Profit and Loss vs Cash Flow: Know the Difference

Introduction: Why You Need to Understand the Difference Between Profit and Cash (Before It Hurts You)

Here’s a common founder shock moment:

You pull up your Profit & Loss (P&L) statement—it says you made a profit.

But when you check your bank balance?

You’re almost out of cash.

Sound familiar?

If you’re a first-time founder, understanding the difference between profit and cash flow might be the most important financial lesson you learn.

Because profit might look great on paper, but cash is what pays salaries, buys tools, funds growth—and keeps your startup alive.

Why This Matters So Much

Too many early-stage founders get caught off guard by the “paper profit” trap:

- They think a profitable month means they’re safe

- They delay fundraising because “we’re cash-flow positive”

- They burn through runway without realizing how much money is tied up in receivables or inventory

The result?

Startups run out of cash even while “profitable” on their books.

This disconnect is what kills companies that otherwise have solid traction, great products, or real demand.

P&L and Cash Flow Tell Two Very Different Stories

Your Profit & Loss (P&L) statement shows whether your business was profitable in a given period.

But it doesn’t show when the money moved—or whether you even have it.

Your Cash Flow Statement tells you when money actually hits or leaves your bank account.

And in a startup, timing is everything.

So if you’ve been using just one of these tools—or if you’re not sure what either really means—this blog is for you.

In this guide, we’ll walk you through:

- The real difference between profit and cash flow (and why most founders confuse them)

- When and how to use each for decisions, pitches, or planning

- What investors expect you to know about both

- A real-world founder story that shows how a “profitable” startup almost ran out of money

- How PlanVista helps you track, manage, and explain both statements with confidence

- Simple tips to make both tools work for you—even if you’re not a finance person

Because knowing your numbers isn’t about spreadsheets or accounting.

It’s about staying alive, raising faster, and making smarter calls as a founder.

What Is a Profit & Loss Statement—and What Does It Actually Tell You?

Let’s start with the basics:

Your Profit & Loss (P&L) statement—also called the income statement—is the go-to document for understanding if your startup is making money on paper.

It tracks:

- Revenue

- Costs directly tied to sales (COGS)

- Operating expenses (like salaries, tools, marketing)

- Net profit or loss over a specific period (month, quarter, or year)

But here’s the important part:

A P&L doesn’t show cash movement. It shows what was earned and owed—even if the cash hasn’t arrived or left yet.

The Structure of a Lean P&L

Let’s break it down:

| Month | Revenue | COGS | Gross Profit | Operating Expenses | Net Profit |

| January | ₹2,00,000 | ₹60,000 | ₹1,40,000 | ₹1,20,000 | ₹20,000 |

- Revenue: Money earned through sales

- COGS: Cost of Goods Sold (direct costs like inventory or fulfillment)

- Gross Profit: Revenue – COGS

- Operating Expenses: Fixed and variable costs not tied directly to product delivery (e.g., salaries, rent, tools)

- Net Profit: What’s left after all costs

Why It’s Important

Your P&L tells you:

- Is your business model profitable (on paper)?

- Are your margins healthy?

- How are your expenses trending month over month?

- Are you generating consistent revenue or facing volatility?

This is what investors use to assess:

- Gross margin scalability

- Operating efficiency

- Unit economics over time

- Break-even potential

If your gross profit is low, or your net profit stays negative with no clear path to improvement, that’s a red flag—even if your user growth is strong.

But There’s a Catch

Just because your P&L says you made ₹20,000 last month doesn’t mean you have ₹20,000 in your bank account.

Here’s why:

- You might have recorded sales that haven’t been paid for yet (invoiced clients)

- You might owe vendors, but haven’t paid them yet

- You might have paid for annual subscriptions upfront, skewing one month’s expenses

- Or received cash from a customer in advance, which doesn’t count as profit yet

That’s where the cash flow statement comes in.

What Is a Cash Flow Statement—and Why It Matters More Than You Think

If the Profit & Loss (P&L) statement is the story of earnings,

the cash flow statement is the story of survival.

Why?

Because cash is reality—it’s what you actually have on hand to run your business.

It doesn’t matter if your P&L says you’re profitable.

If you don’t have enough cash to pay employees or fund marketing, you’re in trouble.

What the Cash Flow Statement Tracks

Your cash flow statement shows how money moves in and out of your business bank account.

It’s usually broken down into three buckets:

- Operating Activities

- Cash from day-to-day business (sales received, bills paid)

- Cash from day-to-day business (sales received, bills paid)

- Investing Activities

- Cash spent on long-term things (equipment, software, IP)

- Cash spent on long-term things (equipment, software, IP)

- Financing Activities

- Cash from funding (loans, investments, equity raises)

- Cash from funding (loans, investments, equity raises)

Let’s simplify:

| Month | Starting Cash | Cash In | Cash Out | Ending Cash |

| January | ₹4,00,000 | ₹1,00,000 | ₹1,50,000 | ₹3,50,000 |

- Cash In: Actual payments received from customers or investors

- Cash Out: Actual money paid (vendors, salaries, marketing, software, etc.)

- Ending Cash: Your new bank balance

Why Founders Must Watch Cash Flow

- It tells you your runway

- How many months you can operate before cash runs out

- How many months you can operate before cash runs out

- It helps you time fundraising

- You don’t raise when you’re broke—you raise months before

- You don’t raise when you’re broke—you raise months before

- It highlights payment gaps

- Revenue looks great, but are clients paying on time?

- Revenue looks great, but are clients paying on time?

- It keeps you out of the “profitable but broke” trap

- Common for D2C and B2B startups with delayed payments or inventory cycles

- Common for D2C and B2B startups with delayed payments or inventory cycles

When Profit and Cash Don’t Match

Here are a few real examples:

- You sell ₹2,00,000 worth of services in January (profit on P&L), but the client pays in March (no January cash).

- You prepay ₹60,000 for a 12-month SaaS tool—full cash out now, but only ₹5,000 expense shows on P&L each month.

- You raise ₹10 lakh from investors—big cash in, but no profit shows on your P&L (it’s financing, not revenue).

In each case, your P&L and cash flow tell different stories.

That’s why investors look at both.

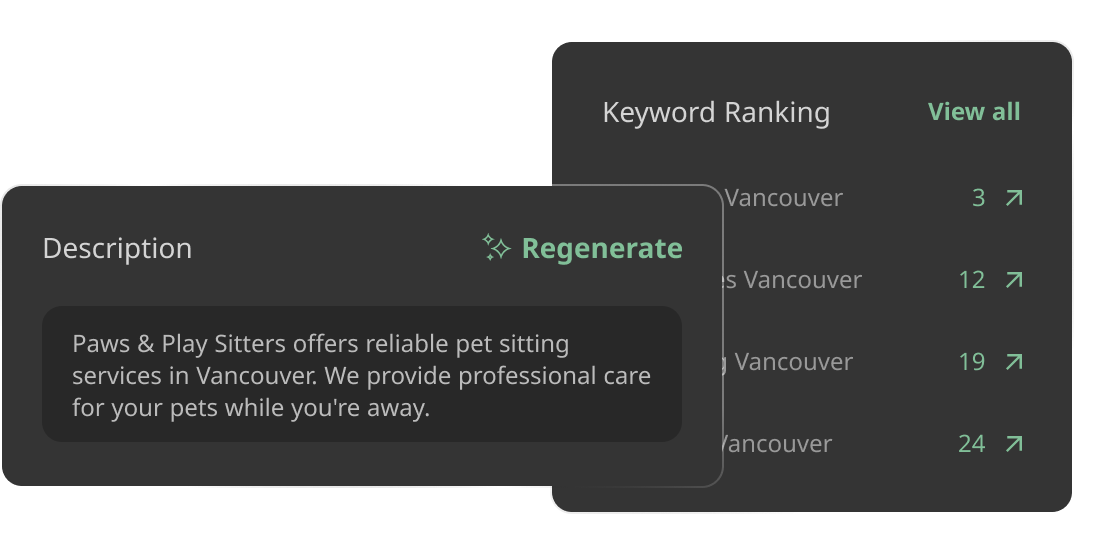

PlanVista Makes Cash Flow Easy to Understand

With PlanVista, you can:

- Auto-generate cash flow statements based on your inputs

- Visualize when cash enters and exits

- Track your ending cash balance and forecast runway

- Compare cash vs. P&L performance side by side

No finance degree. No spreadsheets. Just clean, useful insights.

P&L vs Cash Flow—The Real Difference and When to Use Each

If you’re wondering, “Do I really need both?”—you’re not alone.

A lot of first-time founders either:

- Use only their P&L and ignore cash flow (until they run out of money), or

- Obsess over cash and miss strategic insights in the P&L

The truth is, you need both—but for different reasons.

Here’s how they compare.

P&L = Paper Profit

Tells you: Are we making money (on paper)?

Tracks:

- Revenue when earned (not when paid)

- Expenses when incurred (not when paid)

- Profit or loss over time

Helps you:

- Understand margins and profitability

- Set pricing and cost structure

- Present financial health to investors

Doesn’t show:

- When cash hits or leaves your bank

- Your real ability to pay bills

- What’s in your account today

Cash Flow = Real Money

Tells you: What’s in our bank—and when does it move?

Tracks:

- Actual cash received (not just earned)

- Actual cash paid out (not just owed)

- Net cash position month over month

Helps you:

- Plan your runway

- Time fundraising

- Avoid cash crunches

Doesn’t show:

- Profitability metrics

- Cost efficiency

- Unit economics

When to Use P&L

- Monthly or quarterly performance reviews

- Preparing pitch decks or investor reports

- Measuring margin, gross profit, or net profit

- Tracking trends and cost ratios

When to Use Cash Flow

- Managing your bank balance and liquidity

- Planning hiring, purchasing, or expansion

- Monitoring runway and burn

- Timing funding rounds

Use Them Together, Not Separately

Think of your P&L as your strategy dashboard—it shows how profitable you should be.

Think of your cash flow as your fuel gauge—it shows whether you can actually keep going.

If your P&L looks great but your cash flow is tight, you’ll need to:

- Collect payments faster

- Delay certain expenses

- Raise earlier than expected

If your cash flow looks fine but your P&L is bleeding, you may have:

- Low margins

- Inefficient spending

- A broken business model

Both matter—and together, they tell the full financial story.

PlanVista Keeps Both Sides in Sync

With PlanVista, you can:

- Track both P&L and cash flow from the same inputs

- Visualize how paper profit compares to real cash

- Forecast based on revenue recognition and cash timing

- Stay financially sharp—without spreadsheet headaches

Founder Story—How Misunderstanding Cash Flow Nearly Crashed a “Profitable” Startup

Meet Neha, Founder of BoxBerry

Neha launched BoxBerry, a subscription-based D2C brand for eco-friendly stationery.

Sales were picking up. Instagram buzz was strong.

Her first six months showed impressive growth—on her P&L.

Her accountant’s report showed monthly revenue climbing and even small profits.

She started pitching VCs with confidence:

“We’re profitable by month six, with 30% gross margins.”

But then her bank account hit ₹70,000.

She had ₹2 lakh in unpaid vendor bills due next week.

And her next subscriber renewal wasn’t until the following month.

That “profitable” business?

It was about to run out of cash.

What Went Wrong?

Neha’s P&L looked healthy because:

- She booked revenue when subscriptions were sold—even if cash was collected monthly

- She delayed recording some bulk inventory purchases

- Her gross margin looked strong, but her real cash was tied up in shipping costs and ad spend

She never tracked actual cash inflows and outflows.

Her P&L showed ₹1.5 lakh in monthly “profit.”

But her cash flow was negative—and she didn’t know it.

The Turning Point: Learning the Power of Cash Flow

With her back against the wall, Neha sat down with a mentor who explained the difference between:

- Accrual accounting (P&L): Profit earned on paper

- Cash accounting (Cash flow): Money you can actually use

They built a simple cash flow tracker:

- Looked at payment timing

- Modeled her burn month by month

- Forecasted when her bank account would bottom out

She realized she had just six weeks of cash runway—not the 4 months her “P&L forecast” suggested.

The Fix

- Neha paused all ad spend

- Switched to quarterly billing for new subscribers (improved cash up front)

- Negotiated extended payment terms with her supplier

- Used PlanVista to rebuild her model using real-time cash flow tracking

In under two weeks, she had:

- A new forecast that showed true runway

- Visuals she could use in investor updates

- A better understanding of how to scale sustainably

The Result

Neha avoided a crash.

She raised a ₹40 lakh bridge round using a lean, cash-based plan that showed exactly how she’d stretch runway.

And she never made the same mistake again.

The Lesson

P&L told Neha she was winning.

Cash flow told her she was weeks from shutdown.

If you’re only looking at your profit?

You might be blind to the most important metric of all: survival.

How PlanVista Helps You Track Profit and Cash Flow Side by Side

Most tools make you choose:

- Build a Profit & Loss forecast in one spreadsheet

- Track your cash flow in another

- Or pay for clunky accounting software you don’t need (and don’t want to learn)

PlanVista does it differently.

It’s built for founders—especially first-time founders—who need to see both the big picture (profit) and the real picture (cash) in one place.

Here’s how PlanVista makes that simple:

1. One Input, Two Outputs

When you build your forecast in PlanVista, you only enter your assumptions once:

- Revenue streams

- Pricing

- Costs (fixed and variable)

- Payment timing (e.g., pay upfront, 30 days later)

From there, PlanVista automatically:

- Generates your monthly Profit & Loss (P&L) view

- Builds your Cash Flow forecast side by side

You instantly see:

- Are you profitable on paper?

- Are you cash-flow positive in reality?

No extra work. No duplicate entries. No spreadsheets.

2. Visualize the Gap Between Profit and Cash

PlanVista gives you:

- Side-by-side charts showing P&L vs. Cash Flow

- Clear runway projections based on actual cash balance

- Alerts when your profit and cash flow start to diverge

This is your early-warning system for:

- Delayed customer payments

- Upfront spending that won’t show in profit until later

- Misleading “profitability” that hides a cash crisis

3. Real-Time Scenario Planning

Want to see what happens if:

- Your payment terms shift from 30 to 60 days?

- You delay a hire by two months?

- Your growth rate increases by 20%?

PlanVista lets you model that instantly:

- Adjust one input

- Watch how it impacts both profit and cash

- Make smarter, faster decisions

4. Always Investor-Ready

When investors ask:

“Show us your financials. Are you profitable? What’s your burn? How long is your runway?”

You’ll have clean, credible answers—plus charts they can understand.

PlanVista helps you:

- Export both P&L and Cash Flow statements

- Customize visuals for your pitch deck

- Avoid the “Excel shuffle” hours before your investor call

5. Designed for Founders, Not Accountants

You don’t need to know GAAP.

You don’t need to memorize accounting terms.

PlanVista walks you through every input in plain language—then handles the math.

The Result

You stop flying blind.

You make better calls.

You raise faster—and spend smarter.

All because you finally see the full financial picture, not just one side of the story.

How to Manage Profit and Cash Like a Pro (Even as a First-Time Founder)

Understanding the difference between profit and cash flow is one thing.

Managing them week to week, month to month, quarter to quarter—that’s where great founders set themselves apart.

Here are six pro-level habits to help you manage both profit and cash with clarity, confidence, and control.

1. Track Actuals vs. Forecast Monthly

Every month, sit down and ask:

- What did we project for revenue, profit, and cash flow?

- What actually happened?

- Why was it different?

This isn’t just for “finance people”—it’s for anyone who doesn’t want surprises (or emergencies).

2. Forecast at Least 6–12 Months Ahead

Even if you’re pre-revenue or early-stage, always maintain a rolling 6–12 month forecast for both:

- P&L: Will your margins improve? When do you break even?

- Cash flow: When will you run out of cash? Will you need to raise sooner?

With tools like PlanVista, you can update this in minutes, not days.

3. Negotiate Payment Terms (On Both Sides)

- Get paid faster: Offer discounts for early payment or move to upfront billing.

- Pay slower: Talk to vendors about 30–60 day terms. The more cash in your account, the longer your runway.

These small timing shifts can be the difference between survival and stress.

4. Don’t Confuse Growth with Health

Many startups scale fast—and bleed cash doing it.

A growing P&L with red cash flow is a warning sign.

Make sure you’re watching both as you scale.

Pro tip: Never hire or expand until your cash flow can support the decision—even if your P&L looks great.

5. Use a Model That Evolves With You

Your numbers will change monthly. Your model should too.

PlanVista lets you:

- Quickly adjust assumptions

- Save and compare scenarios

- Track both profit and cash flow in one place

It’s your financial GPS—not a one-time exercise.

6. Make It a Team Conversation

You don’t need to show every line item—but your leadership team should always know:

- What’s our runway?

- Are we profitable yet (or when will we be)?

- What will break if our cash drops next month?

Financial clarity builds alignment, urgency, and smarter execution.

You don’t need to be a financial expert to lead like one.

With a few solid habits and the right tools, you can:

- Stay focused

- Fundraise on time

- Avoid blind spots

- And make your financial model a strategic asset—not just a spreadsheet

Conclusion: Know the Numbers That Keep You Alive (and Investable)

As a founder, your job isn’t just building a great product or finding product-market fit.

It’s staying alive long enough to win.

And the two numbers that will keep you alive—or shut you down—are:

- Profit (on paper)

- Cash (in your account)

If you don’t understand the difference between the two, you’re flying blind.

Your Profit & Loss Statement Shows Strategy

It tells you:

- Whether your business model works

- How efficient your costs are

- Whether your margins are strong enough to scale

It’s what you show to investors when you want to prove traction and viability.

Your Cash Flow Statement Tells the Truth

It tells you:

- Whether you’ll survive the next 3, 6, or 12 months

- Whether you’re managing payment timing well

- Whether you need to raise sooner—or cut back now

It’s what your team and your bank balance need you to know.

You Don’t Need to Choose—You Need Both

Smart founders don’t ignore one side of the story.

They use P&L to plan

And Cash Flow to operate.

They look ahead with confidence—knowing exactly:

- When their next cash crunch might hit

- What changes they need to make

- How much they really need to raise

And when investors ask, “Can you walk me through your financials?”—they don’t panic.

They open up PlanVista and show both stories in one place.

PlanVista Makes This Your Superpower

With PlanVista, you can:

- Build both P&L and Cash Flow from one model

- Visualize runway, burn, and profitability

- Adjust your plan in real time as your business changes

- Stay investor-ready at all times

No spreadsheets. No guessing. No stress.

Just smart, lean financials—built for startup speed.

Final Takeaway

Don’t wait for a cash crisis to learn this lesson.

Don’t raise money just because your P&L looks good—when your cash says otherwise.

And don’t walk into your next investor meeting without knowing both your paper profit and your real bank balance.

Plan smarter. Lead better. Stay funded.

Start your financial model today with PlanVista—free to try, no credit card required.

FAQs

Profit is what you earn on paper; cash flow is the real money moving in and out of your business.

Because revenue can be delayed and expenses can hit before cash is received, causing liquidity issues.

Yes—P&L shows profitability, while cash flow shows your actual bank balance and runway.

PlanVista auto-generates side-by-side P&L and cash flow views from a single set of inputs.

Absolutely—PlanVista is built to help first-time founders model, forecast, and explain their numbers with ease.