The Beginner’s Guide to Startup Financials

Introduction: Don’t Let Startup Financials Scare You—Here’s What You Actually Need to Know

If you’re a first-time founder, the word “financials” probably gives you a mild headache.

You’re juggling product development, marketing, maybe fundraising—and now someone’s asking you about:

- Cash flow projections

- Burn rate

- Unit economics

- Gross margin

- Break-even analysis

It’s overwhelming.

And most startup financial advice either talks down to you—or throws you into a 12-tab spreadsheet built for a Fortune 500 CFO.

Here’s the good news: you don’t need to be a finance expert to understand and manage your startup’s numbers.

You just need to focus on the handful of financial concepts that actually matter early on—and know how to use those numbers to make smarter decisions.

In this guide, we’re breaking it all down in plain language:

- What numbers really matter when you’re starting out

- How to set up a lean, useful financial model without spreadsheets

- The common mistakes early founders make (and how to avoid them)

- How to use your financials to raise money, hire smart, and stay alive

- A real founder story of turning financial chaos into investor-ready clarity

- And how PlanVista makes startup finance simple, fast, and founder-friendly

Financials Shouldn’t Be an Afterthought

Your numbers aren’t just for VCs.

They’re the foundation of your strategy.

When you understand your financials—even just the basics—you:

- Make better decisions faster

- Know when to hire, raise, or slow down

- Build credibility with investors, partners, and team members

- Spot problems before they become crises

And the earlier you build financial literacy into your process, the easier everything else gets.

You stop guessing—and start leading.

Why This Guide Works for Founders

We’re not giving you MBA lectures or long-winded formulas.

We’re giving you the essentials:

- Real definitions

- Real examples

- Real founder context

- And tools like PlanVista that make implementation easy

If you’ve been avoiding your startup’s numbers, or just don’t know where to start, this post will give you clarity—fast.

Let’s break it down, one financial building block at a time.

The 5 Financial Numbers Every Founder Must Know (No Math Degree Needed)

You don’t need to master accounting to run a startup.

But you do need to understand a few core numbers that drive every financial decision—especially when cash is tight, growth is early, and investors are watching.

Here are the five financial metrics you should track from day one.

1. Burn Rate

What it is:

How much money your startup spends each month.

Why it matters:

It tells you how long your cash will last—your runway. Without this, you could be out of money before you see it coming.

How to calculate it:

Monthly expenses – Monthly revenue = Net Burn

If you spend ₹4,00,000/month and bring in ₹1,00,000, your burn rate is ₹3,00,000.

2. Runway

What it is:

How many months you can operate before your cash runs out.

Why it matters:

It helps you plan when to raise funds, cut costs, or grow faster.

How to calculate it:

Cash in bank / Burn rate = Runway (in months)

₹15,00,000 / ₹3,00,000 = 5 months of runway

3. Customer Acquisition Cost (CAC)

What it is:

The average cost to acquire one customer.

Why it matters:

If your CAC is too high, you won’t scale profitably. It’s a critical metric for marketing, fundraising, and pricing strategy.

How to calculate it:

Total marketing + sales spend / Number of new customers acquired

₹1,00,000 spent → 100 customers = ₹1,000 CAC

4. Lifetime Value (LTV)

What it is:

How much money a customer brings in over their entire relationship with your business.

Why it matters:

It tells you how much you can afford to spend to acquire a customer (and still make a profit).

How to calculate it (simple version):

Average monthly revenue × Average customer lifespan (in months)

₹500/month × 12 months = ₹6,000 LTV

5. Gross Margin

What it is:

The percentage of revenue left after direct costs (like production or delivery).

Why it matters:

It shows how scalable and profitable your core product is.

How to calculate it:

(Revenue – COGS) / Revenue × 100

₹1,00,000 revenue – ₹40,000 COGS = 60% gross margin

Why These 5 Metrics Matter

These numbers:

- Help you forecast and budget

- Make your pitch stronger

- Give investors confidence

- Guide your pricing, marketing, and hiring decisions

You don’t need to track everything—just these few, consistently.

How to Build a Simple Startup Financial Model Without Spreadsheets

You don’t need a 12-tab Excel file or a degree in finance to model your startup’s financials.

In fact, overbuilding your model too early can slow you down.

You’ll get lost in numbers that don’t matter—and ignore the ones that do.

What you need is a lean, functional financial model that helps you:

- Forecast your revenue

- Track your costs

- Understand your burn

- Show investors you’ve thought through your business

Here’s how to build one fast.

Step 1: Pick a Time Frame

Start with a 12-month monthly forecast.

It’s enough detail to plan and track progress—without getting lost in long-term hypotheticals.

Only expand to 2–3 years later if an investor specifically asks.

Step 2: Map Your Revenue Model

Think in terms of drivers, not guesses.

For example:

- SaaS product:

Revenue = Customers × Monthly Subscription Fee

- Marketplace:

Revenue = Number of Transactions × Commission Rate

- Product business:

Revenue = Units Sold × Price per Unit

Add growth assumptions like 10–20% month-over-month based on early traction or benchmarks.

Keep it grounded. Fantasy growth curves don’t build credibility.

Step 3: List Your Expenses

Break it down into two buckets:

- Fixed costs (don’t change with growth): salaries, rent, software tools

- Variable costs (scale with customers): fulfillment, support, marketing

Estimate each one monthly. Don’t overthink it—ballpark is fine for early-stage.

Step 4: Calculate Burn and Runway

Now subtract revenue from total expenses.

This gives you your monthly net burn.

Then divide your current bank balance by net burn to calculate runway.

Example:

Monthly burn = ₹2,00,000

Bank = ₹10,00,000

Runway = 5 months

Step 5: Keep It Visual

Avoid dense tables.

Build a simple dashboard with:

- Revenue and expense trends

- Burn rate and runway line

- Key assumptions summary

If you’re pitching, visuals make your model 10x easier to digest.

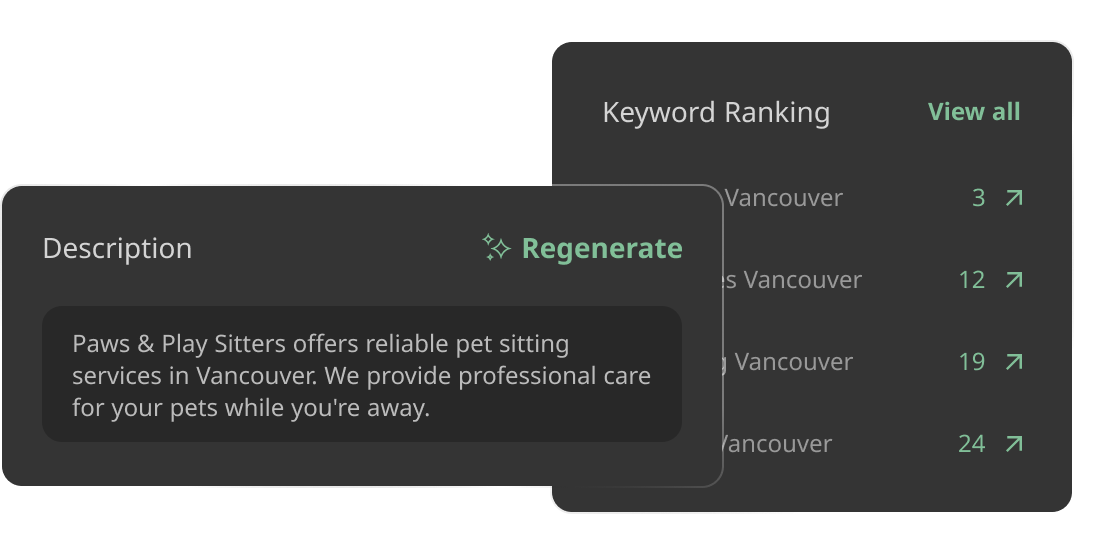

PlanVista Makes This Dead Simple

Instead of building from scratch, PlanVista lets you:

- Choose your business model (SaaS, marketplace, product, etc.)

- Input assumptions with guided prompts

- Auto-generate 12-month forecasts

- Track burn, CAC, LTV, and more

- Export investor-ready visuals in seconds

It’s forecasting without formulas—and clarity without complexity.

Common Startup Financial Mistakes (And How to Avoid Them)

Let’s be honest: most early-stage founders aren’t finance experts—and that’s totally fine.

But there are a few financial mistakes that consistently slow down startups, kill investor trust, or burn through cash faster than expected.

Here’s how to dodge them.

Mistake 1: Confusing Revenue With Profit

Just because money is coming in doesn’t mean you’re profitable.

Many founders celebrate their first ₹1 lakh in revenue—while ignoring the ₹1.5 lakh in monthly expenses.

Fix:

Always track net burn—what’s left after you subtract your expenses from revenue.

Know your runway. Use it to drive decisions.

Mistake 2: Ignoring CAC and LTV

Early traction feels great—but if your customer acquisition cost (CAC) is too high compared to lifetime value (LTV), your growth is unsustainable.

Fix:

Calculate CAC and LTV early—even roughly.

If LTV isn’t at least 3× your CAC, revisit your pricing, churn, or acquisition strategy.

Mistake 3: Overbuilding Financial Models You Don’t Understand

Founders often copy big, complex Excel models from other startups—then can’t explain how they work.

This backfires in investor meetings.

Fix:

Build your model from the ground up.

Start with simple, clear assumptions. Be ready to explain how each number was calculated. Tools like PlanVista make this easy.

Mistake 4: Not Updating Your Forecast Regularly

Startups change fast. If your forecast is six months old, it’s probably wrong.

Fix:

Update your model every month or quarter.

Adjust based on actual sales, spend, or market changes.

This shows you’re not just tracking numbers—you’re using them to drive strategy.

Mistake 5: Hiding Weak Numbers From Investors

Some founders try to fudge forecasts to look more appealing. The problem?

Experienced investors can spot BS from a mile away.

Fix:

Be honest. Show your assumptions. Acknowledge risks.

Credibility wins over perfection every time.

Mistake 6: Underestimating Cash Needs

Most startups think they need less money than they actually do—then get caught raising again too soon.

Fix:

Add a buffer. If you think you need ₹50 lakh, raise ₹60–₹70 lakh.

Model realistic burn and always plan 12–18 months of runway.

Why Avoiding These Mistakes Matters

Investors don’t expect you to have perfect financials.

But they do expect:

- That you understand your numbers

- That you’re tracking the right metrics

- That you’re adjusting based on what’s real—not what looks good on a slide

And that mindset builds confidence—inside and outside your team.

Founder Story—From Financial Fog to Investor Confidence

Meet Sanjana, Founder of FitFuel

Sanjana was building FitFuel, a D2C startup selling plant-based energy bars.

She had product-market fit brewing—monthly orders were growing, influencers were posting about it, and word-of-mouth was kicking in.

But when she started raising her pre-seed round, she hit a wall.

“Your brand is great. But your financials are… rough.”

— Investor feedback, round after round

Her revenue projections were vague.

Her CAC and LTV were based on hope, not data.

Her expenses were buried in a clunky Excel file she couldn’t confidently explain.

She knew her startup was working—but she couldn’t prove it with numbers.

The Problem: Story Without Strategy

Like many early founders, Sanjana had a strong narrative—but her financial model didn’t back it up.

Her burn rate was unclear.

Her forecast didn’t show when she’d break even.

And investors couldn’t see how their capital would create meaningful growth.

The Fix: A Lean Financial Reset Using PlanVista

Instead of hiring a financial consultant, Sanjana turned to PlanVista.

She spent a weekend rebuilding her forecast from the ground up:

- Revenue Model:

Units × Price × Growth Rate = Monthly Revenue

(With real D2C benchmarks built into PlanVista)

- CAC + LTV:

Pulled directly from ad spend and repeat order data

Showed a healthy 4.2x LTV:CAC ratio

- Monthly Burn + Runway:

Tracked fixed and variable expenses

Highlighted exactly when she’d need to raise again

- Scenario Planning:

Built a “base case” and “aggressive growth” version

Showed how ₹50 lakh in funding would impact scale and timeline

She didn’t need to overbuild—she just needed clarity.

The Result: A Forecast That Closed Her Round

With her new PlanVista forecast:

- She pitched 7 investors

- Got 3 offers

- Closed a ₹75 lakh pre-seed round in 4 weeks

More importantly, she now uses her forecast monthly to decide:

- When to increase ad spend

- When to expand SKU lines

- When to prep for the next raise

The Lesson for First-Time Founders

Sanjana didn’t win because she became a finance expert.

She won because she stopped avoiding her numbers—and built a simple, credible model that investors could trust.

Her story proves what every founder needs to remember:

“If you don’t understand your numbers, someone else will—and they’ll control the conversation.”

How PlanVista Simplifies Startup Financials for First-Time Founders

You’re not a CFO. You don’t want to be.

But you still need to understand your startup’s numbers—and be ready to explain them to investors, co-founders, or your own future self.

That’s exactly why PlanVista exists.

PlanVista helps founders skip the spreadsheet struggle and get straight to what matters:

clear, simple, flexible startup financials that you can actually use.

Here’s how it works—and why thousands of founders love it.

1. Guided Setup Built for Startups (Not MBAs)

PlanVista doesn’t drop you into a blank canvas and wish you luck.

It walks you through:

- Revenue models (SaaS, product, service, marketplace, etc.)

- Expense categories

- Pricing strategies

- Customer acquisition assumptions

- Funding timelines

No guesswork. Just clean prompts and smart defaults that match how startups actually grow.

2. Financial Forecasting in Minutes—Not Days

Build a 12-month forecast (or more) in under 30 minutes:

- Input your assumptions

- Use sliders to adjust pricing, growth, CAC, and more

- See your runway, revenue, and profitability auto-calculate

It’s like having a financial co-founder—without the cost or complexity.

3. Visual Outputs That Are Investor-Ready

Investors don’t want spreadsheets. They want clarity.

PlanVista gives you:

- Cash flow visuals

- P&L summaries

- Burn rate and runway charts

- CAC, LTV, and gross margin breakdowns

One click = polished visuals you can drop straight into a pitch deck or update call.

4. Scenario Planning That Actually Helps You Decide

Wondering what happens if CAC increases by 30%?

Or if you delay your next hire by two months?

PlanVista lets you create:

- Base case, best case, and fallback models

- Side-by-side comparisons of different growth paths

- Forecasts that evolve with your startup—not against it

So you can make smarter calls in real time—not just after the fact.

5. Built for Founders Who Want to Stay Focused

No accounting jargon. No hidden formulas. No finance degree required.

PlanVista is built for clarity, speed, and confidence.

Whether you’re pre-revenue, MVP-stage, or growing fast—it helps you:

- Plan smarter

- Raise faster

- Lead better

And all without getting buried in spreadsheet formulas or second-guessing your numbers.

How to Keep Your Startup Financials Sharp Month After Month

You’ve built your financial model, you know your metrics, and maybe you’ve even raised your first round.

Great. But now comes the part most founders skip:

Keeping your numbers up to date—and useful.

Too many startups build one forecast, use it once, and never touch it again.

That’s a mistake.

Startup financials should be a living, breathing tool—not a static document.

Here’s how to keep yours sharp as your business evolves.

1. Review Your Financials Every Month

Set a monthly “finance check-in” with yourself or your team.

Each month:

- Compare actuals vs. forecast

- Review your runway

- Look at CAC, LTV, and churn

- Adjust assumptions based on performance

This helps you catch problems early—and make smarter decisions before it’s too late.

2. Track Actuals vs. Assumptions

Did you actually hit the growth rate you forecasted?

Were expenses higher than expected?

Did CAC go up or down?

Highlight what worked, what didn’t, and why.

Use that learning to update your model and adjust your strategy—not just report on it.

3. Update Your Forecast Quarterly

Don’t let your model go stale.

As your startup grows, revisit:

- Revenue inputs (user growth, pricing, conversion)

- Expense estimates (new hires, tools, vendors)

- Burn rate and runway timeline

- Fundraising targets and timelines

PlanVista makes quarterly updates quick and painless—so your model is always current.

4. Create a “Base Case” and “Stretch Case” Scenario

Your original plan was probably your optimistic best-case.

Now it’s time to model reality:

- Base case: Conservative growth, typical CAC, average churn

- Stretch case: Faster growth, more aggressive hiring, higher CAC

This dual-model setup gives you better visibility and flexibility when making budget, hiring, or fundraising decisions.

5. Use Your Model as a Decision Tool—Not Just a Pitch Tool

Your financial model should help you answer questions like:

- Can we afford to scale paid marketing?

- Should we delay that hire by a month?

- Do we need to raise sooner than expected?

If your model isn’t helping you make these decisions, it’s not doing its job.

6. Share It With Your Team (At Least the Key Numbers)

Even if your team isn’t involved in finance, they should know:

- Burn rate

- Runway

- Revenue targets

- Monthly goals

Transparency builds trust—and helps everyone row in the same direction.

Conclusion: Own Your Numbers, Lead With Confidence

Your startup’s success isn’t just about building the right product—it’s about building the right foundation to make smart, fast, and confident decisions.

And that foundation? It’s your financials.

You Don’t Need to Be a Finance Pro—But You Do Need to Be Financially Aware

Early-stage founders who understand their numbers:

- Raise faster

- Burn smarter

- Avoid unnecessary chaos

- Inspire confidence in investors, team members, and even themselves

Those who avoid the numbers?

They run out of cash, miss funding windows, or make gut decisions that cost them everything.

You don’t need to master accounting.

You just need to:

- Know your burn and runway

- Understand how you make money (and what it costs to do so)

- Forecast a few months ahead with clarity

- Build a simple model you can explain and adjust

That’s it.

PlanVista Helps You Get There—Without the Spreadsheet Stress

With PlanVista, you can:

- Build and update a full forecast in minutes

- Create investor-ready visuals without designing slides

- Track key metrics like CAC, LTV, burn, and runway

- Build multiple scenarios that evolve with your startup

- Stay in control of your finances, not intimidated by them

It’s startup financial planning—minus the spreadsheets and guesswork.

Final Takeaway

Don’t wait until your investor asks for a model.

Don’t wait until your bank balance surprises you.

Don’t wait until you’re forced to “figure out the numbers” under pressure.

Start now.

Build a model that makes sense.

Use it to lead—not just react.

Because when you own your numbers, you own your narrative.

And when you own your narrative, investors follow.

Start planning smarter with PlanVista. Try it now—no credit card required.

FAQs

Burn rate, runway, CAC, LTV, and gross margin are must-track metrics.

No—PlanVista lets you build clear, flexible models without spreadsheets.

Update monthly for actuals and quarterly for forecasting adjustments.

Yes—use assumptions and benchmarks to create a forecast you can refine later.

Absolutely—PlanVista is designed to help first-time founders stay financially sharp from day one.