Market Sizing for Startups: A Simple Guide

Introduction

Starting a business is thrilling, but it’s also a high-stakes endeavor. For startup founders, one of the most critical early steps is figuring out whether their big idea can actually become a big business. That’s where market sizing comes in. It’s not just a buzzword tossed around in investor meetings—it’s a fundamental tool that shapes your startup’s trajectory. Whether you’re pitching to VCs, drafting your first pitch deck, or just trying to assess if your product is viable, understanding your potential market can make or break your venture.

Market sizing is the process of estimating the total demand for your product or service. It answers questions like: How many people could potentially buy what I’m offering? How much are they willing to spend? What percentage of this market can I realistically capture in the near future? These insights help you validate your business idea, build financial forecasts, and allocate resources wisely.

Let’s say you’re launching a mobile app that helps freelancers manage their taxes. If you assume “everyone who works” is your market, you’re aiming too wide. But if you analyze data and find there are 10 million freelancers in your target country, 70% of whom struggle with taxes, and 30% of those are actively seeking solutions—now you have a focused market to work with. That’s market sizing in action.

There are three key terms that entrepreneurs need to grasp: Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM). Each gives you a more refined understanding of your opportunity, from the universe of all potential customers to the niche you can realistically serve. These are not just academic terms—they’re vital metrics that investors look for to gauge a startup’s potential.

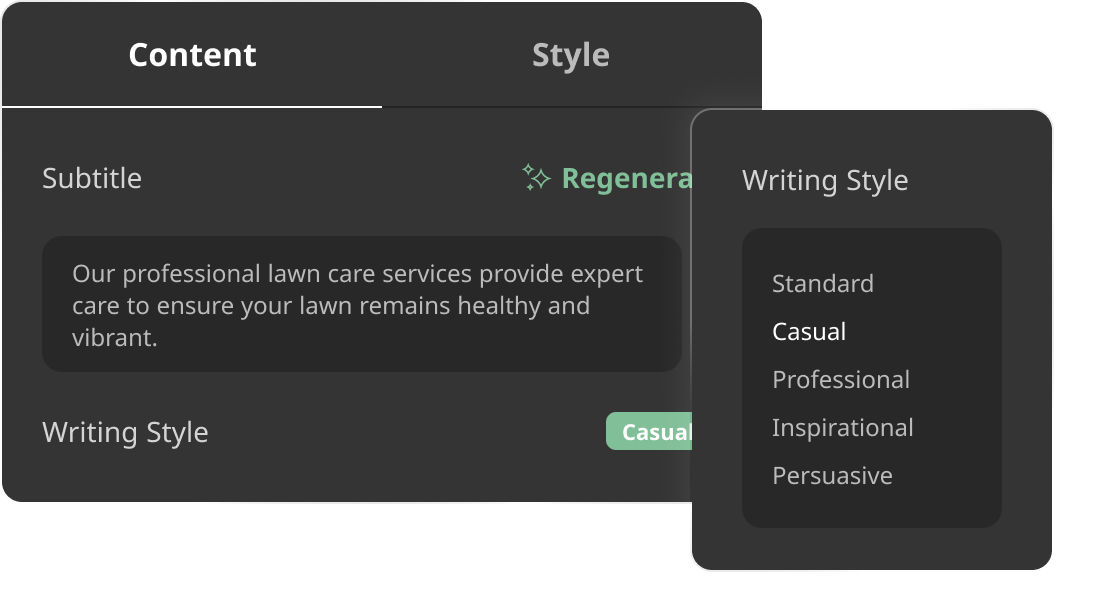

However, many startups either skip this step or get it wrong. They rely on inflated numbers, vague assumptions, or outdated data, which can derail funding efforts and misguide internal planning. That’s why it’s essential to learn how to do market sizing properly. And luckily, with today’s technology—including AI-powered platforms like the PlanVista app—it’s easier than ever to get accurate, actionable insights without needing a Ph.D. in statistics.

In this simple guide, we’ll walk you through everything you need to know about market sizing for startups. We’ll explain the different types of market estimates, outline step-by-step methods for calculating them, explore real-world examples, highlight common pitfalls, and show you how modern AI business plan tools can streamline the entire process.

Whether you’re an aspiring entrepreneur, a startup team building your first pitch, or a business consultant helping others grow, this guide will give you the clarity and confidence to tackle market sizing head-on. And who knows? You might just discover your market is bigger—and more reachable—than you ever imagined.

Let’s dive into the essentials of market sizing and set your startup on the path to smart, scalable growth.

Understanding TAM, SAM, and SOM

To size a market effectively, startup founders need more than just a big number. Investors are no longer impressed by claims like “If we capture just 1% of a billion-dollar market…” unless that claim is backed by a clear, well-reasoned strategy. That’s where the concepts of TAM, SAM, and SOM come in. These acronyms might sound intimidating at first, but they’re essential for breaking down your market into logical, strategic segments.

Total Addressable Market (TAM)

TAM represents the universe. It’s the total demand for your product or service, assuming you could capture every possible customer. Think of it as the theoretical maximum revenue your startup could generate if there were no competitors, no geographic constraints, and no barriers to adoption. For example, if you’re launching an AI-powered budgeting app, and there are 500 million smartphone users worldwide interested in personal finance, your TAM might be all those users multiplied by the average amount they’d pay for such a service annually.

TAM gives investors a sense of the overall market opportunity. Even if it’s out of reach in the short term, it signals whether your industry has room to grow.

Serviceable Available Market (SAM)

SAM is your realistic reach—geographically, demographically, or otherwise filtered. It’s the portion of TAM that fits your product’s current capabilities and market focus. For instance, your AI budgeting app may only be available in English and tailored to U.S. tax law. That narrows your SAM to English-speaking, financially literate users in the U.S., which might reduce the TAM of 500 million users to a SAM of, say, 50 million.

SAM is critical for understanding what your business can target today, not what it might tackle in five years. It’s about the accessible pie, not the entire bakery.

Serviceable Obtainable Market (SOM)

SOM is your slice of that pie—the market share you can realistically acquire in the short term given your resources, competition, and go-to-market strategy. It’s influenced by your marketing budget, brand awareness, pricing, and operational capacity. If your startup can only afford to reach 1% of your SAM through targeted ads, and expects a 10% conversion rate, your SOM could be just 50,000 users.

SOM is where rubber meets the road. It grounds your projections and shows investors you understand how to turn vision into revenue. If your startup can scale that SOM smartly, growth becomes a matter of execution, not luck.

Real-World Example

Imagine a startup offering a mental health support app for college students:

- TAM: 250 million college students worldwide.

- SAM: 20 million students in English-speaking countries with access to smartphones and online payments.

- SOM: 500,000 students reachable via university partnerships and online marketing in year one.

This layered approach lets startups tell a credible, data-backed story of their growth potential. It also helps in crafting business strategies aligned with reality rather than hopes.

Tools like the PlanVista app make these calculations easier by integrating real-time demographic data, user behavior insights, and historical benchmarks to help startups define and refine their TAM, SAM, and SOM. With the PlanVista AI business plan tool, what used to take weeks of research can now be modeled and updated in minutes.

Methods for Calculating Market Size

Once you’ve wrapped your head around TAM, SAM, and SOM, the next big question is: how do you actually calculate them? Market sizing is as much an art as it is a science. While there’s no one-size-fits-all approach, two main methods dominate the scene—top-down and bottom-up. Understanding how to use them effectively can help you avoid guesswork and build a case that resonates with stakeholders and investors alike.

Top-Down Approach

The top-down approach starts big and narrows down. You begin with broad industry data, then filter it through layers of logic to arrive at your specific market. It’s like starting from the peak of a mountain and working your way down to the base camp that matters to your startup.

For instance, suppose you’re launching a digital platform that helps people rent camera gear. You find a market research report stating that the global photography equipment market is valued at $25 billion. If 15% of that market is geared toward rentals, that’s a $3.75 billion TAM. Now, if your app only operates in North America, which accounts for 30% of that market, your SAM becomes $1.125 billion. Finally, if you aim to capture 2% of that within five years, your SOM would be around $22.5 million.

Top-down is fast and useful for big-picture thinking, but it has pitfalls. It often relies on assumptions and secondary data, which can be outdated or irrelevant to your specific niche. The risk is inflating your opportunity based on overly optimistic filters.

Bottom-Up Approach

The bottom-up method flips the script. It starts small, using internal data or real-world assumptions to build your market estimate. It’s more grounded and often more accurate, especially for early-stage startups.

Let’s revisit the camera gear rental app. Say your beta test shows that your average customer rents $100 worth of equipment per month. You’ve validated a strong interest among 50,000 semi-professional photographers in urban areas through surveys. If you can realistically onboard 10% of them in year one, that’s 5,000 customers. Multiply that by the average annual spend of $1,200 per user, and you’re looking at $6 million SOM. You can then extrapolate upwards to forecast your SAM and TAM based on broader adoption trends and expansion potential.

Bottom-up is investor-friendly because it shows traction and scalability from a realistic starting point. It’s also perfect for validating your assumptions with measurable data, making your projections harder to poke holes in.

The Hybrid Model

Savvy startups often use a blend of both methods. The top-down approach helps frame the opportunity size, while the bottom-up grounds your business plan in operational reality. Together, they offer a balanced view that demonstrates ambition without losing credibility.

Today, tools like the PlanVista app streamline both approaches. This AI business plan tool can pull in industry data, forecast user behavior, and simulate financial models—all in one platform. Whether you’re using national statistics or your own sales funnel data, PlanVista helps translate raw inputs into a clear, investor-ready market sizing model.

This combination of analytical rigor and accessible AI tooling means even first-time founders can confidently map out their business landscape—and get a step closer to startup success.

Challenges in Market Sizing

Market sizing is essential, but it’s far from easy. Founders often start with enthusiasm only to run into roadblocks that turn a simple exercise into a frustrating puzzle. Even with the best intentions, market sizing can go wrong in many ways—through bad data, flawed assumptions, or poor methodology. Recognizing these common challenges can help you avoid missteps and approach your analysis with clarity and confidence.

1. Data Availability and Quality

One of the biggest hurdles startups face is the lack of reliable data. Especially in niche industries or emerging markets, the numbers simply may not exist—or, if they do, they might be outdated or behind a paywall. Free sources like government databases or market research reports offer some insights, but they often generalize or lag behind fast-moving trends.

Take a startup targeting eco-friendly pet products. While you might find data on the broader pet care industry, you’ll struggle to isolate metrics for sustainable or biodegradable goods. This forces founders to make educated guesses or rely on proxies, which can skew projections.

2. Overly Optimistic Assumptions

Another common trap is overestimating adoption rates or assuming rapid scalability. It’s tempting to think, “If even 1% of a billion-dollar market uses our product, we’ll be rich!” But market adoption rarely works that smoothly. Barriers like user habits, customer education, brand trust, and competition significantly slow down uptake.

Consider a new app helping restaurants reduce food waste. The TAM might look massive on paper, but real-world constraints—like tight profit margins, resistance to operational change, or lack of awareness—can limit actual adoption.

3. Market Fragmentation

Markets aren’t always unified or easy to segment. You may be targeting a TAM that spans geographies, cultures, and consumer behaviors. Trying to build a uniform strategy for such a fragmented landscape can dilute your focus and misrepresent your SOM.

For example, a startup offering online courses may identify a global TAM, but the effectiveness of their content and marketing will vary wildly between countries. Market sizing needs to account for these regional nuances, not gloss over them.

4. Dynamic Market Conditions

Markets evolve rapidly, especially in tech. What looks like a strong opportunity today may shrink tomorrow due to regulatory changes, new competitors, or shifts in consumer preferences. If your analysis doesn’t factor in these potential disruptions, it could quickly become irrelevant.

COVID-19 reshaped dozens of industries overnight—telehealth, remote work tools, delivery apps. Market sizing done pre-pandemic was suddenly obsolete. Startups need to adopt dynamic planning tools that update forecasts in real time.

5. Internal Bias

Founders often fall in love with their ideas. That passion, while valuable, can cloud judgment. Confirmation bias might lead you to cherry-pick data that supports your vision and ignore red flags. Even well-meaning optimism can skew your market estimates, which spells trouble when it’s time to raise capital.

Overcoming the Challenges

This is where an AI-powered startup planning tool like the PlanVista app makes a huge difference. PlanVista helps validate your assumptions, tap into real-time data, and flag inconsistencies in your logic. By integrating tools that adapt to shifting conditions and eliminate bias through objective analysis, it ensures your market sizing stands up to scrutiny—from cofounders and advisors to venture capitalists.

The best market sizing isn’t just about numbers—it’s about telling a believable story. With the right tools and mindset, even the most complex market can become navigable.

Leveraging AI Tools for Market Sizing

In the past, market sizing was an exercise in manual labor—digging through dense industry reports, building spreadsheets from scratch, and making calculated guesses based on limited data. Today, that landscape has dramatically shifted. Thanks to artificial intelligence, startups can now access tools that bring speed, accuracy, and clarity to what used to be a complicated and error-prone process. AI doesn’t just assist with market sizing—it’s transforming how startups approach business planning from day one.

Smarter Data Collection

The first game-changer AI brings to market sizing is smarter, faster data gathering. Rather than scouring the web for reports or subscribing to expensive databases, AI-powered tools can instantly pull information from reliable public and proprietary sources. These platforms synthesize data across demographics, buying behavior, industry trends, and economic indicators to provide a comprehensive market view.

For example, if you’re launching a fintech product for millennials, an AI system can quickly identify relevant financial behaviors, geographic clusters, income ranges, and even sentiment data from forums and reviews. That means your TAM, SAM, and SOM estimates are not just educated guesses—they’re built on timely, verifiable intelligence.

Enhanced Accuracy Through Predictive Analytics

AI excels in pattern recognition, making it ideal for projecting future market behavior. Machine learning algorithms can analyze historical trends and current variables to forecast market growth or decline, helping you understand not just where the market is now, but where it’s heading.

Take a mental wellness app targeting remote workers. AI can factor in mental health trends, changes in work-from-home policies, and app usage patterns to predict demand over the next three years. These insights lead to more grounded and forward-looking business plans.

Introducing PlanVista: Your AI Business Plan Tool

For startup founders, the road from idea to execution is filled with tough decisions, constant iterations, and high stakes. One misstep in your early planning—especially in market sizing—can derail funding rounds or slow your product’s growth trajectory. That’s why PlanVista was built: to provide founders with an intelligent, intuitive, and AI-powered platform to transform raw ideas into investor-ready business plans. And at the heart of this transformation is effective, data-driven market sizing.

PlanVista is more than just a business plan generator. It’s a full-spectrum startup planning tool that integrates market intelligence, financial modeling, and strategic forecasting into one streamlined experience. Designed specifically for startups, PlanVista simplifies the complex, eliminates guesswork, and empowers you to focus on what matters most—building your business.

Built-In Market Sizing Frameworks

One of the standout features of the PlanVista app is its built-in TAM, SAM, and SOM analysis engine. Rather than relying on vague assumptions or static spreadsheets, PlanVista uses real-time data from global markets and AI-driven insights to help you define your total addressable market with precision. It guides you through the process of narrowing down to your serviceable available and obtainable market, using dynamic filters like geography, customer demographics, pricing models, and industry trends.

Whether you’re launching a health tech platform or a SaaS tool for freelancers, PlanVista adjusts its calculations to your unique niche—offering tailored estimates that you can instantly incorporate into your pitch deck or financial model.

Automated Data Aggregation

Say goodbye to sifting through outdated market reports or piecing together disparate data sources. PlanVista pulls from a curated library of industry databases, census records, trend analyses, and proprietary data models to ensure your market sizing is grounded in up-to-date, reliable intelligence. The platform continuously updates its data sets, so your market forecasts adapt as conditions change.

This is especially powerful for startups in rapidly evolving spaces—like AI, fintech, or sustainability—where yesterday’s data may no longer apply tomorrow.

Scenario Modeling Made Simple

Need to test what your SOM looks like under a new pricing structure? Wondering how expanding to a new region affects your SAM? PlanVista’s interactive modeling tools let you tweak key variables and instantly see the results. These “what-if” simulations help you make informed decisions and communicate strategic flexibility to investors.

Scenario modeling also helps stress-test your business model. Instead of presenting just one optimistic projection, you can show a range of outcomes—backed by real data and algorithmic analysis.

Investor-Ready Outputs

PlanVista doesn’t just give you numbers; it helps you tell a story. Its outputs include customizable charts, executive summaries, and full business plan reports that are polished, professional, and presentation-ready. You can export your market sizing graphics or integrate them directly into your pitch materials—all without hiring a designer or analyst.

Conclusion

Market sizing isn’t just a checkbox on your business plan—it’s the cornerstone of strategic startup planning. It tells you if your idea has legs, how big the opportunity is, and whether the market is worth chasing. For early-stage entrepreneurs, it provides the roadmap from vision to validation, helping you focus your energy, resources, and messaging where they matter most.

As we’ve explored throughout this guide, understanding your Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) is more than a financial exercise. It’s a storytelling tool. Each number paints a piece of the narrative: the size of the prize, your near-term goals, and the reality of what your startup can achieve today. When done well, market sizing builds investor confidence and keeps your entire team aligned around clear, realistic targets.

But market sizing is also full of landmines. From limited data access to biased assumptions and dynamic market shifts, startups face multiple challenges that can distort their projections. That’s why more founders are turning to technology—and specifically AI tools—to improve accuracy, save time, and reduce the margin for error.

Enter PlanVista.

PlanVista isn’t just another planning tool. It’s your strategic co-founder—an AI-powered business plan generator designed to handle the complexities of startup planning with ease. Whether you’re trying to estimate your market size, build financial forecasts, or create pitch-ready materials, PlanVista streamlines the process from idea to execution.

With real-time data aggregation, automated TAM/SAM/SOM modeling, and dynamic scenario planning, PlanVista helps you turn rough ideas into actionable, investor-grade business plans. Instead of juggling spreadsheets, outdated PDFs, and scattered notes, you get one seamless platform that does the heavy lifting—so you can focus on building your product, engaging your market, and growing your business.

What used to take weeks now takes hours. And what once required a team of analysts can now be done with a few clicks.

So, whether you’re just getting started or refining your next funding round, remember this: market sizing is your strategic foundation. It tells you where to aim, how far you can go, and how fast you can get there. And with the right tool—like the PlanVista app—you don’t have to navigate that journey alone.

Make your startup planning smarter, faster, and more focused. Explore PlanVista today and put your startup on the path to success with confidence and clarity.

FAQs

Use a combination of top-down and bottom-up methods to balance broad market trends with real user data. Tools like PlanVista can simplify both approaches with AI-driven insights.

Investors typically look for a large, growing TAM with a realistic SOM that your startup can capture. Backing these numbers with credible data and clear logic is key.

Absolutely. PlanVista is ideal for early-stage planning, helping founders validate ideas, understand their markets, and prepare business strategies before seeking funding.

Inaccurate sizing can misguide your strategy or undermine investor trust. Regularly update your estimates and use tools like PlanVista to reduce errors and improve reliability.

Yes, PlanVista supports businesses of all sizes, including niche markets. It tailors insights and projections based on your industry, location, and customer base.