure to actually follow up, and do it promptly.

Remember, objection handling isn’t about “winning” the argument. It’s about creating a dialogue, building trust, and showing that you understand both your business and your investors’ concerns. That’s what turns skeptical investors into enthusiastic partners.

In the next section, we’ll explore real-world examples of how startups successfully turned investor objections into pivotal funding wins.

Real-World Success Stories: Startups That Turned Objections into Opportunities

The best way to learn how to handle investor objections is to study the entrepreneurs who’ve done it successfully. Many iconic startups faced tough investor questions—and initial rejections—before turning the tables. Their stories offer valuable insights into how preparation, humility, and the right tools can transform skepticism into support.

1. Airbnb: “Strangers Sleeping in My House?”

One of the most famous objections Airbnb faced early on was that people wouldn’t feel comfortable letting strangers stay in their homes. This concern wasn’t just about trust—it cut to the core of their business model. The founders didn’t brush it off. Instead, they leaned into the concern, explaining how user reviews, identity verification, and a host guarantee program would create a sense of safety and reliability.

By methodically addressing this psychological barrier and improving their product based on the feedback, they won over investors. Today, those objections seem trivial in hindsight—but back then, handling them with calm precision made all the difference.

2. Dropbox: “The Market is Too Crowded”

When Drew Houston pitched Dropbox, many investors believed the market was already saturated with storage solutions. Instead of denying the competition, he acknowledged it and clearly articulated how Dropbox’s user experience and seamless synchronization set it apart. He even used a simple, memorable demo video to show the product in action—turning a vague concern into an opportunity to shine.

This tactic—clarifying differentiation through show-not-tell—resonates well with investors. It’s a strategy you can emulate using a startup planning tool like PlanVista to create data-backed feature comparisons and customer experience narratives.

3. Twitch: “Is This Just for Gamers?”

When pitching what would become Twitch, the founders heard repeated objections about the platform being too niche. The common concern? That gaming livestreams were a passing trend. Instead of arguing, they reframed the niche as a passionate, fast-growing market with high engagement and long user sessions—metrics that advertisers and partners value.

They backed this with user growth data and early monetization experiments, eventually winning over skeptical investors who now wish they’d joined earlier.

4. Planned Success with AI Tools

Today, founders are much better equipped to face these objections because of the growing ecosystem of support tools. Entrepreneurs using PlanVista, for example, have reported smoother investor conversations because their plans are more thorough, their data more consistent, and their responses more refined. By using an AI business plan tool, they’ve avoided common pitfalls like vague market sizing or unsupported revenue projections—issues that often trigger investor doubt.

5. From Rejection to Funding: The 2nd Pitch

Many startup founders don’t land funding on the first try. A founder may hear, “You’re too early,” or “We don’t get it.” Smart founders listen, refine their pitch and business plan, and return stronger. When supported by tools like PlanVista, which provide ongoing analytics and plan optimization, that second pitch often lands the check.

Real-world success hinges not just on the brilliance of the idea but on the resilience of the founder. Handling objections with professionalism, backed by great tools, can be the tipping point.

Next, we’ll explore how AI and digital tools give modern founders a strategic edge when dealing with investor objections.

The AI Advantage: How Business Plan Tools Like PlanVista Help You Handle Objections

In the high-stakes world of investor pitching, clarity, consistency, and data-backed insights are non-negotiables. This is where technology, especially artificial intelligence, becomes your greatest ally. AI-powered business plan tools like PlanVista aren’t just about creating beautiful pitch decks—they’re about building the strategic muscle founders need to anticipate, manage, and overcome investor objections effectively.

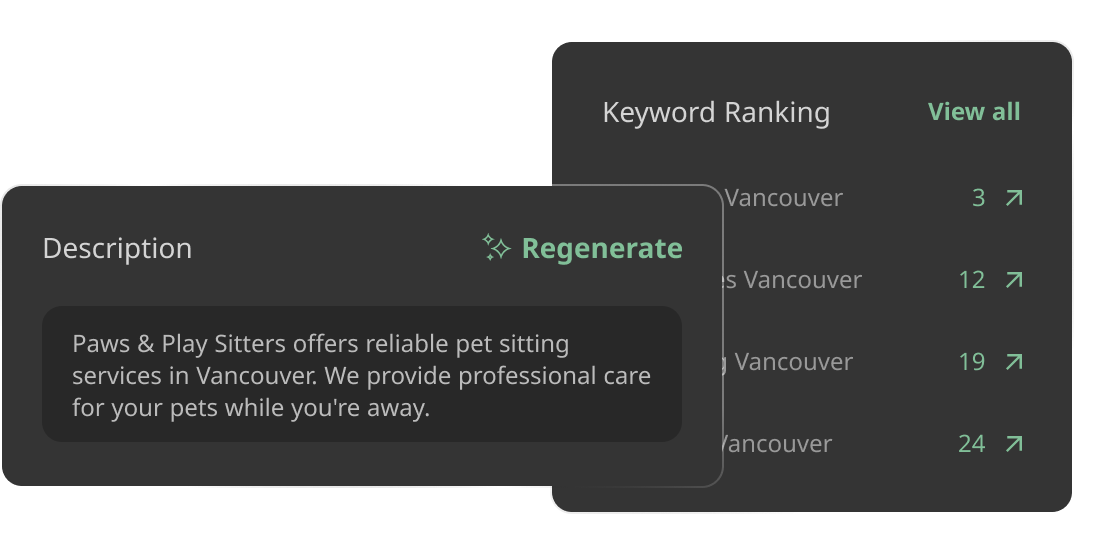

1. Spot Weaknesses Before Investors Do

One of the most powerful features of PlanVista is its ability to simulate investor thinking. The platform uses machine learning to flag gaps or inconsistencies in your business plan—areas where investors are likely to push back. Whether it’s an unrealistic growth projection or a vague revenue model, PlanVista helps you course-correct before you’re in the hot seat.

This kind of proactive planning is critical. Rather than scrambling to answer hard questions mid-pitch, you walk in with a bulletproof narrative and airtight data.

2. Strengthen Financial Forecasts with Confidence

Investors scrutinize numbers. They want to see coherent revenue streams, sound cost structures, and realistic cash flow projections. PlanVista’s AI business plan tool not only helps you build these models—it also analyzes them for credibility. The platform offers industry benchmarks and scenario testing, allowing you to back up your claims with real-world comparisons.

When an investor says, “Your margins seem too optimistic,” you’ll be ready with comparative data and layered assumptions—all generated and verified by your planning tool.

3. Improve Messaging Across the Board

A compelling pitch isn’t just about content—it’s about storytelling. PlanVista helps founders align their executive summary, market strategy, and team bios with investor expectations. By ensuring consistency across your entire business plan, the tool prevents narrative gaps that often lead to investor doubts.

For instance, if your go-to-market strategy is aggressive but your team lacks sales experience, PlanVista will flag the disconnect. It doesn’t just help you write—it helps you think strategically.

4. Real-Time Updates and Iteration

Investor feedback doesn’t stop after the first pitch. Many successful funding rounds require multiple meetings and refined versions of your plan. With PlanVista, updating your pitch based on new feedback is seamless. The app stores previous versions, allows A/B comparisons, and incorporates changes across all sections with minimal friction.

This agility shows investors that you’re not just responsive—you’re efficient and precise, qualities they value in a startup founder.

5. Presentation-Ready Outputs

Finally, PlanVista doesn’t just help you plan—it helps you present. With automated charts, competitor matrices, and cleanly formatted financial summaries, your pitch materials will look as solid as your strategy. This polish goes a long way in building credibility, especially when paired with confident objection handling.

In today’s competitive startup environment, AI-powered tools are not a luxury—they’re a necessity. PlanVista gives founders a strategic edge, enabling them to anticipate investor objections and respond with clarity, data, and professionalism.

Next, we’ll wrap up with a deep-dive conclusion on how to bring all these elements together to master investor objections and raise smarter.

Conclusion: Mastering Investor Objections to Raise Smarter

Facing investor objections can feel like a trial by fire—but it’s also one of the best opportunities to demonstrate your startup’s potential, and your own credibility as a founder. When handled with preparation, composure, and insight, objections can become stepping stones toward building strong investor relationships and ultimately securing funding.

Throughout this guide, we’ve explored the psychology behind investor pushback and how to turn it into constructive dialogue. From decoding common objections about market size, valuation, and competition, to learning from real-world success stories, it’s clear that objection handling is more about communication and preparation than persuasion.

The key is not to dodge objections, but to lean into them. Anticipate them with strategic planning. Respond to them with specifics. Support your answers with data and real-world insights. And above all, maintain your calm, show humility, and listen with intent. Investors aren’t looking for perfection—they’re looking for potential, resilience, and founders who are serious about execution.

And this is where the right tools become game-changers.

The PlanVista app was built with this founder mindset in mind. It’s more than a business plan generator—it’s a strategic partner. By using PlanVista, you’re not just drafting a business plan; you’re building a roadmap that addresses investor concerns before they even arise. You’re equipping yourself with financial models, market insights, and a cohesive pitch strategy—all backed by AI.

Whether you’re preparing for your first pitch or refining your approach for a second-round raise, PlanVista can give you the clarity and confidence to face investor scrutiny head-on. The app’s intelligent prompts, professional formatting, and real-time updates ensure that your pitch evolves as fast as your startup does.

In a competitive funding landscape, founders who anticipate objections and come prepared with smart, data-driven responses don’t just survive—they thrive. Mastering investor objections isn’t just about securing funding. It’s about becoming the kind of founder investors believe in.

So, what’s your next move?

If you’re ready to take your pitch to the next level and make every investor meeting count, try PlanVista today. With the power of AI and strategic business planning in your corner, you’ll walk into every pitch not just prepared—but unstoppable.

FAQs

Common objections include concerns about market size, team experience, revenue model, competition, and company valuation.

Provide credible market research and explain how your product can expand into adjacent or emerging markets to increase growth potential.

Stay calm, listen actively, validate the concern, and respond with specific data or examples. If needed, follow up with more detailed information after the pitch.

Yes, AI business plan tools like PlanVista help identify weak points, optimize your business plan, and prepare data-backed responses to likely objections.

Be honest and professional. Acknowledge the question, promise to follow up, and make sure to send a thorough response after the meeting.