Primary research involves collecting new data directly from your audience (like surveys), while secondary research uses existing data sources (like industry reports).

Top Market Research Mistakes New Founders Make

Introduction: Why Market Research Is the Startup Lifeline

Launching a startup is one of the most exciting—and daunting—challenges an entrepreneur can take on. It’s a whirlwind of creativity, risk, ambition, and long nights. You’ve got the spark of an idea, a passionate drive to build something new, and maybe even a few early supporters ready to cheer you on. But there’s one essential element that determines whether your startup survives or fades into the crowded graveyard of failed ventures: market research.

Market research is more than just an early checkbox in the startup journey. It’s your compass in a storm, your blueprint in a construction project, and your foundation in a skyscraper. Without it, even the most promising idea can falter. It tells you who your customers are, what they want, how they behave, and what they’ll pay for. It shines a light on your competitors and reveals gaps in the market. Yet, surprisingly, many first-time founders either skip this step or get it wrong—often with devastating consequences.

Why does this happen? Often, it’s because new founders are fueled by excitement and optimism. They fall in love with their idea and assume others will too. This emotional bias creates a dangerous blind spot where assumptions replace evidence. Founders might think, “I’d use this product, so others will too,” or “There’s nothing exactly like this on the market, so it must be needed.” But in the real world, assumptions don’t replace data, and enthusiasm doesn’t equal demand.

Take for example the case of EatFresh, a once-promising food delivery startup that tried to replicate the urban food tech model in smaller Indian cities. Their premise seemed solid—if it works in Bangalore and Delhi, why not Bhopal or Kanpur? But they failed to account for deep regional differences: smaller cities often rely on hyperlocal methods for ordering food, like calling restaurants directly or even using WhatsApp. Their assumption-led expansion tanked. Without accurate market data, their product missed the mark.

These kinds of oversights are incredibly common. Whether it’s misunderstanding your target audience, ignoring competitors, relying on outdated data, or not recognizing cultural nuances, market research mistakes can bleed resources and shatter momentum. And in today’s highly competitive and rapidly evolving business landscape, there’s little room for error.

The good news? These mistakes are avoidable. With the right approach—and the right tools—founders can sidestep common pitfalls and make smarter, data-driven decisions from the get-go. Advanced AI-powered startup planning tools like the PlanVista app make it easier than ever to conduct robust market research, define your niche, and build a business plan grounded in reality, not guesswork.

In the following sections, we’ll explore the most frequent market research missteps new founders make. We’ll break down real-world examples, explain the implications of each mistake, and show how AI solutions like PlanVista can help you navigate startup planning with confidence. Whether you’re still brainstorming or gearing up to launch, this guide will help ensure your startup is informed, prepared, and poised for success.

Skipping Market Research Altogether

One of the most fundamental—and unfortunately common—mistakes new founders make is skipping market research altogether. In the rush to build a product, launch a website, or pitch to investors, this critical step is often brushed aside. Many assume that their excitement, intuition, or anecdotal experiences are enough to predict market success. The problem? Without concrete data, you’re not building a business—you’re gambling.

The Risk of Assumptions Over Evidence

Founders often operate under the belief that if they have a brilliant idea, customers will naturally follow. This “build it and they will come” mentality has sunk countless startups. In reality, the world is full of products that nobody asked for. A cool concept is not the same as a viable business. Without proper validation, there’s no way to know if your target market needs your product, understands it, or is even willing to pay for it.

For instance, imagine a founder developing a productivity app based on their personal workflow preferences. They might invest thousands of dollars and months of development time only to realize that most users don’t share their unique needs—or that similar apps already exist with stronger market traction.

Real-World Consequences

Consider Juicero, a startup that raised over $120 million to sell a $700 internet-connected juicer. While the company focused heavily on tech and sleek design, they missed a key insight: consumers didn’t actually need a Wi-Fi-enabled juicer. The juice packs could be squeezed just as easily by hand. Juicero’s demise serves as a textbook example of what happens when you assume demand without validating it.

Why It Happens

New founders often wear many hats—visionary, developer, marketer, customer support—and market research feels like a slow and detached task compared to building or launching. Others fear negative feedback. They worry that research will expose flaws in their idea or dampen their enthusiasm. Ironically, that’s exactly the purpose of research: to uncover potential issues early, when they can be addressed with far less risk.

How to Avoid It

- Validate Before You Build: Before writing a single line of code or sourcing inventory, validate your idea. Talk to potential customers. Find out what they struggle with, what they value, and how they solve the problem today.

- Start with Simple Tools: Surveys, online polls, Reddit threads, and social media groups can provide initial insights. You don’t need a big budget to start collecting data.

- Use AI-Powered Tools: Platforms like the PlanVista app offer built-in features to help founders test ideas, evaluate market demand, and even simulate customer personas—all before investing significant time or money. With a reliable business plan generator, you can anchor your vision in real market insights.

- Document Your Findings: As you gather data, record it. This not only strengthens your business plan but also helps when pitching to investors or applying for grants.

Relying Solely on Secondary Data

After skipping market research, the next major misstep is relying too heavily on secondary data—the kind that’s already out there. This includes published market reports, government statistics, academic papers, news articles, and industry analyses. While these resources are undeniably useful, treating them as your sole source of market intelligence can steer your startup in the wrong direction.

The Illusion of Confidence

Secondary data provides a sense of legitimacy. If a McKinsey report says the fintech sector is booming, it must be the right time to launch a new personal finance app—right? Not necessarily. Secondary data often reflects broad trends, not specific nuances. It doesn’t tell you whether your exact niche has demand, or whether your unique angle addresses an actual pain point for your intended audience.

Take the example of a founder launching a plant-based protein drink after reading about the rise in veganism. While the trend is real, the founder might miss that their target demographic—say, busy Gen Z consumers—actually prefers portable snack bars over beverages, or that the market is saturated with well-established competitors. Relying on industry trends without primary validation can lead to costly misalignments.

The Limitations of Secondary Data

- Outdated Information: Some reports are months—or years—old. In fast-moving industries like tech or fashion, this data may no longer be relevant.

- Generic Scope: Broad data can obscure the realities of niche markets. For instance, knowing that “e-commerce is growing” doesn’t mean your specific idea for a subscription-based eco-friendly stationery box is viable.

- Bias and Interpretation: Reports can be influenced by the perspectives or goals of those producing them. It’s essential to approach them critically and corroborate with direct input from your target market.

Why Founders Rely on It

Secondary data is easy to access and gives an immediate sense of direction. When under time or financial pressure, many startups lean on this information to quickly fill out pitch decks or business plans. But it’s a shortcut that often leads to strategic detours.

The Solution: Pair with Primary Data

To avoid this trap, balance secondary research with primary data collection. This includes:

- Surveys and Interviews: Talk directly to potential users. Ask what they like, what they struggle with, and what they currently use.

- Prototype Testing: Share early versions of your product and gather feedback.

- Landing Pages and Ads: Run small-scale campaigns to gauge interest and test pricing or messaging.

These approaches give you direct, real-time insights that secondary data cannot match.

Leverage Technology to Combine Both

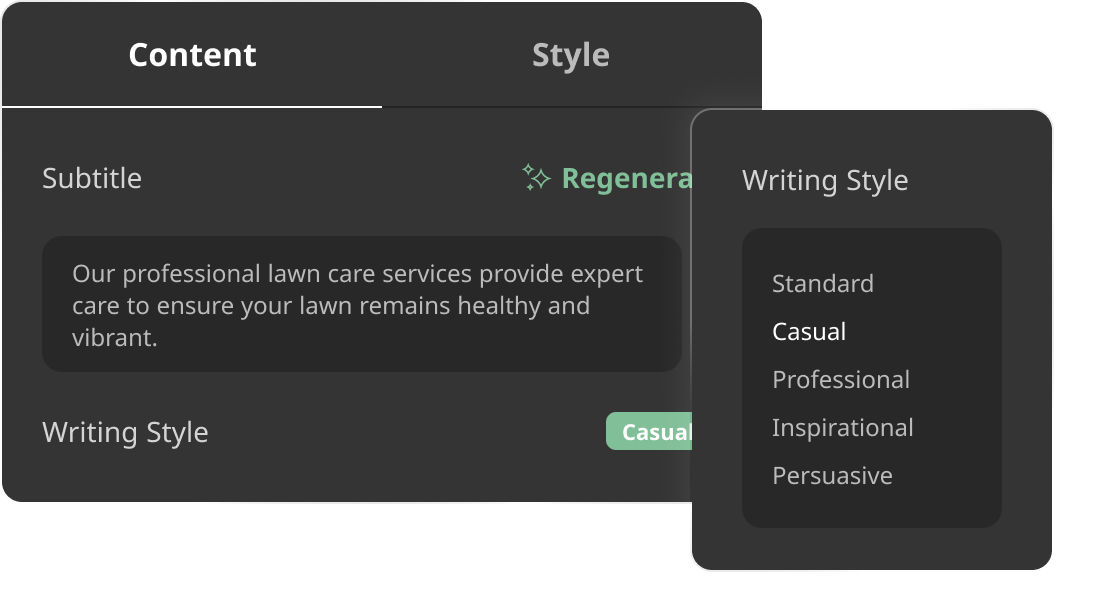

Tools like the PlanVista app help founders combine secondary data with custom-built primary insights. It doesn’t just offer trend analysis—it walks you through surveys, guides you in customer persona creation, and uses AI to generate actionable insights. As a startup planning tool, it bridges the gap between raw data and real-world application.

Relying solely on secondary data is like trying to cook with someone else’s recipe for a dish you’ve never tasted. You may get something edible, but it likely won’t delight your customers. Primary research, combined with curated secondary insights, helps you develop a product that truly hits the mark.

Misidentifying the Target Audience

One of the most frequent—and costly—mistakes new founders make is misidentifying their target audience. It’s easy to assume that everyone will love your product, especially when you’re emotionally invested in your idea. But in reality, trying to market to “everyone” often ends in reaching “no one.”

The Myth of Universal Appeal

Founders often fall into the trap of building a product with mass appeal in mind. On the surface, this might sound strategic—after all, a broader audience means more potential customers, right? Not quite. Broad targeting typically results in vague messaging, diluted branding, and generic features that don’t deeply satisfy any specific group.

For example, imagine launching a wellness app and saying it’s “for anyone who wants to be healthier.” That message is so wide that it fails to resonate with any particular person. A fitness enthusiast, a busy mom, and a senior citizen all have drastically different needs, pain points, and user behaviors. Without clear segmentation, your product may seem irrelevant to all of them.

Real-World Misfires

A real-world example of this pitfall is the story of early Facebook competitors like Friendster and MySpace. Both had massive user bases but failed to understand the specific needs of user segments—whether it was college students, professionals, or niche communities. Facebook, on the other hand, started by focusing solely on Harvard students, then gradually expanded its audience. This hyper-focused approach built a strong foundation that scaled successfully.

Symptoms of a Misidentified Audience

- Low conversion rates despite high website traffic

- High customer churn

- Poor engagement on social media

- Confusing or conflicting customer feedback

- Difficulty crafting marketing messages that resonate

If you’re experiencing any of these issues, there’s a good chance your target audience hasn’t been properly identified—or has shifted over time.

Defining Your Ideal Customer

To fix this, you need to develop a clear Ideal Customer Profile (ICP). Here’s how:

- Demographics: What age, gender, income, and education level are you targeting?

- Psychographics: What are their interests, values, and lifestyle preferences?

- Behavioral Traits: How do they interact with similar products? What drives their purchase decisions?

Surveys, interviews, and customer journey mapping are powerful tools to dig into these details. You can also run A/B tests on landing pages to see which messages or visuals appeal most to different segments.

The Role of AI in Audience Discovery

With the PlanVista app, you can simplify and accelerate this process. The app uses AI to help you generate customer personas, analyze behavioral data, and create segmentation models. It ensures that your business plan isn’t based on guesswork but on validated audience insights. As a startup planning tool, it connects your value proposition directly to the people most likely to appreciate—and pay for—it.

Ignoring Competitor Analysis

There’s a common refrain among new founders: “We don’t have any competition.” While it may stem from confidence or a belief in the product’s uniqueness, this mindset is not just incorrect—it’s dangerous. Every product or service competes for time, money, or attention. Even if there’s no identical offering, people are already solving their problems in some way. Failing to recognize this is one of the most critical market research mistakes a founder can make.

The Delusion of Uniqueness

Many startups fall in love with their ideas to the point where they believe they’re the first to do it. But more often than not, competitors already exist in some form—directly or indirectly. A founder launching a new meditation app, for instance, might overlook other apps like Calm or Headspace and claim they’re offering something revolutionary. In reality, users already have preferred tools and habits, and breaking into that behavior requires careful strategy and differentiation.

Real-World Example: Quibi’s $1.75 Billion Miscalculation

Quibi was a high-profile short-form streaming service designed for mobile devices. Despite raising nearly $2 billion, it failed within six months of launching. Why? It ignored competitors—especially indirect ones. Quibi assumed its slick interface and Hollywood-quality content would outshine social media. But users already had YouTube, TikTok, and Instagram—platforms that delivered quick, engaging content in formats they loved. Quibi didn’t offer enough differentiation or meet existing user habits, and it flopped.

Why Founders Skip Competitor Research

- Overconfidence in Innovation: Believing their product is so different that comparisons are unnecessary.

- Fear of Discouragement: Worrying that discovering strong competitors will undermine motivation.

- Lack of Research Know-How: Simply not knowing how to conduct a thorough competitor analysis.

But ignorance isn’t bliss—it’s a blindfold. Without competitor insights, you can’t effectively position your product, identify market gaps, or avoid repeating others’ mistakes.

How to Conduct Smart Competitor Analysis

A well-rounded analysis includes:

- Identifying Competitors:

- Direct: Offer the same or similar product.

- Indirect: Solve the same problem in a different way.

- Direct: Offer the same or similar product.

- Feature Comparison:

- What functionalities do they offer?

- Where do they fall short?

- What functionalities do they offer?

- Pricing Strategy:

- How do they price their product or service?

- What’s their freemium or value-based model?

- How do they price their product or service?

- Customer Sentiment:

- What are users saying in reviews?

- What complaints or praise do they consistently mention?

- What are users saying in reviews?

- Market Positioning:

- What is their branding like?

- What’s their tone, voice, and messaging?

- What is their branding like?

Use AI to Stay Ahead

Manual competitor research can be tedious, but platforms like the PlanVista app make it easier. Its AI business plan tool can automatically scan your industry, identify competitors, highlight differentiation opportunities, and even predict how your value proposition stacks up. This gives you the strategic edge to carve out a unique space in a crowded market.

Ignoring competitor analysis is like entering a battlefield without knowing where the enemy is. You might be brave—but you’re also unprepared. Knowing your rivals, learning from their wins and losses, and adapting smartly is key to outmaneuvering them.

Overlooking Cultural and Regional Nuances

In the rush to scale and expand, many startup founders make the costly mistake of treating all markets as homogeneous. A marketing strategy or product that works in one region may flop in another due to deeply rooted cultural, social, or behavioral differences. Ignoring these nuances is not just a missed opportunity—it’s a strategic blunder.

One Size Doesn’t Fit All

Founders often default to using the same messaging, pricing, and product features across different geographies. While this might be efficient, it rarely resonates on a local level. Consumers don’t just buy products—they buy experiences, values, and relevance. And what’s relevant in New York City might not resonate in Tokyo, Lagos, or São Paulo.

Take the example of Airbnb. In its early days of international expansion, it found success in Europe but struggled in Asian markets. Why? The idea of renting a stranger’s home conflicted with cultural norms around privacy and hospitality in many parts of Asia. It wasn’t until Airbnb localized its approach—adjusting messaging, adding safety features, and partnering with local influencers—that it began gaining traction.

Startup Example: Walmart in Germany

Even giant corporations aren’t immune. Walmart’s failure in Germany is a textbook example. Despite being a retail juggernaut in the U.S., Walmart struggled because it didn’t adapt to German shopping habits. From forced smiling at checkout (which made German shoppers uncomfortable) to misunderstanding labor expectations, Walmart’s lack of cultural sensitivity cost them billions.

Why Founders Miss This

- Cultural Blind Spots: Founders may be so immersed in their own background that they fail to recognize other perspectives.

- Assumption of Global Uniformity: Believing globalization has standardized consumer preferences.

- Underestimating Local Competitors: Not realizing that local brands may have a stronger cultural fit, even if their product is inferior.

The Solution: Localization, Not Just Translation

True localization goes beyond language. It involves adapting your entire product and brand experience to fit the cultural context of each market. This includes:

- User Interface (UI) and Design: Colors, symbols, and layouts can carry different meanings across cultures.

- Product Features: Tailor functionality to meet local usage patterns.

- Payment Methods: Integrate regionally preferred options like UPI in India or WeChat Pay in China.

- Marketing Strategy: Use culturally relevant messaging, holidays, influencers, and content formats.

- Customer Support: Offer service in local languages with culturally aware representatives.

How PlanVista Helps

Localization can be complex, especially for resource-strapped startups. That’s where tools like the PlanVista app come in. This AI business plan tool helps founders identify regional differences through automated market analysis and generates localized strategies. Whether you’re planning a product launch in Latin America or Southeast Asia, PlanVista ensures your strategy reflects local needs and preferences.

Ignoring cultural and regional nuances is like showing up to a wedding in beachwear—it might be acceptable somewhere, but it’s a faux pas in most places. To build trust, relevance, and loyalty, you must demonstrate cultural intelligence. That’s not just smart—it’s essential for sustainable global growth.

Conclusion: Mastering Market Research for Startup Success

Market research isn’t just a preparatory step—it’s an ongoing discipline that defines whether your startup thrives, stalls, or fades out. As we’ve seen, the most common market research mistakes—skipping research, relying solely on secondary data, misidentifying target audiences, ignoring competitors, overlooking cultural nuances, and failing to keep research up to date—can cost startups dearly in wasted time, lost capital, and missed opportunities.

But these are not just mistakes—they are lessons in disguise. Each pitfall is avoidable with a proactive mindset and the right tools. Smart founders know that success isn’t about having a perfect idea out of the gate; it’s about refining that idea continuously based on real-world feedback, data, and insights. It’s about staying humble, curious, and committed to understanding the ever-evolving needs of your market.

In today’s digital-first landscape, there’s no excuse to fly blind. Market research tools are more accessible, efficient, and insightful than ever—especially with the help of artificial intelligence. That’s where the PlanVista app comes into play.

With PlanVista, you’re not just getting a business plan generator—you’re getting a dynamic AI business plan tool that evolves with your startup. It helps you uncover audience insights, map out competitive landscapes, track regional trends, and adapt your business strategy with speed and precision. It’s the startup planning tool that understands that markets change and that your plan needs to keep up.

Whether you’re still in the idea stage or already scaling, make market research a core habit, not a one-time activity. The smartest founders don’t just build for today—they plan for what’s next. Equip yourself with the knowledge, tools, and agility needed to win in your niche.

So, before you launch your next campaign, develop a new feature, or pitch investors, pause and ask: “What do I really know about my market?” If the answer isn’t grounded in fresh, accurate, and actionable data, it’s time to revisit your research—and PlanVista is here to help.

Start strong, stay smart, and build your startup on a foundation of insights, not assumptions. Your future customers—and your future self—will thank you.

FAQs

Market research helps validate your business idea, identify your ideal customers, analyze competitors, and make data-driven decisions, reducing the risk of failure.

Ideally, market research should be updated regularly—at least quarterly or whenever there’s a significant change in the market, competition, or customer behavior.

Even if you don’t have identical competitors, customers are solving the problem in some way. Identify indirect competitors and analyze how your solution compares.

PlanVista is an AI business plan tool that simplifies market research, customer analysis, and competitive insights—helping you build and update a winning startup strategy with confidence.