Why Most Startups Fail Before Year One (And How to Avoid It)

Introduction: The First-Year Startup Survival Test

You’ve probably heard the brutal stat: most startups fail.

But what’s even more sobering is that the majority of those failures happen within the first 12 months.

This isn’t just an industry myth—it’s backed by hard data. According to multiple studies, including CB Insights and Startup Genome, a massive percentage of startups never make it past their first birthday. The reasons are as old as entrepreneurship itself—poor market fit, running out of cash, founder disputes, and ignoring customers. Yet, every year, a new wave of founders makes the same avoidable mistakes.

And here’s the kicker: it’s not because these founders are lazy or naive.

It’s because the first year of a startup is designed to kill you.

It’s a sprint to find your footing in an uncertain market, with limited cash, limited time, and limited margin for error.

It’s not about raising millions or going viral—it’s about validating the essentials:

- Do you have a real customer problem?

- Can you get your first paying customers?

- Will your business model actually work?

- Can you survive long enough to figure the rest out?

Many first-time founders fall into the trap of focusing on the wrong things. They obsess over perfecting the product, polishing the pitch deck, or chasing vanity metrics. Meanwhile, they miss the signals that their startup isn’t getting traction—or worse, that it’s heading toward an early death.

But here’s the good news:

Most of these early-stage failures are predictable—and preventable.

If you know what to look for, you can avoid the common traps and dramatically increase your chances of surviving year one.

That’s what this post is about.

In this guide, you’ll learn:

- The hard data on why startups fail before year one

- The most common founder mistakes that kill momentum fast

- How to recognize the warning signs early—and correct your course

- A real-world example of a founder who almost failed in year one—but turned things around by focusing on fundamentals

- How PlanVista can help you stay focused, organized, and investor-ready during those critical first 12 months—without adding more chaos to your plate

If you’re a founder in your first year—or about to launch—this is the post to bookmark, print, and stick to your fridge.

Because the startups that survive year one?

They don’t survive by luck.

They survive by getting the basics right—and ruthlessly avoiding the mistakes that take most founders down.

Let’s dive in.

The Hard Data Why Most Startups Fail Early

The Founder Traps That Kill Startups Before Year One

Most startup failures aren’t sudden. They’re the result of small, avoidable mistakes that compound over time.

Founders often don’t even see them coming—until it’s too late.

These are the traps that sneak up on early-stage startups and quietly kill them before year one. The good news? Once you know what they are, you can avoid them.

Trap 1: Falling in Love with the Product, Not the Problem

This is the founder blind spot that kills more startups than anything else. You get obsessed with your product, your features, your vision—but forget to obsess over your customer’s actual pain.

Founders who skip validation and assume they know what customers want are setting themselves up for a painful crash.

How to avoid it:

Talk to real customers—early and often. Focus on their problem, not your solution. Let data and conversations guide your product decisions, not your ego.

Trap 2: Skipping the Business Model Conversation

You’d be shocked how many founders launch products, raise a little money, and still don’t have a clear answer to:

How does this business make money?

Hoping to “figure out monetization later” might fly in Silicon Valley fairytales—but for most founders, it’s a death sentence.

How to avoid it:

Define your business model from day one. Even if it evolves later, investors want to see you’re thinking about revenue, pricing, and sustainability now.

Trap 3: Overbuilding Before Validating

Building out a full-featured product before testing your assumptions is a classic mistake. Founders spend months (or years) in development mode, only to launch and hear crickets.

How to avoid it:

Build scrappy MVPs. Test landing pages. Use pre-orders. Validate demand with as little code as possible. Speed is your friend—but only if it’s paired with learning.

Trap 4: Treating Marketing as an Afterthought

Even with a validated product, many founders fail because they don’t have a plan to acquire customers. They assume good products go viral.

Spoiler: they rarely do.

How to avoid it:

Design your go-to-market plan as seriously as your product roadmap. Test 2–3 acquisition channels early. Track CAC and conversion rates from day one.

Trap 5: Burning Cash Without a Runway Strategy

Many early startups die with money in the bank—but no clue how long it will last. Poor financial discipline, over-hiring, and wishful projections kill more startups than bad products.

How to avoid it:

Track your burn rate religiously. Use tools like PlanVista to forecast runway and scenario plan. Ruthlessly prioritize spend that accelerates learning and traction.

Trap 6: Ignoring Team Dynamics

Even the best ideas collapse if the founding team falls apart. Misalignment on roles, vision, or equity splits can destroy startups from the inside.

How to avoid it:

Have hard conversations early. Set clear roles. Put operating agreements in writing. Prioritize transparency and alignment.

Red Flags You’re Heading Toward Early Failure (And How to Pivot Fast)

Startup failure rarely happens overnight. It’s usually a slow slide into trouble—unless you spot the warning signs early and adjust.

The key to surviving year one? Recognizing the red flags that you’re off course—and taking decisive action before you burn through your runway.

Here are the early warning signs most founders miss (or ignore)—and how to correct your course fast.

Red Flag 1: No One’s Paying (or Willing to Pay)

If you’ve launched and people are using your product—but not paying—you don’t have a business yet.

Free users don’t equal validation. Willingness to pay is the only true market proof.

How to pivot fast:

Test pricing aggressively. Add paywalls, premium features, or subscription models early—even if it’s just to gauge intent. Better to lose non-paying users than burn cash chasing the wrong audience.

Red Flag 2: Customer Conversations Are Dry or Vague

If your early customer interviews feel forced, vague, or filled with polite praise—but no urgency—it’s a sign your problem isn’t painful enough.

How to pivot fast:

Dig deeper. Ask customers what they’re doing now to solve the problem. If they’re doing nothing, or using workarounds they don’t hate, your problem might not be urgent enough to build a business around.

Red Flag 3: Marketing Spend Isn’t Converting

If you’re spending money on ads or outreach—and seeing little to no conversions—it’s not just bad targeting. It might be a signal that your offer, messaging, or product isn’t resonating.

How to pivot fast:

Pause spending immediately. Revisit your value proposition and test simpler, cheaper acquisition experiments (landing pages, cold outreach) to validate messaging before scaling.

Red Flag 4: Burn Rate Is Outpacing Learning

If your startup is spending more than it’s learning, you’re in danger. Founders often mistake activity (building, meetings, hiring) for progress—but if you’re not gaining real customer insights or traction, you’re just burning runway.

How to pivot fast:

Trim spending aggressively. Prioritize experiments that accelerate learning over scale. Know your runway and model it monthly.

Red Flag 5: The Founding Team Is Avoiding Tough Conversations

If co-founders are avoiding discussions around equity, strategy pivots, or customer feedback, you’ve got a culture problem brewing. These issues don’t fix themselves—they explode at the worst times.

How to pivot fast:

Have the uncomfortable conversations now. Align on roles, goals, and decision-making processes. Address team friction before it fractures.

A Real-World Founder Story: From Almost-Failure to First-Year Survival

Let’s turn theory into reality with a founder story that shows how early red flags can either be ignored—or become turning points.

Meet Sarah, Founder of CraftCaddy

Sarah launched CraftCaddy, a subscription box for DIY craft projects, after seeing a gap in the market during the pandemic. She quickly built a Shopify site, launched on Instagram, and started shipping boxes.

For the first few months, it looked promising. She got some influencer shoutouts, a few hundred followers, and her first batch of paying subscribers.

But by month six, the cracks started showing.

- Churn was high. Customers signed up for one month, then canceled.

- Paid ads weren’t converting profitably. She was spending $50 to acquire a customer who only paid $30 for the first box.

- Customer feedback was generic at best. When she surveyed users, she heard, “It’s cute,” but no urgency or loyalty.

- Her burn rate was accelerating. She’d invested heavily in inventory and marketing, without clear returns.

Sarah was staring down the barrel of classic year-one startup failure.

The Pivot: Facing the Red Flags Head-On

Instead of pushing harder on what wasn’t working, Sarah paused.

She used the Business Model Canvas to map out her assumptions. What she realized was eye-opening:

- She thought people wanted general craft boxes.

- In reality, the few loyal customers she had were parents looking for structured, educational craft projects for kids.

Her value proposition was too broad—and the customers who stuck around were using the box in a very different way than she had imagined.

The Turnaround Plan

Sarah pivoted CraftCaddy’s focus exclusively to busy parents looking for creative, kid-focused at-home projects.

- She rewrote her value proposition to emphasize “30-minute creative learning for busy parents.”

- She adjusted her pricing to reflect the premium positioning—$39 per box, with an optional annual membership.

- She cut paid ads and focused on partnerships with parenting blogs, teacher influencers, and Facebook parenting groups.

She also revamped her onboarding email sequence and added a “refer a parent friend” program.

Using tools like PlanVista, she reworked her financial projections, mapped her new customer journey, and rebuilt her business plan to reflect her sharper focus.

The Results

Within three months of the pivot:

- Churn dropped by 40%.

- CAC decreased by 60% through organic channels and referrals.

- She reached breakeven by month 10—just two months shy of the dreaded first-year cliff.

When she shared her revised plan and metrics with investors, she secured her first $150K in seed funding.

The Lesson

Sarah didn’t avoid failure because she hustled harder.

She avoided it because she spotted the red flags early, listened to customers, and pivoted decisively.

She let data—not assumptions—guide her turnaround.

And that’s the difference between startups that survive year one—and the ones that don’t.

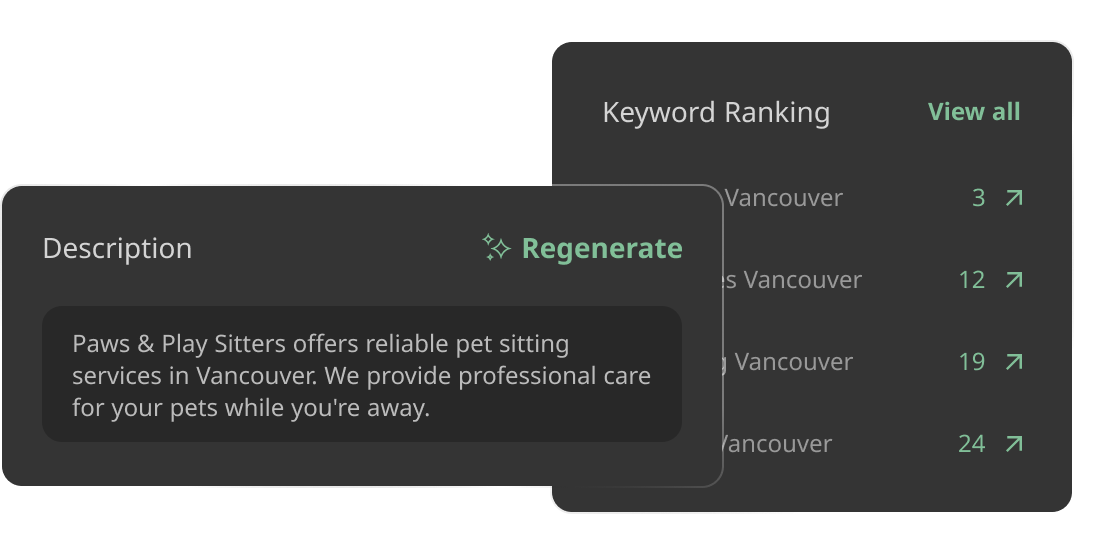

How PlanVista Helps Founders Avoid Early Failure (And Stay Investor-Ready From Day One)

When you’re an early-stage founder, you’re constantly pulled in a dozen directions. You’re wearing every hat—product manager, marketer, customer support, fundraiser. The last thing you want is to get bogged down in messy spreadsheets, guesswork, or outdated business plan templates.

But skipping the fundamentals is exactly what causes startups to fail in year one.

That’s where PlanVista comes in.

PlanVista isn’t just another planning tool. It’s a startup survival system, designed to help founders avoid the chaos, stay focused on what matters, and build the kind of clarity investors—and your own team—can rally behind.

Here’s how it helps you stay on track (and out of the early-stage failure zone):

1. Validate Your Idea Before You Waste Time and Money

PlanVista prompts you to define your problem, solution, and customer segments clearly from day one.

It helps you map your assumptions, test them fast, and spot holes in your thinking—before you invest months (or thousands) building the wrong thing.

Think of it as your early-stage reality check.

2. Build a Clear, Testable Business Model (Not Just a Guess)

Instead of guessing how you’ll make money, PlanVista helps you map your business model using proven frameworks like the Business Model Canvas—and then turns that into a usable, evolving document.

You can test pricing scenarios, model unit economics, and see instantly how your model holds up.

3. Create an Investor-Ready Business Plan Without the Overkill

Once you’ve validated your model, PlanVista helps you build a lean, focused business plan that investors respect.

- Executive summaries

- Market analysis

- Go-to-market plans

- Financial projections

All formatted and structured to investor expectations—no spreadsheets, no design skills needed.

4. Built-in Financial Forecasting (No Excel Headaches)

One of the fastest ways founders run out of runway?

Poor financial planning.

PlanVista includes simple financial forecasting tools that walk you through revenue projections, burn rate, CAC, LTV, and break-even analysis—without needing to touch Excel.

You get clarity on your runway, your risks, and your funding needs.

5. One-Click Exports for Every Stage

Need a one-pager for a cold outreach?

A full plan for a seed investor?

A pitch deck for demo day?

PlanVista lets you export everything from one place, keeping your messaging and metrics consistent.

6. Designed for First-Time Founders Who Move Fast

You don’t need to be a finance wizard or MBA to use PlanVista.

It’s built for scrappy founders who want to focus on building—while staying investor-ready from day one.

Because the startups that avoid year-one failure?

They don’t just build faster.

They plan smarter—and adjust even faster when the data tells them to.

Pro Survival Tips to Keep Your Startup Alive in Year One (Bonus Section)

Surviving your first year as a startup isn’t about being the smartest founder in the room.

It’s about making fewer avoidable mistakes, staying disciplined, and focusing on what actually moves the needle.

Here are pro-level survival tips from founders who’ve made it past the first-year cliff—and what they wish they’d known sooner.

Tip 1: Fall in Love with the Problem, Not Your Product

Your product will change. Your features will pivot.

But the one thing that shouldn’t change? Your obsession with the customer’s pain point.

Talk to customers every week.

Ask about their struggles—not your features.

Let your product evolve based on their feedback, not your assumptions.

Tip 2: Build Only What You Can Validate Fast

Resist the urge to overbuild.

Build only what you can test in the next 30 days.

Use no-code tools, prototypes, and scrappy MVPs to learn fast.

Remember: validation beats perfection in year one.

Tip 3: Track Your Burn Rate Like Your Life Depends On It (Because It Does)

Your burn rate is your runway.

Track it weekly. Know exactly how much you’re spending and how much time that gives you.

Forecast different scenarios (PlanVista makes this easy) and always have a 6–12 month runway plan.

Tip 4: Get Laser-Focused on One or Two Acquisition Channels

Year-one startups die trying to do too much at once.

Pick one or two marketing channels. Get good at them.

Ignore everything else until you have a repeatable, scalable acquisition system.

Tip 5: Don’t Avoid the Hard Conversations with Co-Founders

Most co-founder breakups happen because issues were ignored, not because they were addressed.

Have the tough conversations now—about roles, equity, decision-making, and vision alignment.

Write them down. Get them in writing.

Tip 6: Ruthlessly Prioritize Traction Over Vanity

Your goal isn’t to look good on LinkedIn.

It’s to prove traction with real customers and real revenue.

Avoid distractions like PR, awards, or pitching without validation.

Focus on:

- Paying customers

- Retention rates

- Conversion metrics

Tip 7: Build a Plan That’s Built to Change

Your plan isn’t static. It should evolve as you learn.

Use tools like PlanVista to keep your business plan, model, and projections up to date.

A living plan keeps your team, your investors, and your own brain aligned as you adapt.

Conclusion: Ruthless Clarity Is Your First-Year Survival Superpower

Most startups don’t fail because they weren’t smart enough, fast enough, or well-funded enough.

They fail because they lacked clarity when it mattered most.

Clarity about the problem they were solving.

Clarity about their customer.

Clarity about their business model, their financials, their path to traction.

In the chaos of year one, clarity is your survival superpower.

It’s what lets you move faster, pivot smarter, and make better decisions under pressure.

The Harsh Reality? Year One Doesn’t Forgive Guesswork

Your runway is short.

Your margin for error is thin.

And the market doesn’t care about your idea—it cares about whether you can deliver real value.

That’s why founders who survive the first 12 months do three things differently:

- They validate every assumption early and often.

- They stay brutally honest about what’s working—and what’s not.

- They use tools and systems that keep them organized, disciplined, and investor-ready from day one.

Why Tools Like PlanVista Give Founders an Edge

When you’re juggling product, customers, team, and funding, the last thing you want is to get lost in spreadsheets or DIY business plan templates.

That’s where PlanVista changes the game:

- It helps you validate your business model early—before you waste time and money.

- It guides you through building an investor-ready business plan that’s lean, clear, and credible.

- It lets you forecast your runway, burn rate, and key metrics without needing a finance background.

- It keeps everything in one place—so you can adjust your strategy in real-time as you learn.

PlanVista isn’t just a planning tool—it’s your early-stage decision engine.

Final Takeaway: Survive Year One, and You Change the Odds Forever

The first year is a filter.

It’s where most startups give up, run out of cash, or crumble under their own assumptions.

But if you make it past that brutal first 12 months?

You join the tiny group of startups that actually have a shot at scaling, raising serious capital, and building something that lasts.

So if you’re in the trenches right now, wondering if you’re on the right track—don’t guess.

Start planning smarter with PlanVista—free to try, no credit card required.

FAQs

PlanVista is a startup planning tool that helps founders create business models, business plans, and financial forecasts.

Yes—PlanVista guides founders through validation, business modeling, and planning to avoid early-stage failure traps.

Absolutely—PlanVista includes simple tools to build revenue projections, cash flow, and runway analysis.

Yes—PlanVista generates investor-ready plans, one-pagers, and decks that help founders raise capital confidently.

Yes—PlanVista offers a free trial with no credit card required.