What Investors Look for in a Business Plan

Introduction: More Than a Document—It’s Your First Impression

You’re ready to raise capital. Maybe it’s $50K from angel investors or your first big seed round. You’ve got a strong pitch, maybe even a promising MVP. But there’s one thing every serious investor will ask for before they write a check: your business plan.

Not a deck. Not a demo. A real business plan.

It’s not about having a perfectly formatted 30-page document. It’s about showing that you’ve done the hard thinking. That you understand your market, your numbers, and your path to growth. Investors know that early-stage startups are risky. They’re not expecting perfection—they’re expecting clarity. They want to see that you understand how to turn your idea into a sustainable business.

Here’s the key: your business plan isn’t just for investors. It’s also for you. It forces you to get specific. Who are you serving? What do they need? How will you find them—and how will you make money doing it? These aren’t just questions for funding—they’re the foundation of your startup’s success.

And yet, writing a business plan can feel like a huge task—especially when you’re juggling a dozen other founder responsibilities. That’s why this blog exists: to simplify the process and help you create a plan investors will actually read.

In this post, you’ll learn:

- What investors are really looking for in a business plan

- Which sections matter most (and which to keep simple)

- Common mistakes founders make—and how to avoid them

- A real example of how a founder used a strong plan to land pre-seed funding

- How to save time and build a better plan with tools like PlanVista

This is the post to bookmark before you open that blank document.

And if you’ve already validated your idea, built your MVP, or started onboarding early users? Even better. You’re not starting from zero—you’re starting from insight. This post will help you turn that momentum into a plan that gets attention, builds trust, and opens doors.

What Investors Actually Want (Core Concept)

Before you get caught up in formatting, pitch decks, or investor emails, it’s important to understand what investors are really looking for when they ask for your business plan.

They’re not just scanning to see if your product is interesting. They’re asking three key questions:

- Is there a real problem worth solving?

- Is this the right team to solve it?

- Is this a business that could generate a return?

Your business plan should clearly answer all three.

Let’s break that down:

1. A Real, Painful Problem

Investors want to know you’re not building something just because it sounds cool or trendy. They want to see evidence that the problem you’re solving is significant and urgent. That means it causes real frustration, costs time or money, and affects enough people to build a market around.

This is where a good founder pulls in research. Customer interviews, waitlists, pilot users, pre-orders, or even survey data—anything that shows you’ve validated the pain point with real people.

2. A Clear and Scalable Solution

Once you’ve proven the problem, investors want to know: is this solution better than what already exists? Your business plan should explain not just what you’re building, but why it’s uniquely positioned to win in the market.

It’s not just about the product. It’s about your approach. Maybe it’s faster, cheaper, more personalized, or more accessible. Maybe it’s built with better margins. Whatever your edge is—make it crystal clear.

3. A Market Worth Entering

The size of the opportunity matters. A great product in a tiny niche can be a lifestyle business, but it’s unlikely to attract investor dollars. Your plan should include data-backed estimates of your total addressable market (TAM), and more importantly, your serviceable obtainable market (SOM)—the segment you can realistically reach in the next 1–3 years.

And don’t just throw out big numbers. Investors want to see a thoughtful breakdown of your assumptions.

4. A Business Model That Works

You don’t need to be profitable today, but you do need to show a path to profitability. Your business plan should explain how you make money, how much it costs to acquire a customer, and what it takes to grow efficiently over time.

Even better if you can tie this to early data—customer LTV, average spend, CAC estimates, or margins.

5. A Team That Can Execute

Great ideas fail all the time when they’re in the wrong hands. That’s why investors put so much weight on the team. Your business plan should include a clear outline of who’s involved, their roles, and what makes them qualified to execute on this idea.

It’s not about having a huge team—it’s about showing that the founding team understands the problem, the customer, and the execution roadmap.

Step-by-Step: What to Include in Your Business Plan

If you’re writing your business plan for investors, you’re not just building a document—you’re building trust. Investors don’t expect perfection, but they do expect structure, clarity, and logic. This section breaks down what your plan needs to include, and why each part matters.

Here’s the step-by-step layout investors expect:

1. Executive Summary

This is your entire business in one page. Think of it as your elevator pitch in writing. Cover:

- The problem you’re solving

- Your solution and what makes it different

- Your target market and traction so far

- Your business model (how you make money)

- Funding required and how it will be used

Even though it’s the first section, many founders write it last—after the rest of the plan is complete. That’s a smart move.

2. Problem and Solution

Start by clearly articulating the customer pain point. Then explain how your product or service directly solves it. This section should prove that you understand your customer deeply—and that you’ve validated the need.

Tip: Use customer quotes, research insights, or pilot results if you have them.

3. Market Opportunity

Here’s where investors want to see data. Show the total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM). Be realistic. Segment your audience, show growth trends, and highlight why this market is worth entering now.

If you have competitors, that’s normal. Your job here is to show what differentiates you and why your approach is better for a specific segment.

4. Product or Service

Describe your product clearly. What are the core features? What’s the status—MVP, beta, launched? Do you have early users or case studies?

Keep the focus on benefits, not just features. Show how your solution improves the customer’s life or business.

5. Business Model

How will you make money? Outline your pricing, margins, projected revenue streams, and cost structure. If you have early metrics, include them—monthly recurring revenue (MRR), average revenue per user (ARPU), or customer acquisition cost (CAC).

Also mention distribution or sales channels. This shows that you’ve thought through how your product will reach the customer.

6. Go-to-Market Strategy

Investors want to see how you plan to get your first 100, 1,000, or 10,000 users. That means:

- Customer acquisition channels (organic, paid, partnerships, etc.)

- Marketing plan (content, social, events, referrals)

- Sales funnel or conversion strategy

- Customer onboarding and retention plan

Be specific. Generic statements like “We’ll grow through word of mouth” don’t build confidence.

7. Financial Projections

Outline your expected revenue, expenses, burn rate, and break-even timeline for the next 3–5 years. Show assumptions—don’t just drop numbers without explanation.

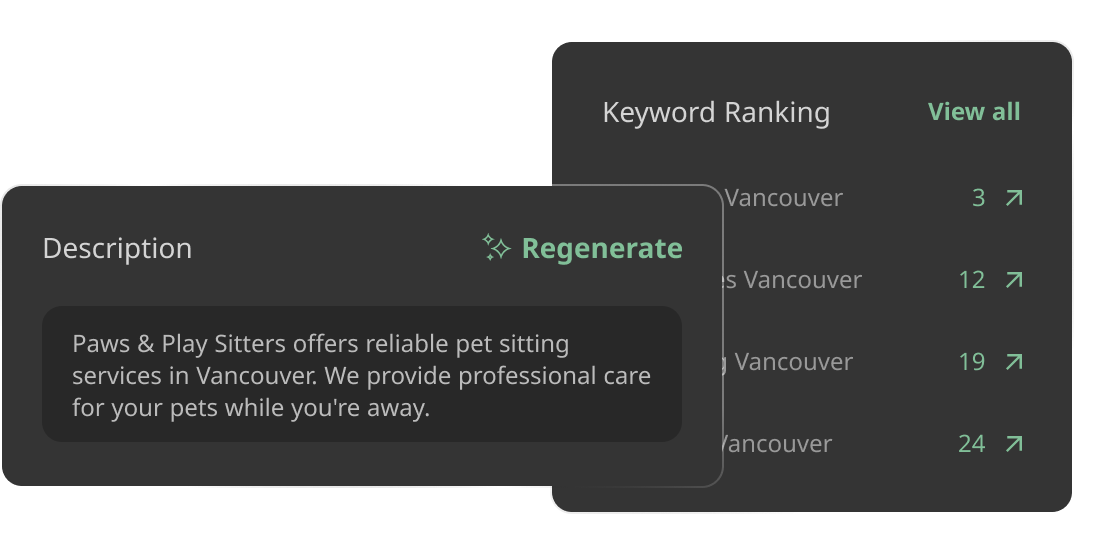

Tools like PlanVista make this part easy by helping you generate realistic, investor-friendly financials without needing spreadsheets.

8. The Team

Show who’s behind the company. List core team members, their roles, and relevant experience. Include brief bios that highlight why they’re qualified to solve this problem and build this company.

9. The Ask

Close with your funding request. Be direct:

- How much are you raising?

- What will it fund (team, product, marketing, etc.)?

- What milestones will that capital help you achieve?

Common Red Flags That Turn Investors Off

Even with a promising idea and a slick pitch, many founders lose investor interest because of unforced errors in their business plan. These aren’t always huge blunders—they’re often small signals that raise doubts. And when investors have hundreds of plans to review, a few red flags are all it takes to move on.

Let’s walk through the most common deal-breakers and how to avoid them.

1. Unrealistic Financial Projections

Saying you’ll go from $0 to $10 million in revenue in 18 months without a clear path is one of the fastest ways to lose credibility. Investors know how long it takes to build traction, and they’re not expecting hyper-growth without solid strategy and validation.

How to avoid it:

Build conservative projections based on real assumptions. Show what drives revenue—pricing, user growth, conversion rates—and explain the logic behind your numbers.

2. Undefined Target Market

If your business plan says “our product is for everyone,” that’s a red flag. Investors want to see that you’ve deeply understood a specific audience—not just a broad industry category.

How to avoid it:

Narrow your focus. Describe your ideal customer clearly. Show how you’ve engaged with them, what pain points they’ve expressed, and why they’ll choose your solution.

3. Weak or Missing Go-to-Market Strategy

“We’ll go viral” is not a strategy. Neither is “We’ll advertise on social media” without detailing budget, targeting, or expected results. A vague or generic go-to-market section makes investors think you haven’t thought it through—or that you’ll burn their money learning the basics.

How to avoid it:

Outline your top 2–3 customer acquisition channels, explain how you’ll use them, and include cost estimates and early data if possible.

4. Ignoring the Competition

Claiming you have “no competitors” is a classic red flag. Every product has alternatives—even if it’s just Excel, pen and paper, or doing nothing.

How to avoid it:

Acknowledge your competitors, show how you’re different, and explain why your approach gives you an edge in a specific niche or use case.

5. Incomplete or Unbalanced Team

If your founding team doesn’t include the key roles needed to execute the plan—or if your team section is vague or underdeveloped—investors may doubt your ability to deliver.

How to avoid it:

Show the current team, clarify roles, and explain how gaps (e.g., tech, sales) will be filled. If you have strong advisors or early hires lined up, mention them.

6. Overuse of Buzzwords or Fluff

A business plan filled with phrases like “revolutionary,” “unprecedented,” or “industry-disrupting” but lacking data or a clear roadmap sets off alarms. Investors aren’t buying hype—they’re buying strategy.

How to avoid it:

Be clear, direct, and evidence-driven. Confidence is good. Clarity is better.

A Real-World Example of an Investor-Ready Plan

Let’s make all of this real.

Meet Ashwin, an early-stage founder with a background in logistics. After years in the industry, he noticed a recurring pain point: small eCommerce brands struggled with last-mile delivery tracking. Packages would go missing, customers got frustrated, and businesses lost revenue and trust.

Ashwin had an idea for a simple SaaS tool that would plug into Shopify and WooCommerce to give real-time, branded delivery updates for end customers. Think: better tracking, more transparency, fewer “Where’s my order?” emails.

Early Signals — But No Plan

Ashwin started strong. He built a no-code MVP using off-the-shelf tools, signed up 20 pilot users, and started seeing positive feedback. But when he began reaching out to investors, the interest stalled.

Everyone asked the same thing: “Can you send over your business plan?”

He didn’t have one. He had traction, but not structure. No market sizing, no financial model, no roadmap for what he’d do with funding. Without that, investors weren’t sure he was ready to scale.

Building a Plan the Smart Way

Rather than spend weeks figuring it out from scratch, Ashwin turned to PlanVista.

He used the platform to:

- Document the problem he was solving, backed by real quotes from eCommerce founders

- Define his target market—mid-sized DTC brands in the US, shipping over 500 orders/month

- Break down his pricing model (monthly subscription + volume-based tiering)

- Project his revenue and costs using PlanVista’s financial projection tool

- Outline his go-to-market strategy: cold outreach, app store visibility, and co-marketing with shipping providers

He also filled out the team section, even though he was a solo founder, by noting his developer partner and planned hires post-funding.

Within a week, he had a clean, investor-ready business plan that clearly told his story and mapped his next 18 months.

The Result

Ashwin sent the plan to five investors he’d previously pitched informally. This time, three responded with meeting requests.

One angel investor, impressed by the clarity and traction, offered $150,000 on the spot to help him expand the platform, hire support staff, and test paid acquisition.

What changed? Not the idea. Not the product. Just the plan.

Ashwin had shifted from being “a founder with potential” to “a founder with a real strategy and business roadmap.” And that made all the difference.

Why This Works

This example isn’t about getting lucky. It’s about showing that investors fund preparedness. When you show a well-structured, validated business plan, you prove you’re ready for their money—and ready to make it work.

And when the right tools do the heavy lifting for you, like PlanVista did for Ashwin, you don’t just write faster—you plan smarter.

How PlanVista Helps Founders Build Investor-Ready Plans

If you’ve ever sat in front of a blank page trying to write a business plan from scratch, you know how overwhelming it can be. What should go in each section? How much detail is enough? Will investors take it seriously?

That’s exactly the problem PlanVista solves.

PlanVista is built specifically for startup founders—especially those in the early stages—who need to create professional, credible business plans and pitch materials quickly, without hiring consultants or spending weeks formatting spreadsheets.

Here’s how it helps you move faster and plan smarter.

1. Step-by-Step Guided Plan Builder

Instead of dumping you into a blank template, PlanVista walks you through each section of your business plan with smart, industry-tailored prompts.

- What’s your problem statement?

- How are you solving it?

- Who are your customers?

- What’s your pricing strategy?

As you answer each question, PlanVista automatically structures your plan and helps you connect the dots. You’re not just writing—you’re building strategy in real time.

2. Built-In Financial Forecasting Tools

This is where most founders get stuck—and where PlanVista shines.

You enter your key assumptions (pricing, number of customers, cost of goods, operating expenses), and PlanVista builds:

- Revenue projections

- Expense breakdowns

- Burn rate

- Break-even analysis

- 3–5 year forecasts

Everything’s laid out in clean tables and visuals, so investors can easily grasp your financial logic without flipping between tabs or PDFs.

You don’t need a finance background—PlanVista does the math and makes it look great.

3. Professional, Investor-Ready Formatting

A great business plan isn’t just about content. It’s about presentation. Sloppy formatting, inconsistent fonts, or crowded charts give off the wrong impression—even if your numbers are solid.

PlanVista automatically formats your business plan for clarity and professionalism. You get a structured, branded, ready-to-share document that looks like it came out of a top-tier accelerator.

No design work required.

4. Export Options for Every Stage

Whether you’re applying to an accelerator, emailing an angel investor, or meeting a VC, PlanVista has export options for:

- Full business plans (PDF or doc)

- Executive summaries

- One-pagers

- Investor pitch decks

You build once, and the platform generates the materials you need—instantly, and in the right format.

5. Built for Founders Who Move Fast

Startup life doesn’t give you time to perfect a document over 3 months. PlanVista was designed for velocity. It helps you get something good in front of investors quickly—then improve it as you go.

You don’t need to know everything. You just need a smart system that helps you start, structure, and scale your thinking.

If you’re ready to stop guessing and start presenting a plan that gets taken seriously, PlanVista is the best place to begin.

The Importance of Financials and Presentation

You can have a bold vision, a validated product, and a great team—but if your financials are weak or missing, most investors will pass.

It’s not because they expect you to be profitable on day one. It’s because your numbers tell a story: about how you think, how you plan, and how you make decisions under uncertainty. Good financials signal that you’re building a business—not just a product.

Let’s look at what that means, and how PlanVista helps make this part less intimidating.

Why Investors Zero in on Financials

When investors read your business plan, they’re looking for signs of viability. Your financial section is where that comes through most clearly.

They want to see:

- How your business makes money

Clear revenue streams: subscriptions, transactions, services, etc.

- What it costs to operate

Staff, tools, vendors, marketing—what’s your burn rate?

- When you break even

How much do you need to earn to cover your monthly spend?

- How fast you can grow

Based on CAC (Customer Acquisition Cost), LTV (Lifetime Value), and user growth

But here’s the catch: numbers without explanation don’t mean much. A spreadsheet filled with ambitious revenue doesn’t prove anything if it’s not backed by logic.

The Power of Story-Driven Projections

Your financial plan isn’t about impressing with big numbers. It’s about showing why those numbers make sense.

For example:

- If your revenue doubles in year two, explain what’s driving that. A new sales hire? A channel partnership? A product release?

- If your CAC is low, show how. Organic traffic? A strong referral loop? Built-in virality?

This is where many founders struggle—and where PlanVista makes it simple.

PlanVista Makes Financials Fast and Clear

Instead of guessing or struggling with Excel templates, PlanVista helps you build financial projections by asking the right questions:

- What’s your pricing model?

- What are your fixed and variable costs?

- How many users or customers are you forecasting?

- How do your expenses scale as revenue grows?

From there, it automatically builds:

- Revenue and expense projections

- Gross margins and burn rate

- Cash flow forecasts

- Visual charts and summaries for quick reference

Even better, you can update numbers as things change and regenerate your forecast instantly.

Presentation Matters—More Than You Think

First impressions count. A clean, well-structured business plan with easy-to-read visuals builds confidence. It tells investors: “We’re serious. We’re organized. We’re ready.”

Messy formatting or generic copy-paste templates have the opposite effect. They make your plan feel rushed—and your team feel unprepared.

PlanVista ensures that your plan doesn’t just have good content. It looks investor-ready, every time.

Conclusion: Show the Plan That Wins the Investment

When investors ask to see your business plan, they’re not looking for fluff. They’re looking for answers. They want to see evidence that you’ve done the work—not just building a product, but building a business.

Your business plan is more than a document. It’s a signal.

It signals that you’re not guessing. You’ve talked to customers. You understand your market. You’ve mapped out how you’ll grow—and what it will cost to get there. It tells investors you’ve got a handle on your burn rate, your margins, and your milestones. And just as important, it tells them you’re the kind of founder who follows through.

The good news? You don’t have to spend weeks writing it from scratch. You don’t need to be a finance expert or a formatting wizard. What you need is a structured way to think clearly and present confidently.

That’s exactly what PlanVista helps you do.

With PlanVista, you can:

- Build your business plan section-by-section, with AI-guided prompts

- Create financial projections without touching a spreadsheet

- Generate pitch decks and one-pagers directly from your plan

- Share a clean, investor-ready document that gets read—not ignored

Thousands of founders are using PlanVista to plan smarter, raise faster, and pitch with more clarity. Whether you’re validating an idea or preparing for your first funding round, this is the tool that gives you the structure—and the confidence—to show up like a founder who’s ready to win.

So if you’ve been waiting to build your plan, now’s the time.

Don’t let formatting or fear slow you down. You’ve already got the vision. Now you need the plan that brings it to life—and gets others excited to back it.

Start planning smarter with PlanVista. Try it now—no credit card required.

FAQs

PlanVista is an AI-powered business planning tool for founders to create investor-ready plans, financials, and pitch decks.

Yes—PlanVista is designed specifically for idea-stage and early-growth founders.

Absolutely—PlanVista helps you build detailed forecasts without spreadsheets.

Yes—many founders use PlanVista to create plans and decks that win investor meetings.

Yes—get started free with no credit card required.